Key Takeaways:

- BlackRock’s iShares Bitcoin Belief (IBIT) now holds over 3.25% of all Bitcoin in circulation, making it the single-largest holder amongst spot ETFs globally.

- IBIT has absorbed over $69.7 billion value of BTC, dominating over 54.7% of the US spot Bitcoin ETF market.

- Institutional accumulation is rising sharply, whereas retail participation slows, signaling a shift in Bitcoin market dynamics.

BlackRock’s embrace of crypto has advanced from a symbolic second to a market-moving drive. A Bitcoin ETF began by the asset administration big simply over a yr in the past has hit a historic milestone: over 3.25% of the fastened 21 million provide of Bitcoin. Nevertheless, there’s a story behind the figures: it issues a flip of the stability of energy, altered funding tendencies and the rising affect of classical finance within the crypto world.

The Numbers Behind BlackRock’s Bitcoin Play

IBIT’s Speedy Accumulation and Market Share

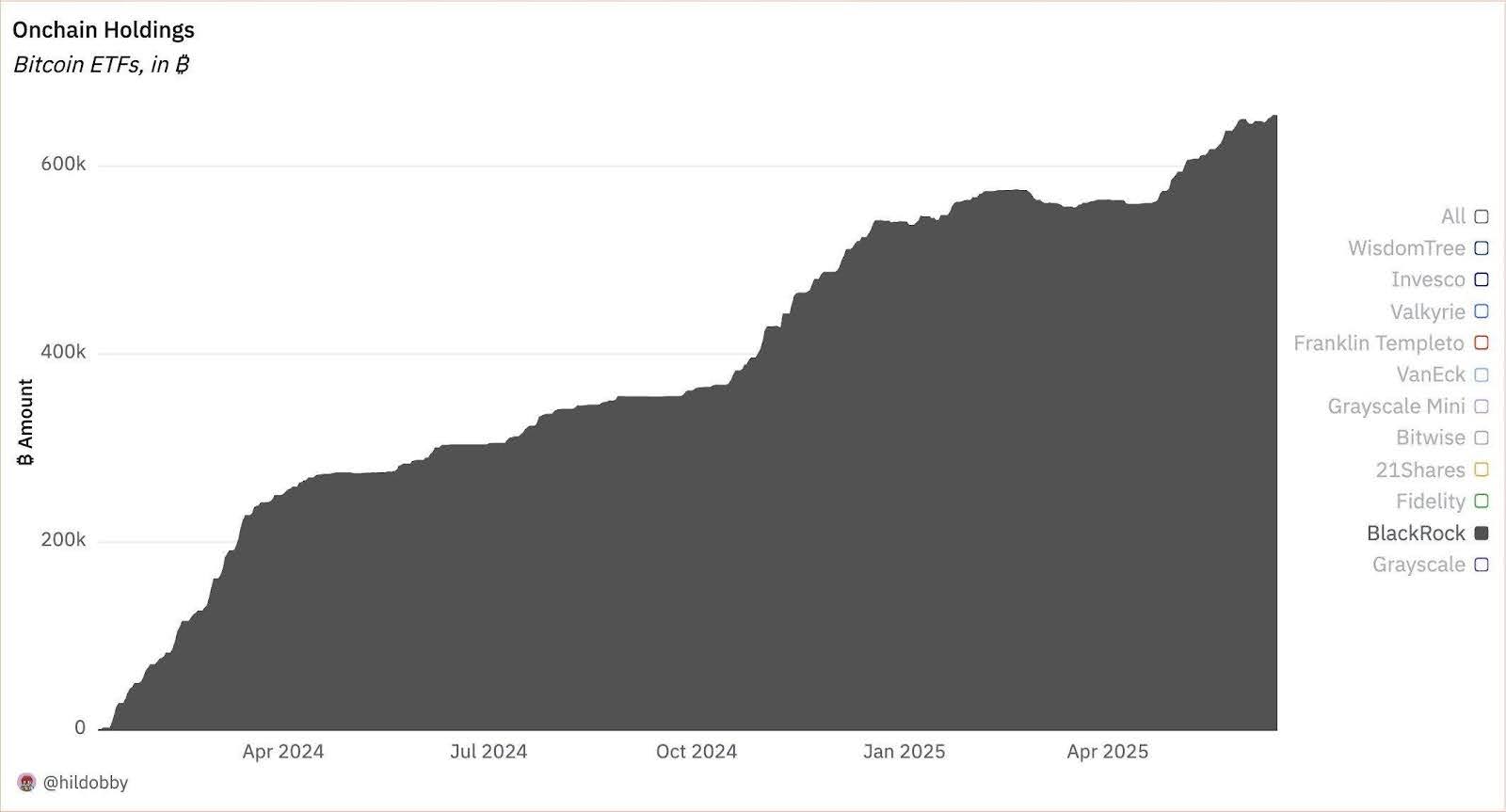

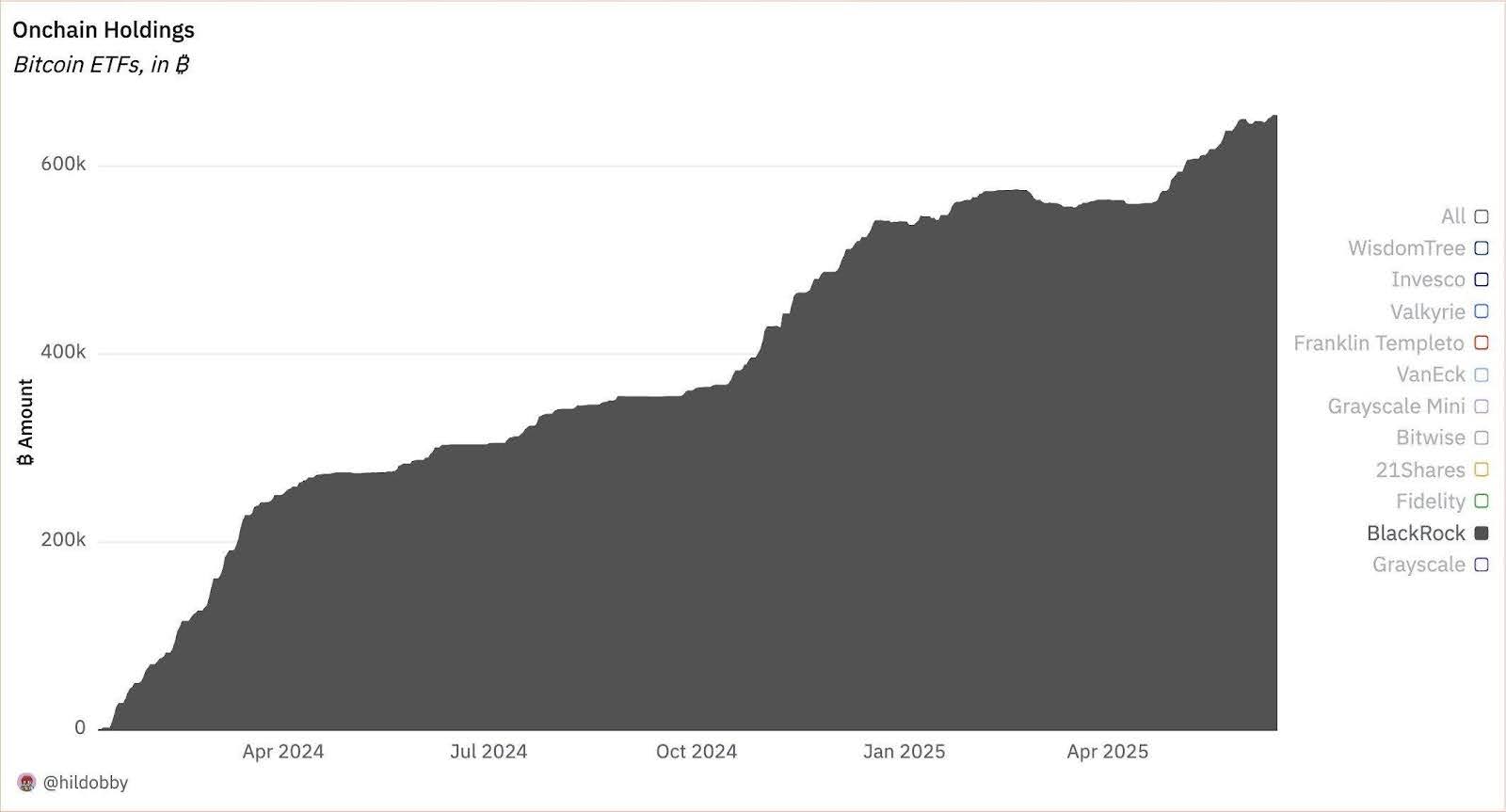

By the center of June, 2025, BlackRock, which takes over the iShares Bitcoin Belief (IBIT) affords, is allegedly sitting on in extra of three.25 % of the combination variety of Bitcoins, a quantity over 682,500 BTC, the worth of which equates round $69.7 billion.

The ETF already instructions over a half (54.7%) of the US spot Bitcoin ETF market, and has left Constancy’s FBTC and ARK 21Shares in its mud. After the spot Bitcoin ETFs have been authorized by the USA Securities and Trade Fee in January 2024, BlackRock has been on an aggressive purchase spree, main different funds in day by day internet inflows.

