In an evaluation shared on X, crypto analyst Astronomer (@astronomer_zero) delves into the query that’s been looming over the crypto group in recents months: “Will we by no means have a correct altcoin season once more?” As Bitcoin’s dominance (BTC.D) continues to surge and altcoins battle to maintain tempo, Astronomer gives a data-driven perspective difficult the prevailing narratives that counsel the period of altcoin seasons could also be over.

Astronomer begins by acknowledging the difficulties confronted by altcoin holders within the present market surroundings. “Alts are nonetheless at low costs and BTC.D is raging up, and sure, ETH (and altcoin) holders are having a troublesome time,” he notes.

He observes a rising sentiment of disbelief amongst buyers that Bitcoin dominance may decline once more, casting doubt on the potential for one more altcoin season. “You hear issues like ‘BTC ETF modified the whole lot,’ ‘Boomers won’t purchase altcoins which is why they gained’t go up,’ ‘BTC is at ATH and alts have accomplished nothing.’ That are all issues which can be simple to say and grasp as a result of they match the present chart completely,” Astronomer explains.

Nonetheless, he cautions towards accepting these narratives at face worth. “They provide you a way of consolation and a cause to not maintain any alts, which is usually tough throughout accumulation levels, particularly if the BTC chart ‘appears to be like’ so much higher,” he provides.

Associated Studying

To supply readability, Astronomer provides his personal definition of an altcoin season: “A real altcoin season is one the place liquidity from essentially the most dominant asset (BTC) flows to the opposite belongings (ETH and altcoins). As a consequence, BTC.D drops and almost all altcoins go up.”

The Case For An Impending Altcoin Season

Astronomer lays out a sequence of details to assist his argument that an altcoin season remains to be on the horizon:

#1 Historic Priority

“First reality: we had the large altcoin season each single cycle (4-year rotation) like clockwork,” he asserts. This sample shouldn’t be solely evident in historic charts but in addition within the collective reminiscence of these lively throughout earlier cycles. Astronomer cautions towards adopting a “this time is completely different” mindset, which inherently positions buyers at an obstacle. “Historical past rhymes/repeats,” he reminds readers.

