- Since July 2025, the XRP value witnessed a gradual downtrend, resonating inside two converging trendlines of falling wedge patterns.

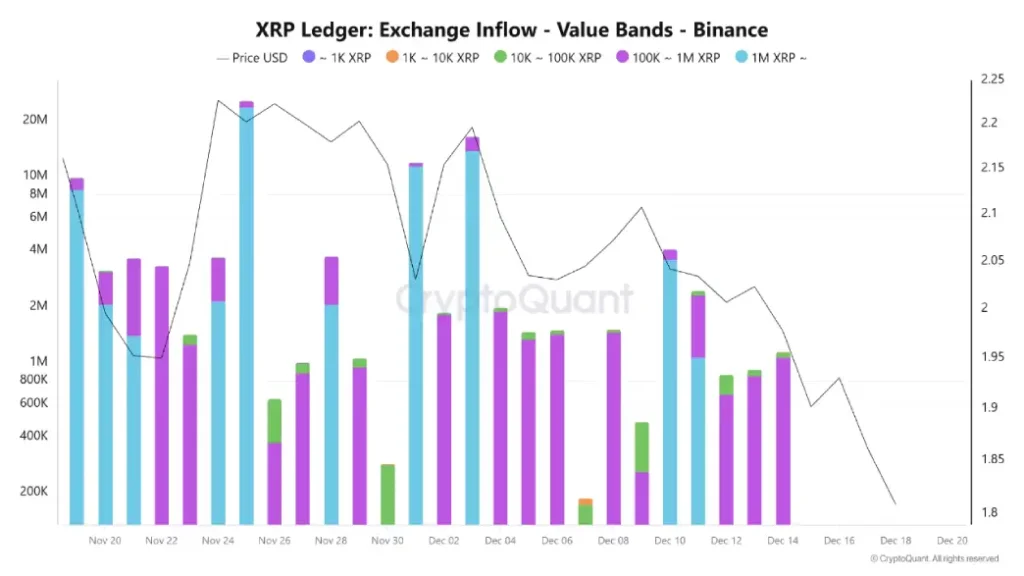

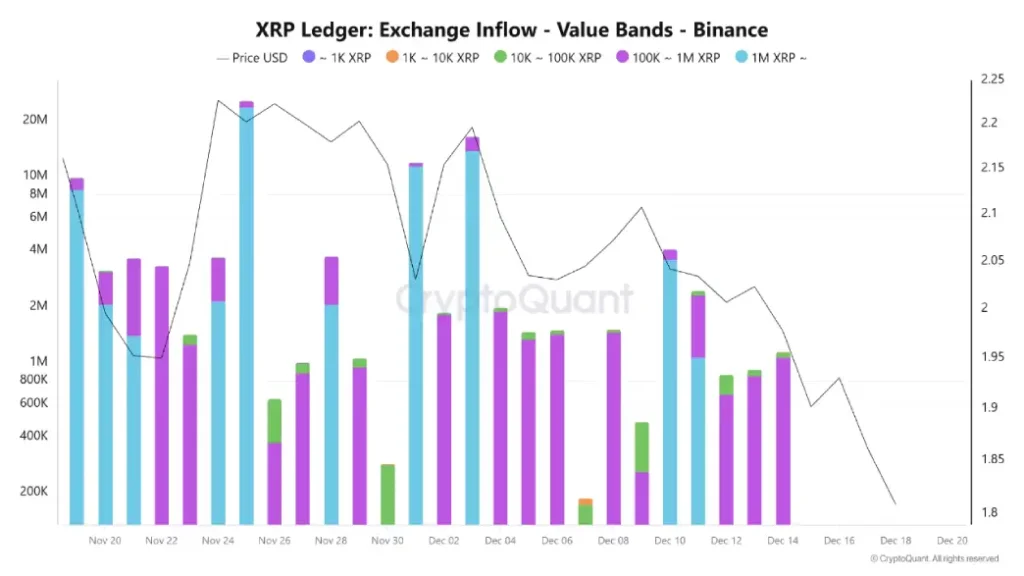

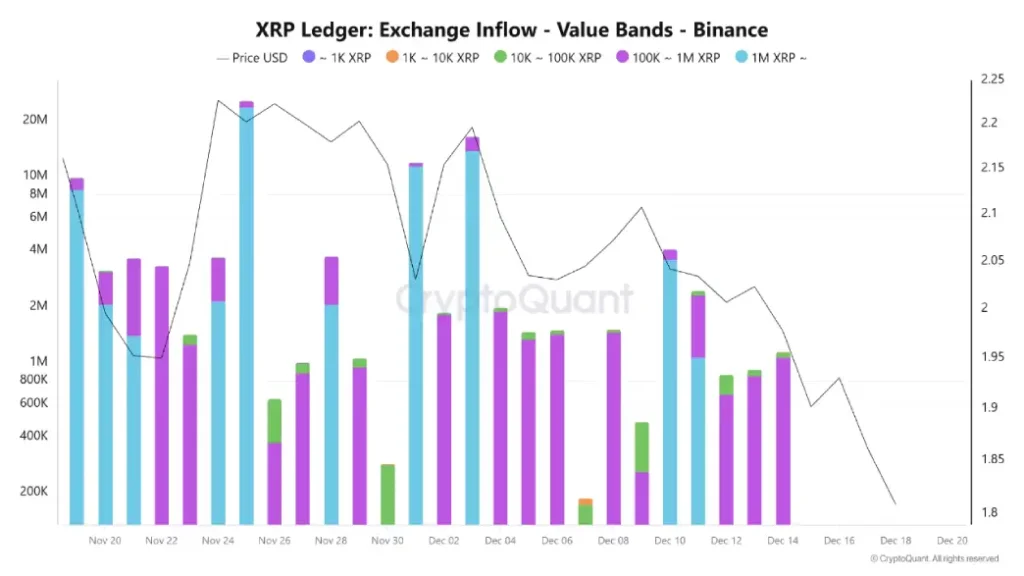

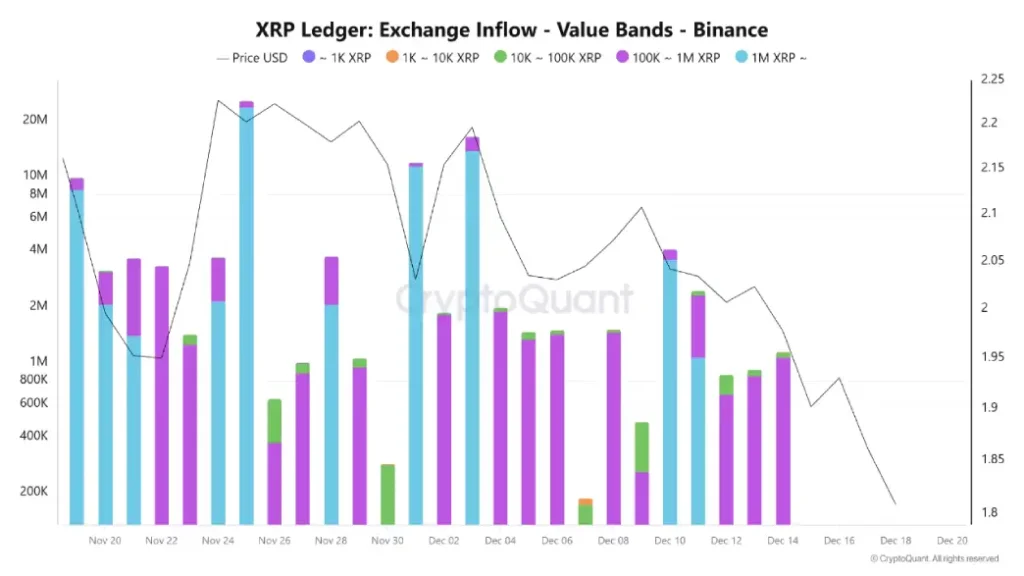

- Massive XRP transfers to Binance are dominated by holders controlling 100K–1M and 1M+ tokens

- A bearish alignment between the important thing EMAs (20<50<100<200) signifies the trail to least resistance is down.

XRP, the native cryptocurrency of the XRP Ledger, reveals low volatility buying and selling on weekends as its value stabilizes round $1.92. The shopping for stress continues to be skinny and the substantial trade influx from giant traders highlights threat of extended correction. The technical chart additionally accentuates a number of resistance restriction XRP from sustained restoration.

XRP Faces Promoting Strain as Whale Deposits Surge on Binance

Current information on Binance reveals giant actions in XRP as transfers are largely coming from holders who management between 100,000 to 1 million tokens and greater than 1 million. These patterns are indicative of the key gamers, somewhat than on a regular basis merchants, transferring belongings onto buying and selling platforms, typically indicating the intention of offloading holdings.

Following sharp will increase in these deposits, market developments present a constant development of declining peak values and troughs and point out an imbalance the place incoming provide exceeds buying curiosity. With no new sturdy shopping for exercise, this sort of dynamic has resulted in gradual declines with even average promoting from large holders including downward stress.

Based mostly on influx depth and value reactions, analyst PelinayPA highlights $1.82 to $1.87 as a significant assist zone the place non permanent halts and slight uptake have occurred up to now. Ought to deposit volumes proceed to commerce at heightened ranges, further slides might fall into the 1.50 to 1.66 greenback vary. General, the visuals from this influx monitoring doesn’t match with buildup for upward momentum.