To place the size in perspective:

- 3.25% of 21 million BTC is a large holding for a single regulated funding product.

- That locations IBIT among the many prime 25 ETFs on the planet by belongings, in contrast with legacy funds that monitor the S&P 500 index and a worldwide bond index.

The pace is as hanging as the quantity. IBIT was capable of cowl that sum in lower than 18 months and there have been no indicators of liquidation and outflows. BlackRock has additionally not offered any BTC since June 2024 in keeping with analysts, indicating that it holds a robust long-term bullish sentiment.

Learn Extra: BlackRock Information for Digital Shares in $150 Million Cash Market Fund to Use Blockchain Tech

Provide Shock and Bitcoin’s Subsequent Section

The Position of ETFs in Lowering Liquid Provide

One among Bitcoin’s defining options is its fastened provide of 21 million cash. Estimates counsel that as much as 20% of BTC might already be misplaced or locked in long-term holdings. With IBIT’s 3.25% share, and all US Bitcoin ETFs mixed holding 6.12%, greater than 1.28 million BTC is now tied up in regulated automobiles.

This tendency has a critical implication when it comes to liquidity:

- ETFs are black holes to Bitcoin – as soon as an asset is sucked into it, it’s hardly ever traded within the spot markets.

- This limits the availability resulting in the attainable value stress when the demand is excessive.

- The availability squeeze, brought on by the ETF, is all of the extra pronounced when hooked up to the slowdown within the printing of Bitcoin that’s occasioned by halving occasions, a slowdown that takes place after each 4 years.

