Key Highlights

- The New York Inventory Change (NYSE) has unveiled its plan to launch a platform for buying and selling and settling tokenized securities utilizing blockchain expertise, want regulatory approval

- The announcement comes at a time of intense debate over the Digital Asset Market Readability Act, began after the Coinbase CEO withdrew help for the invoice

- Alternatively, some teams just like the World Federation of Exchanges and Citadel Securities demand a transparent, SEC-aligned regulatory framework

On January 19, the New York Inventory Change unveiled its plan to launch a first-of-its-kind platform to commerce and settle tokenized securities on the blockchain.

💥BREAKING:

🇺🇸 NYSE to launch 24/7 US inventory buying and selling via new on-chain tokenized alternate. pic.twitter.com/ZCZXbylV37

— Crypto Rover (@cryptorover) January 19, 2026

In response to the official press launch, the brand new platform is predicted to combine superior blockchain expertise to spice up pace and effectivity for inventory buying and selling.

If authorised by regulators just like the U.S. Securities and Change Fee (SEC), the platform might launch later this yr. The platform will permit for buying and selling almost 24 hours a day, 7 days every week. By utilizing this platform, customers can settle this commerce immediately as a substitute of the present 1-day settlement customary.

The platform can also be anticipated to simply accept USD-denominated orders and permit funding via stablecoins.

NYSE Prepares to Undertake Tokenized Shares, however Regulatory Uncertainty Persists

This announcement comes amid the growth on this planet of tokenized securities. These are digital tokens on a blockchain that present possession in conventional property like firm shares or exchange-traded funds (ETFs). These tokenized securities or shares could make markets extra environment friendly, scale back prices, and permit for fractional possession of high-value property.

The NYSE platform would record each tokenized variations of current shares and new securities born instantly on the blockchain.

Lynn Martin, President, NYSE Group, said within the press launch, “For greater than two centuries, the NYSE has reworked the best way markets function. We’re main the business towards totally on-chain options, grounded within the unmatched protections and excessive regulatory requirements that place us to marry belief with state-of-the-art expertise. Harnessing our experience to reinvent market infrastructure is how we’ll meet and form the calls for of a digital future.”

“Since its founding, ICE has propelled markets from analog to digital,” Michael Blaugrund, Vice President of Strategic Initiatives, ICE, mentioned. “Supporting tokenized securities is a pivotal step in ICE’s technique to function on-chain market infrastructure for buying and selling, settlement, custody, and capital formation within the new period of world finance.”

Nonetheless, the announcement comes in the course of a regulatory chaos in Washington over find out how to regulate digital property. The controversy revolves across the proposed Digital Asset Market Readability Act, which is a significant invoice anticipated to ascertain federal guidelines for cryptocurrencies and tokenized property.

