Key Highlights

- Talos has introduced that it raised a $45 million in extension to its Sequence B funding spherical, which brings the entire for the spherical to $150 million

- The funding spherical witnessed the participation of latest and returning buyers, together with Robinhood Markets, Sony Innovation, a16z crypto, BNY Mellon, and Constancy Investments

- The corporate will use this capital to speed up product improvement

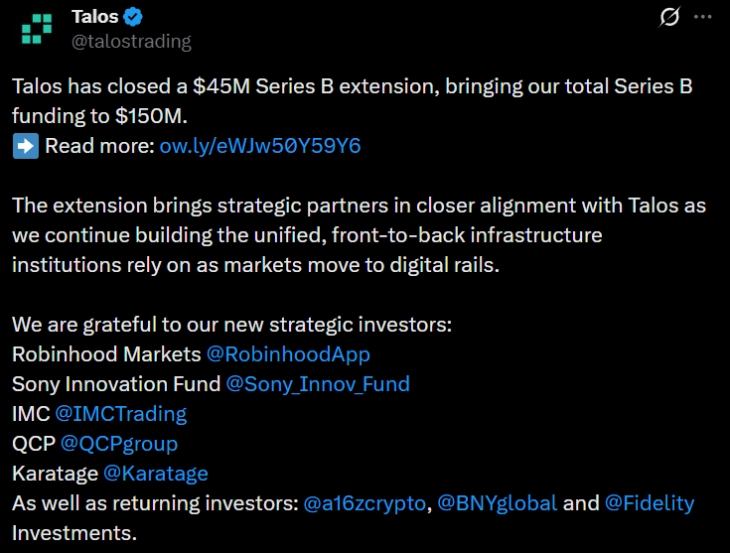

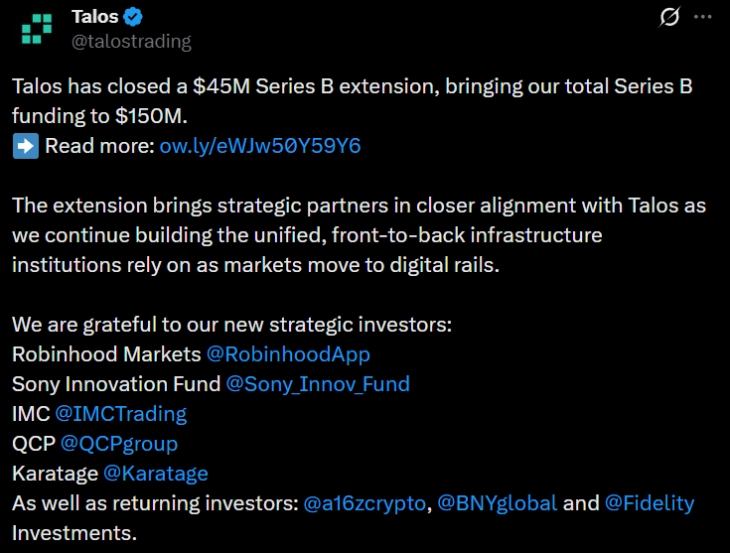

On January 29, Talos, the main digital asset buying and selling infrastructure supplier, introduced that it has raised an extra $45 million in a Sequence B fundraising spherical.

(Supply: Talos on X)

This fundraising spherical will worth the New York-based firm at roughly $1.5 billion after the funding.

This extension of its Sequence B funding spherical brings the entire raised on this sequence to $150 million.

This funding spherical is seen as a landmark second for Talos because it entails main buyers. It attracted new strategic companions, together with the retail buying and selling big Robinhood Markets, Sony Innovation Fund, IMC, QCP, and Karatage, alongside returning buyers a16z crypto, BNY, and Constancy Investments.

Anton Katz, CEO and Co-Founding father of Talos, acknowledged within the press launch, “We’re proud to have among the world’s most revered establishments, most of them present shoppers and companions, be part of us as buyers. We prolonged our Sequence B spherical to accommodate curiosity from strategic companions who acknowledge Talos’s function in offering core institutional infrastructure for digital belongings.”

“At a time when conventional asset lessons are more and more migrating to digital rails, these companions needed to be extra intently aligned with our development. Collectively, we’re constructing the inspiration for the subsequent technology of economic markets,” he mentioned.

The involvement of varied companions creates an important coalition for Talos. Robinhood comes with perception into retail markets, as it’s main the cryptocurrency platform. However, companies like IMC and Constancy additionally include their experience in market construction and conventional asset administration. Their involvement within the funding spherical reveals their confidence in retail and institutional finance on a shared technological basis developed by Talos.

“Talos’s flexibility and speedy adaptability enable us to deepen our liquidity and ship much more superior options to Robinhood Crypto clients,” Johann Kerbrat, SVP and GM of Crypto at Robinhood, mentioned. “We’re blissful to assist their development as they work to energy the digital asset ecosystem.”

“Talos has constructed a complete crypto platform from the bottom as much as deal with the advanced wants of enormous monetary establishments as they quickly scale their companies,” Kazuhito Hadano, CEO, Sony Ventures Company, shared in his comment within the press launch. “At Sony Innovation Fund, we’ve been notably impressed by the corporate’s evolution from order execution to a full front-, middle- and back-office resolution, complemented by sturdy digital asset knowledge and analytics. We’re excited to assist Talos on this subsequent section of development and assist speed up its continued growth.”