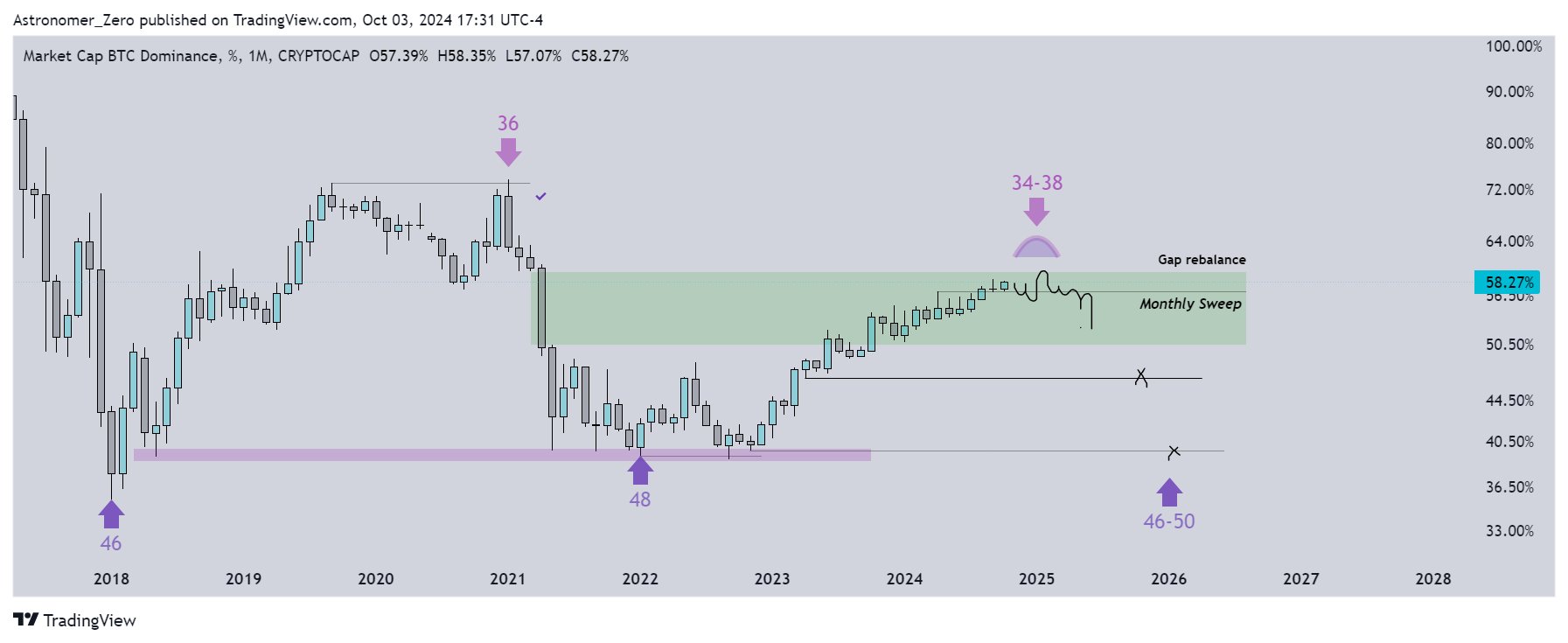

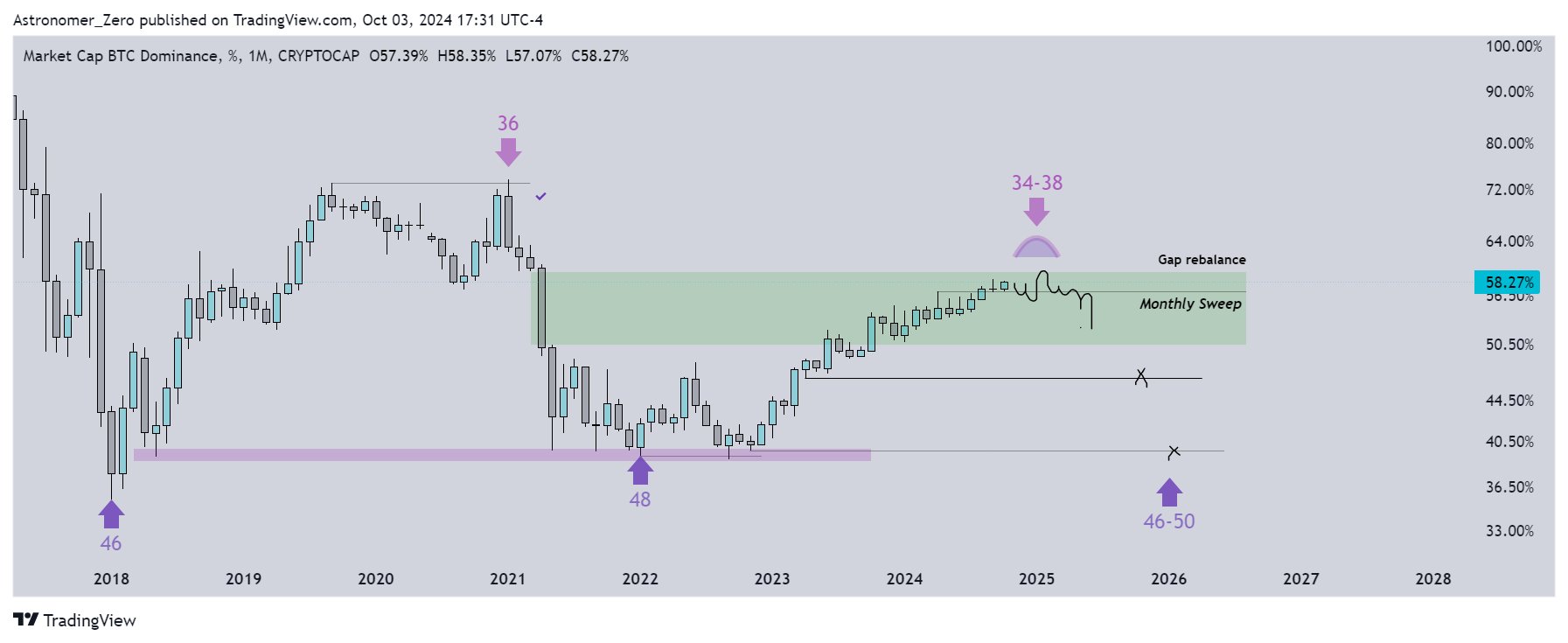

#2 Bitcoin Dominance Chart Aligns With 4-12 months Cycle

“The BTC.D chart is on observe with its 4-year cycle,” Astronomer notes. He beforehand predicted {that a} high in Bitcoin dominance would happen round months 34 to 38 of the cycle. “We at the moment are month 33 within the 4-year cycle, which implies the tides are about to shift in only a few months,” he factors out. Believing that Bitcoin dominance will proceed to rise unchecked is basically betting towards established cyclical patterns, based on the analyst.

#3 The Grand Crypto Rotation

“The ‘first Grand Altcoin rotation’ typically occurs as soon as per cycle: round This fall in 12 months 3 of the cycle and is once more enjoying out like clockwork to this point,” Astronomer states. He explains that in earlier cycles, sure altcoins (a minority) carry out strongly early on, pushed by particular narratives, whereas the bulk expertise vital features later, fueled by liquidity flowing from Bitcoin.

He cites the 2018–2022 cycle as a first-rate instance. “On this cycle, within the first 3 years, LINK is a superb instance because it was one of many strongest high 100 altcoins and has put in a 100x, whereas ETH (and all the opposite BTC liquidity-driven altcoins) have put in a measly 3x,” he explains. Within the final 12 months of that cycle, the dynamics shifted: “ETH has put in a 10x, and LINK has solely gained one other 3x or so.”

Associated Studying

#4 Overrated Impression Of Bitcoin ETF