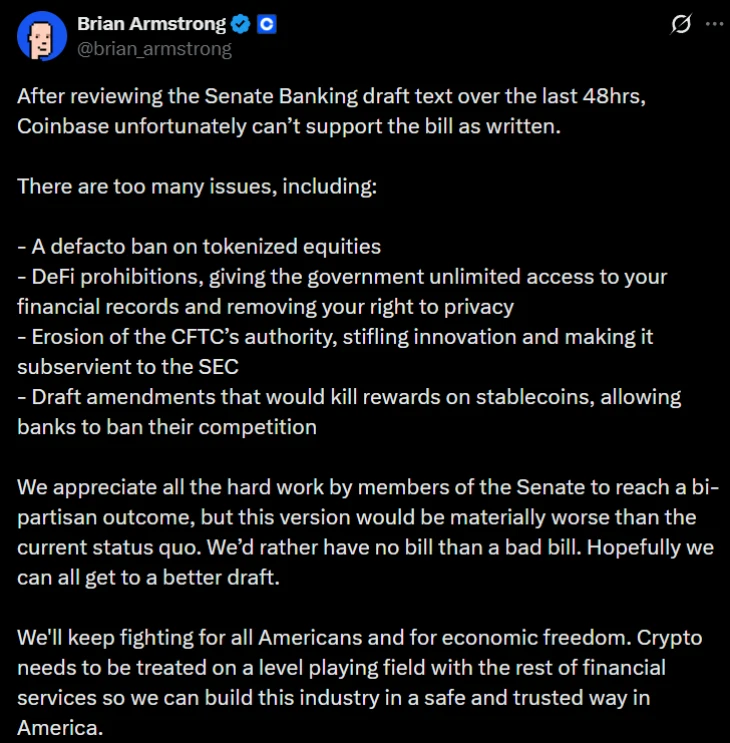

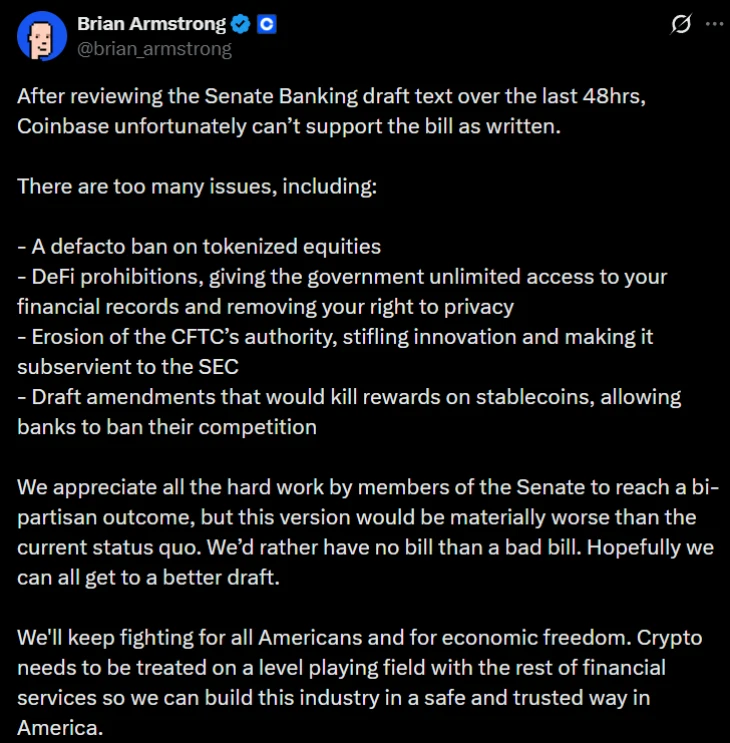

A number of days in the past, the controversy began. Coinbase CEO Brian Armstrong publicly withdrew his firm’s help for the present Senate draft of the invoice.

(Supply: Brian Armstrong on X)

In a publish on X, Armstrong referred to as the draft “materially worse than the present establishment.” He affirmed that it will impose a “de facto ban” on tokenized equities by putting them strictly underneath SEC management, which he believes might curb innovation.

Armstrong additionally raised objections to different components of the invoice. He mentioned that it will prohibit many decentralized finance actions, weaken the Commodity Futures Fee’s position, ban rewards on stablecoin holdings, and provides the federal government an excessive amount of entry to consumer monetary information.

His sudden reversal pressured the Senate Banking Committee to postpone a significant markup on the invoice.

Ongoing Debates round Tokenized Securities Break up the Neighborhood

Armstrong’s assertion has divided the digital asset business into two. Whereas some corporations, like Ripple, have supported the invoice for offering clearer guidelines, others agree with Coinbase’s issues.

But, a significant group instantly concerned in tokenization has countered Armstrong’s “de facto ban” declare.

Leaders of companies specializing in creating regulated digital securities say that the invoice really helps them. Carlos Domingo, CEO of Securitize, said that the draft clarified that tokenized equities are securities underneath current regulation, calling it a “key step” for bringing blockchain into the normal monetary world.

Glabe Otte of Dinari and executives from Superstate additionally rejected the thought of a ban, noting that the laws brings essential investor protections.

Additionally Learn: Uniswap On-Chain Alerts Flip Bullish Amid Delicate Spot Demand