IBIT’s constant accumulation, alongside eight straight days of internet inflows in June totaling $388 million, reveals no signal of slowing. This means that institutional demand may change into a structural characteristic of the market, not only a non permanent narrative.

Learn Extra: BlackRock Engages Anchorage Digital to Improve Crypto Custody and Tokenized Asset Infrastructure

The ETF Shift: What’s Totally different in Bitcoin’s Market Now

Bitcoin Turns into an Asset Class

Mainstream finance had usually dismissed Bitcoin for greater than a decade. Now, it’s uneventfully making its method into the strategic asset allocation of a number of the world’s most conservative traders.

BlackRock’s motion is not only in regards to the crypto hype. It’s half of a bigger shift:

- Pension funds, sovereign wealth funds and endowments gaining publicity to Bitcoin by way of regulated ETFs.

- BlackRock model is authentic and in addition a supply of belief particularly to advisors who might purchase purchasers with risk-averse behaviors.

As this development strengthens, anticipate the next:

- Extra merchandise with related construction to IBIT with a possible concentrate on going after multi-asset publicity with BTC within the middle.

- The market matures and its volatility within the long-term horizons turns into diminished underneath the stewardship of establishments.

- Fewer speculative bubbles pushed by retail FOMO (worry of lacking out), and extra value motion formed by macroeconomic components and fund flows.