Addressing the notion that the approval of a Bitcoin ETF has basically altered market dynamics, Astronomer is skeptical. “The BTC ETF narrative to cancel alt season is manner overrated,” he argues. He factors out that since their launch, ETF complete flows have amassed as much as $40 billion, whereas Bitcoin’s centralized trade (CEX) volumes common $20 billion day by day. “ETF flows are negligible, which is why you by no means heard me speak about them as I prefer to filter noise,” he asserts.

#5 Favorable Financial Coverage Looms

Astronomer additionally highlights macroeconomic components that might profit altcoins. “Rates of interest are on the decline, the US cash provide is growing drastically (the place now additionally China is following go well with). The one factor we’re ready for is QE, which is usually a pure consequence of M2 growing (with a delay),” he explains. Traditionally, such financial situations have been conducive to altcoin appreciation. “The financial coverage shifting in our favor sometimes additionally means altcoins do effectively,” he notes.

#6 Bitcoin’s All-Time Excessive Is An Arbitrary Indicator

He challenges the concept that Bitcoin reaching an all-time excessive (ATH) and not using a concurrent altcoin season alerts a everlasting decoupling. “BTC being at ATH is an arbitrary gauge to when alt season begins and the truth that it reached ATH however altcoin season hasn’t begun but is, for my part, not legitimate to name it canceled,” Astronomer argues. He emphasizes that point and cyclical patterns are extra vital components than worth milestones.

