Key Highlights:

- Nicely-known crypto dealer TechnoRevenant has added $7M to Uniswap.

- A $15M transfer reveals that the commerce nonetheless trusts WLFI, regardless that there’s a large ongoing drama across the token.

- This transfer by the dealer has helped calm fears about decentralization and has stored belief in WLFI’s ecosystem.

Not too long ago WLFI token has gained a big quantity of consideration from the crypto neighborhood, not solely due to the value rally but in addition as a result of main strikes which were made by a widely known crypto dealer. Regardless that the issues which were sparked just lately by Justin Solar as a result of current freezing of his WLFI tokens, the market has responded with stunning resilience.

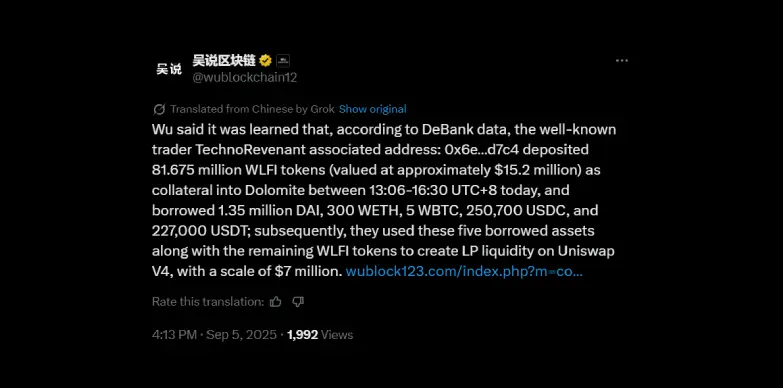

In accordance with DeBank information, a widely known crypto dealer, TechnoRevenant has deposited round 81.675 million WLFI tokens (worth at round $15.2 million) into Dolomite, which is a decentralized finance (DeFi) platform. All of this occurred between 13:06 and 16:30 UTC+8 on Thursday, which was proper after Justin Solar’s tokens had been frozen. Utilizing this collateral, the dealer then has borrowed varied property resembling 1.35 million DAI, 300 WETH, 5 WBTC, 250,700 USDC, and 227,000 USDT.

As an alternative of cashing out or just holding, the dealer mixed the borrowed property with their remaining WLFI tokens and crated a $7 million liquidity pool on Uniswap V4.

Why Does This Transfer Matter?

When you have a look at it, this transfer by TechnoRevenant appears like a really regular DeFi play, the place you place tokens down as collateral. After these tokens have been put down as collateral, you borrow different property after which present liquidity to earn the buying and selling charges. Nevertheless, with all that has occurred with WLFI, this transfer means way more than only a regular DeFi transfer.

Let’s speak in regards to the Justin Solar drama. Not too long ago, a big batch of WLFI tokens that had been linked to Justin Solar had been frozen. This incident sparked issues relating to centralization the place questions had been raised on how decentralized the World Liberty Monetary system actually is. Secondly, a query was additionally raised that if such an enormous quantity of tokens may be locked up, will there nonetheless be sufficient tokens transferring round for others to commerce?

That is precisely the place the dealer, TechnoRevenant, stepped in. The dealer added a recent $7 million liquidity pool on Uniswap and managed to deal with each the issues without delay. The dealer stored the trades clean by making it simpler for folks to purchase and promote WLFI with out wild worth jumps, which is an important facet of retaining confidence available in the market. The dealer with this transfer shared his vote of confidence for the undertaking.

Value Uptick Provides Momentum

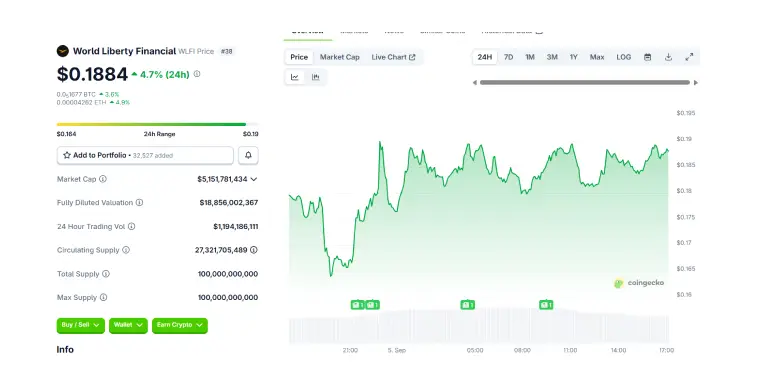

On the similar time, the value of the WLFI token has been on the rise, and this makes the transfer by the dealer much more strategic. Depositing WLFI as collateral whereas its worth is excessive permits for better borrowing energy. In different phrases, the dealer leveraged the rally to maximise what they may draw towards their holdings, without having to promote the tokens.

This means that the dealer shouldn’t be letting go of his WLFI tokens however they’re doubling down on it. The dealer is utilizing their tokens to unlock extra property whereas nonetheless actively supporting WLFI’s liquidity ecosystem.