Anticipation round potential XRP exchange-traded funds had fueled hopes for higher institutional participation and worth development by means of direct acquisitions. Nonetheless, the response was within the type of a rise in token deposits on Binance. This means giant accumulators, who took their positions first within the ETF frenzy, used their accumulator stashes to ship exit liquidity. Primarily, these entities took benefit of the hype by directing gross sales at smaller market members.

Because of this, efforts to push nearer to $1.95 face push again, and iron the impression that constructive modifications are unlikely to happen whereas there are nonetheless excessive inflows.

XRP Worth 2% Quick From Key Resistance Problem

Within the final two weeks, the XRP value reveals a short pullback from $2.17 to $1.93, registering a lack of 12.34%. Consequently, the asset market cap plunged to $116.86 billion.

An evaluation of the day by day chart reveals this downswing resonating strictly inside two converging trendlines indicating the formation of falling wedge patterns. The chart setup is often supported on the finish of downtrend as converging trendline hints diminishing bearish momentum.

With an intraday achieve of 1.3%, the XRP value is heading near the sample’s resistance trendline at $2.2. The 20-day exponential transferring common wavering near this resistance signifies further resistance towards patrons.

If the crypto sellers proceed to defend the overhead trendline, the coin value reverses decrease and drives extended correction beneath the $2.

Subsequently, for patrons to regain their management over this asset, the XRP value should breach the overhead trendline to provoke restoration momentum.

Additionally Learn: Ethereum Finds Stability Above $2,700 Amid Macro Aid and Community Development

- Since July 2025, the XRP value witnessed a gradual downtrend, resonating inside two converging trendlines of falling wedge patterns.

- Massive XRP transfers to Binance are dominated by holders controlling 100K–1M and 1M+ tokens

- A bearish alignment between the important thing EMAs (20<50<100<200) signifies the trail to least resistance is down.

XRP, the native cryptocurrency of the XRP Ledger, reveals low volatility buying and selling on weekends as its value stabilizes round $1.92. The shopping for stress continues to be skinny and the substantial trade influx from giant traders highlights threat of extended correction. The technical chart additionally accentuates a number of resistance restriction XRP from sustained restoration.

XRP Faces Promoting Strain as Whale Deposits Surge on Binance

Current information on Binance reveals giant actions in XRP as transfers are largely coming from holders who management between 100,000 to 1 million tokens and greater than 1 million. These patterns are indicative of the key gamers, somewhat than on a regular basis merchants, transferring belongings onto buying and selling platforms, typically indicating the intention of offloading holdings.

Following sharp will increase in these deposits, market developments present a constant development of declining peak values and troughs and point out an imbalance the place incoming provide exceeds buying curiosity. With no new sturdy shopping for exercise, this sort of dynamic has resulted in gradual declines with even average promoting from large holders including downward stress.

Based mostly on influx depth and value reactions, analyst PelinayPA highlights $1.82 to $1.87 as a significant assist zone the place non permanent halts and slight uptake have occurred up to now. Ought to deposit volumes proceed to commerce at heightened ranges, further slides might fall into the 1.50 to 1.66 greenback vary. General, the visuals from this influx monitoring doesn’t match with buildup for upward momentum.

Anticipation round potential XRP exchange-traded funds had fueled hopes for higher institutional participation and worth development by means of direct acquisitions. Nonetheless, the response was within the type of a rise in token deposits on Binance. This means giant accumulators, who took their positions first within the ETF frenzy, used their accumulator stashes to ship exit liquidity. Primarily, these entities took benefit of the hype by directing gross sales at smaller market members.

Because of this, efforts to push nearer to $1.95 face push again, and iron the impression that constructive modifications are unlikely to happen whereas there are nonetheless excessive inflows.

XRP Worth 2% Quick From Key Resistance Problem

Within the final two weeks, the XRP value reveals a short pullback from $2.17 to $1.93, registering a lack of 12.34%. Consequently, the asset market cap plunged to $116.86 billion.

An evaluation of the day by day chart reveals this downswing resonating strictly inside two converging trendlines indicating the formation of falling wedge patterns. The chart setup is often supported on the finish of downtrend as converging trendline hints diminishing bearish momentum.

With an intraday achieve of 1.3%, the XRP value is heading near the sample’s resistance trendline at $2.2. The 20-day exponential transferring common wavering near this resistance signifies further resistance towards patrons.

If the crypto sellers proceed to defend the overhead trendline, the coin value reverses decrease and drives extended correction beneath the $2.

Subsequently, for patrons to regain their management over this asset, the XRP value should breach the overhead trendline to provoke restoration momentum.

Additionally Learn: Ethereum Finds Stability Above $2,700 Amid Macro Aid and Community Development