Talos Will get Recent Capital to Increase Its Operations

The newest influx of money comes after Talos’s earlier Sequence B spherical in Might 2022. At the moment, the corporate raised $105 million in a spherical led by Common Atlantic that helped it to realize a valuation of $1.25 billion. That spherical included buyers like Citi, Wells Fargo Strategic Capital, PayPal Ventures, and Galaxy Digital. The capital helped the corporate to broaden into Europe and the Asia-Pacific area, together with its product suite.

The brand new $45 million fund will enhance the tempo for product improvement. With this capital, the corporate is planning to advance its portfolio building instruments, threat analytics programs, and automatic buying and selling algorithms.

Marius Barnett, Co-Founder and CEO, Karatage, acknowledged within the press launch, “Anton and the Talos crew have constructed an distinctive, institutional-grade platform that’s the important infrastructure for the evolving digital asset ecosystem. Their relentless concentrate on innovation, mixed with best-in-class execution, positions Talos because the dominant chief as conventional finance migrates to digital rails.”

It’s also planning to extend its integration with decentralized finance protocols. The corporate has not too long ago partnered with Uniswap Labs and Fireblocks to create institutional-grade entry to DeFi liquidity, permitting conventional companies to securely faucet into on-chain alternatives.

Additionally Learn: Liquid Capital’s JackYi Rejects Bear Cycle, Backs Technique

Key Highlights

- Talos has introduced that it raised a $45 million in extension to its Sequence B funding spherical, which brings the entire for the spherical to $150 million

- The funding spherical witnessed the participation of latest and returning buyers, together with Robinhood Markets, Sony Innovation, a16z crypto, BNY Mellon, and Constancy Investments

- The corporate will use this capital to speed up product improvement

On January 29, Talos, the main digital asset buying and selling infrastructure supplier, introduced that it has raised an extra $45 million in a Sequence B fundraising spherical.

(Supply: Talos on X)

This fundraising spherical will worth the New York-based firm at roughly $1.5 billion after the funding.

This extension of its Sequence B funding spherical brings the entire raised on this sequence to $150 million.

This funding spherical is seen as a landmark second for Talos because it entails main buyers. It attracted new strategic companions, together with the retail buying and selling big Robinhood Markets, Sony Innovation Fund, IMC, QCP, and Karatage, alongside returning buyers a16z crypto, BNY, and Constancy Investments.

Anton Katz, CEO and Co-Founding father of Talos, acknowledged within the press launch, “We’re proud to have among the world’s most revered establishments, most of them present shoppers and companions, be part of us as buyers. We prolonged our Sequence B spherical to accommodate curiosity from strategic companions who acknowledge Talos’s function in offering core institutional infrastructure for digital belongings.”

“At a time when conventional asset lessons are more and more migrating to digital rails, these companions needed to be extra intently aligned with our development. Collectively, we’re constructing the inspiration for the subsequent technology of economic markets,” he mentioned.

The involvement of varied companions creates an important coalition for Talos. Robinhood comes with perception into retail markets, as it’s main the cryptocurrency platform. However, companies like IMC and Constancy additionally include their experience in market construction and conventional asset administration. Their involvement within the funding spherical reveals their confidence in retail and institutional finance on a shared technological basis developed by Talos.

“Talos’s flexibility and speedy adaptability enable us to deepen our liquidity and ship much more superior options to Robinhood Crypto clients,” Johann Kerbrat, SVP and GM of Crypto at Robinhood, mentioned. “We’re blissful to assist their development as they work to energy the digital asset ecosystem.”

“Talos has constructed a complete crypto platform from the bottom as much as deal with the advanced wants of enormous monetary establishments as they quickly scale their companies,” Kazuhito Hadano, CEO, Sony Ventures Company, shared in his comment within the press launch. “At Sony Innovation Fund, we’ve been notably impressed by the corporate’s evolution from order execution to a full front-, middle- and back-office resolution, complemented by sturdy digital asset knowledge and analytics. We’re excited to assist Talos on this subsequent section of development and assist speed up its continued growth.”

Talos Will get Recent Capital to Increase Its Operations

The newest influx of money comes after Talos’s earlier Sequence B spherical in Might 2022. At the moment, the corporate raised $105 million in a spherical led by Common Atlantic that helped it to realize a valuation of $1.25 billion. That spherical included buyers like Citi, Wells Fargo Strategic Capital, PayPal Ventures, and Galaxy Digital. The capital helped the corporate to broaden into Europe and the Asia-Pacific area, together with its product suite.

The brand new $45 million fund will enhance the tempo for product improvement. With this capital, the corporate is planning to advance its portfolio building instruments, threat analytics programs, and automatic buying and selling algorithms.

Marius Barnett, Co-Founder and CEO, Karatage, acknowledged within the press launch, “Anton and the Talos crew have constructed an distinctive, institutional-grade platform that’s the important infrastructure for the evolving digital asset ecosystem. Their relentless concentrate on innovation, mixed with best-in-class execution, positions Talos because the dominant chief as conventional finance migrates to digital rails.”

It’s also planning to extend its integration with decentralized finance protocols. The corporate has not too long ago partnered with Uniswap Labs and Fireblocks to create institutional-grade entry to DeFi liquidity, permitting conventional companies to securely faucet into on-chain alternatives.

Additionally Learn: Liquid Capital’s JackYi Rejects Bear Cycle, Backs Technique