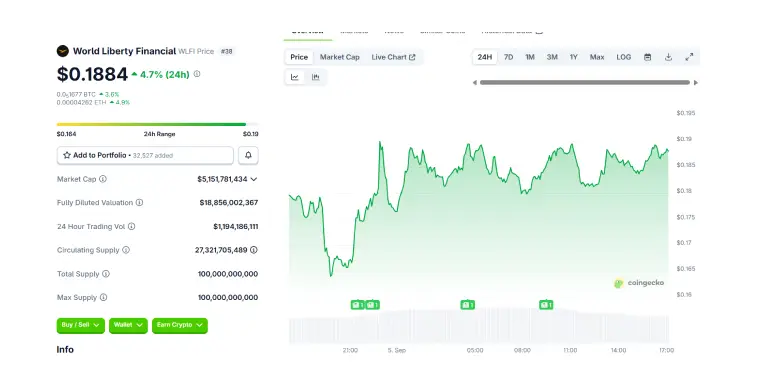

At press time, the value of the token stands at $0.1884 with an uptick of 4.7% within the final 24 hours as per CoinGecko.

Wanting Forward

The token as of now faces challenges which are associated to its affiliation with Justin Solar and questions over governance and transparency. For now, it appears just like the token is regaining belief and momentum throughout the neighborhood. If this WLFI rally can maintain itself or not is but to be seen.

Additionally Learn: Pudgy Penguins, Blur Market Drop Forged Doubt on PENGU ETF

Key Highlights:

- Nicely-known crypto dealer TechnoRevenant has added $7M to Uniswap.

- A $15M transfer reveals that the commerce nonetheless trusts WLFI, regardless that there’s a large ongoing drama across the token.

- This transfer by the dealer has helped calm fears about decentralization and has stored belief in WLFI’s ecosystem.

Not too long ago WLFI token has gained a big quantity of consideration from the crypto neighborhood, not solely due to the value rally but in addition as a result of main strikes which were made by a widely known crypto dealer. Regardless that the issues which were sparked just lately by Justin Solar as a result of current freezing of his WLFI tokens, the market has responded with stunning resilience.

In accordance with DeBank information, a widely known crypto dealer, TechnoRevenant has deposited round 81.675 million WLFI tokens (worth at round $15.2 million) into Dolomite, which is a decentralized finance (DeFi) platform. All of this occurred between 13:06 and 16:30 UTC+8 on Thursday, which was proper after Justin Solar’s tokens had been frozen. Utilizing this collateral, the dealer then has borrowed varied property resembling 1.35 million DAI, 300 WETH, 5 WBTC, 250,700 USDC, and 227,000 USDT.

As an alternative of cashing out or just holding, the dealer mixed the borrowed property with their remaining WLFI tokens and crated a $7 million liquidity pool on Uniswap V4.

Why Does This Transfer Matter?

When you have a look at it, this transfer by TechnoRevenant appears like a really regular DeFi play, the place you place tokens down as collateral. After these tokens have been put down as collateral, you borrow different property after which present liquidity to earn the buying and selling charges. Nevertheless, with all that has occurred with WLFI, this transfer means way more than only a regular DeFi transfer.

Let’s speak in regards to the Justin Solar drama. Not too long ago, a big batch of WLFI tokens that had been linked to Justin Solar had been frozen. This incident sparked issues relating to centralization the place questions had been raised on how decentralized the World Liberty Monetary system actually is. Secondly, a query was additionally raised that if such an enormous quantity of tokens may be locked up, will there nonetheless be sufficient tokens transferring round for others to commerce?

That is precisely the place the dealer, TechnoRevenant, stepped in. The dealer added a recent $7 million liquidity pool on Uniswap and managed to deal with each the issues without delay. The dealer stored the trades clean by making it simpler for folks to purchase and promote WLFI with out wild worth jumps, which is an important facet of retaining confidence available in the market. The dealer with this transfer shared his vote of confidence for the undertaking.

Value Uptick Provides Momentum

On the similar time, the value of the WLFI token has been on the rise, and this makes the transfer by the dealer much more strategic. Depositing WLFI as collateral whereas its worth is excessive permits for better borrowing energy. In different phrases, the dealer leveraged the rally to maximise what they may draw towards their holdings, without having to promote the tokens.

This means that the dealer shouldn’t be letting go of his WLFI tokens however they’re doubling down on it. The dealer is utilizing their tokens to unlock extra property whereas nonetheless actively supporting WLFI’s liquidity ecosystem.

At press time, the value of the token stands at $0.1884 with an uptick of 4.7% within the final 24 hours as per CoinGecko.

Wanting Forward

The token as of now faces challenges which are associated to its affiliation with Justin Solar and questions over governance and transparency. For now, it appears just like the token is regaining belief and momentum throughout the neighborhood. If this WLFI rally can maintain itself or not is but to be seen.

Additionally Learn: Pudgy Penguins, Blur Market Drop Forged Doubt on PENGU ETF