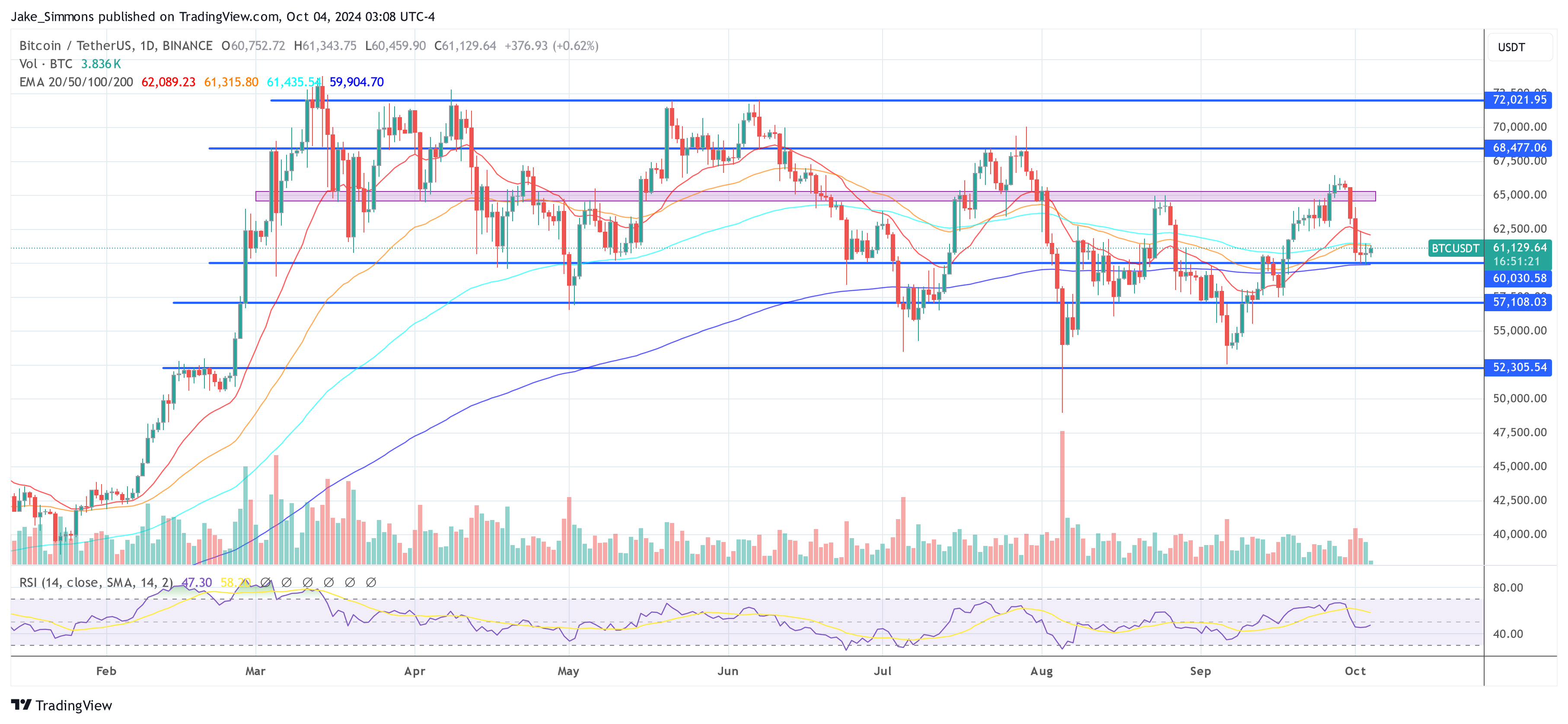

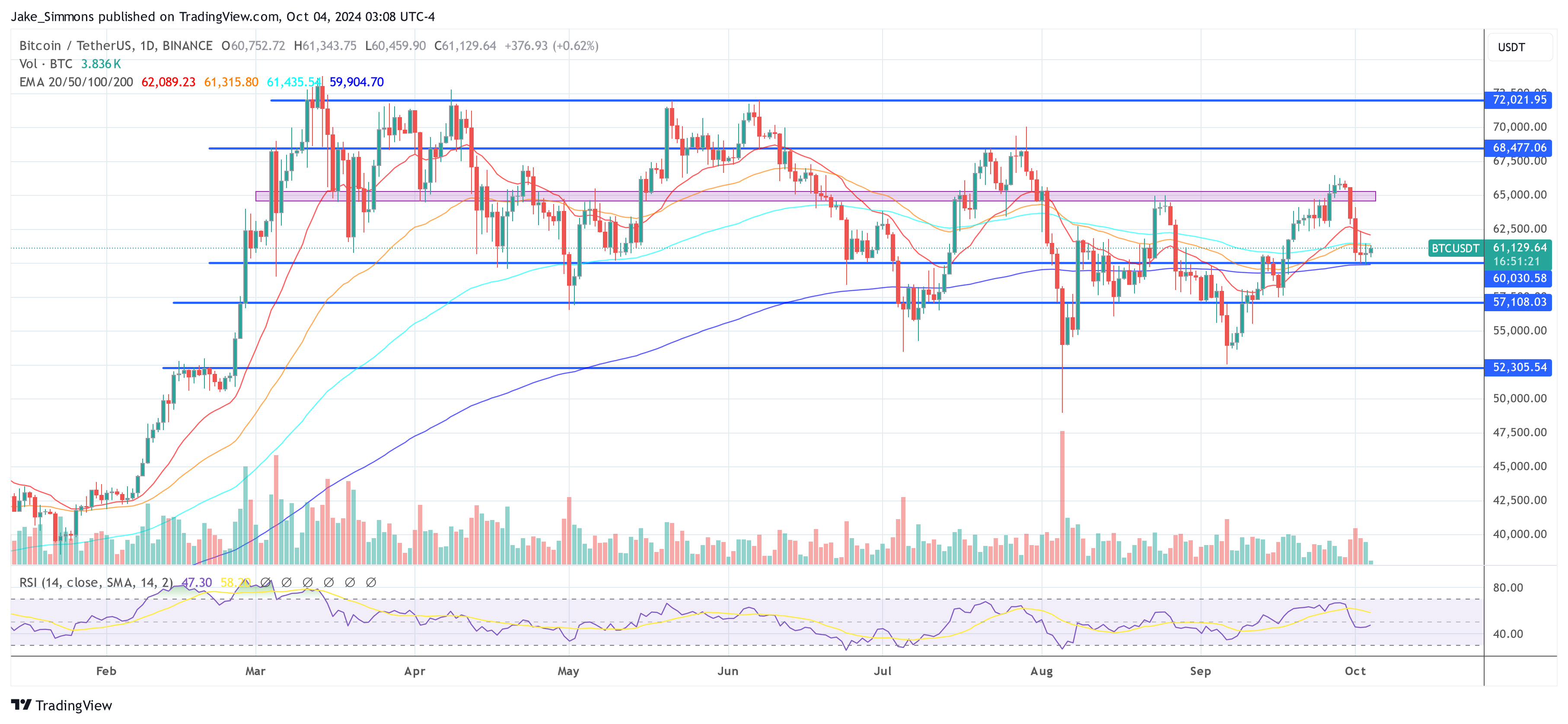

At press time, Bitcoin traded at $61,129.

Featured picture created with DALL.E, chart from TradingView.com

In an evaluation shared on X, crypto analyst Astronomer (@astronomer_zero) delves into the query that’s been looming over the crypto group in recents months: “Will we by no means have a correct altcoin season once more?” As Bitcoin’s dominance (BTC.D) continues to surge and altcoins battle to maintain tempo, Astronomer gives a data-driven perspective difficult the prevailing narratives that counsel the period of altcoin seasons could also be over.

Astronomer begins by acknowledging the difficulties confronted by altcoin holders within the present market surroundings. “Alts are nonetheless at low costs and BTC.D is raging up, and sure, ETH (and altcoin) holders are having a troublesome time,” he notes.

He observes a rising sentiment of disbelief amongst buyers that Bitcoin dominance may decline once more, casting doubt on the potential for one more altcoin season. “You hear issues like ‘BTC ETF modified the whole lot,’ ‘Boomers won’t purchase altcoins which is why they gained’t go up,’ ‘BTC is at ATH and alts have accomplished nothing.’ That are all issues which can be simple to say and grasp as a result of they match the present chart completely,” Astronomer explains.

Nonetheless, he cautions towards accepting these narratives at face worth. “They provide you a way of consolation and a cause to not maintain any alts, which is usually tough throughout accumulation levels, particularly if the BTC chart ‘appears to be like’ so much higher,” he provides.

Associated Studying

To supply readability, Astronomer provides his personal definition of an altcoin season: “A real altcoin season is one the place liquidity from essentially the most dominant asset (BTC) flows to the opposite belongings (ETH and altcoins). As a consequence, BTC.D drops and almost all altcoins go up.”

The Case For An Impending Altcoin Season

Astronomer lays out a sequence of details to assist his argument that an altcoin season remains to be on the horizon:

#1 Historic Priority

“First reality: we had the large altcoin season each single cycle (4-year rotation) like clockwork,” he asserts. This sample shouldn’t be solely evident in historic charts but in addition within the collective reminiscence of these lively throughout earlier cycles. Astronomer cautions towards adopting a “this time is completely different” mindset, which inherently positions buyers at an obstacle. “Historical past rhymes/repeats,” he reminds readers.

#2 Bitcoin Dominance Chart Aligns With 4-12 months Cycle

“The BTC.D chart is on observe with its 4-year cycle,” Astronomer notes. He beforehand predicted {that a} high in Bitcoin dominance would happen round months 34 to 38 of the cycle. “We at the moment are month 33 within the 4-year cycle, which implies the tides are about to shift in only a few months,” he factors out. Believing that Bitcoin dominance will proceed to rise unchecked is basically betting towards established cyclical patterns, based on the analyst.

#3 The Grand Crypto Rotation

“The ‘first Grand Altcoin rotation’ typically occurs as soon as per cycle: round This fall in 12 months 3 of the cycle and is once more enjoying out like clockwork to this point,” Astronomer states. He explains that in earlier cycles, sure altcoins (a minority) carry out strongly early on, pushed by particular narratives, whereas the bulk expertise vital features later, fueled by liquidity flowing from Bitcoin.

He cites the 2018–2022 cycle as a first-rate instance. “On this cycle, within the first 3 years, LINK is a superb instance because it was one of many strongest high 100 altcoins and has put in a 100x, whereas ETH (and all the opposite BTC liquidity-driven altcoins) have put in a measly 3x,” he explains. Within the final 12 months of that cycle, the dynamics shifted: “ETH has put in a 10x, and LINK has solely gained one other 3x or so.”

Associated Studying

#4 Overrated Impression Of Bitcoin ETF

Addressing the notion that the approval of a Bitcoin ETF has basically altered market dynamics, Astronomer is skeptical. “The BTC ETF narrative to cancel alt season is manner overrated,” he argues. He factors out that since their launch, ETF complete flows have amassed as much as $40 billion, whereas Bitcoin’s centralized trade (CEX) volumes common $20 billion day by day. “ETF flows are negligible, which is why you by no means heard me speak about them as I prefer to filter noise,” he asserts.

#5 Favorable Financial Coverage Looms

Astronomer additionally highlights macroeconomic components that might profit altcoins. “Rates of interest are on the decline, the US cash provide is growing drastically (the place now additionally China is following go well with). The one factor we’re ready for is QE, which is usually a pure consequence of M2 growing (with a delay),” he explains. Traditionally, such financial situations have been conducive to altcoin appreciation. “The financial coverage shifting in our favor sometimes additionally means altcoins do effectively,” he notes.

#6 Bitcoin’s All-Time Excessive Is An Arbitrary Indicator

He challenges the concept that Bitcoin reaching an all-time excessive (ATH) and not using a concurrent altcoin season alerts a everlasting decoupling. “BTC being at ATH is an arbitrary gauge to when alt season begins and the truth that it reached ATH however altcoin season hasn’t begun but is, for my part, not legitimate to name it canceled,” Astronomer argues. He emphasizes that point and cyclical patterns are extra vital components than worth milestones.

At press time, Bitcoin traded at $61,129.

Featured picture created with DALL.E, chart from TradingView.com