Solana (SOL) continued to commerce sluggishly on Thursday, following a pointy drop of round 20% to roughly $128.62 on Wednesday. This decline has been linked to sustained promoting stress from a serious unidentified whale or institutional investor, who has already unloaded over $99 million price of the cryptocurrency this 12 months.

“Since January 1, this whale/establishment has offered a mean of 19,306 SOL (price $2.76 million) weekly, totaling practically $100 million.” In accordance with on-chain evaluation agency Lookonchain tweeted on Sep 3.

The agency additionally revealed that the whale nonetheless holds 1.88 million $SOL (valued at $255.89 million) in staking, elevating considerations over potential continued promoting stress.

Notably, SOL has struggled to keep up momentum since reaching an area yearly excessive of $210 final March, falling right into a sideways consolidation sample just like different main crypto belongings like BTC, ETH, and ADA.

Nonetheless, regardless of this lull, a number of analysts stay assured in SOL’s potential. On Wednesday, distinguished crypto analyst Javon Marks projected a surge in SOL’s worth to $457. In his evaluation, Marks highlighted that his $233.8 goal for Solana has held regular since mid-2023, when costs had been at $16.12, marking a outstanding 1,203% rise.

With SOL’s current pullback, the pundit reaffirmed his subsequent goal, noting that the breakout holding the worth in play continues to point out power, backed by bullish indicators that push the worth to his goal.

“With that pullback and bull sign, we are able to look ahead to a break of this $233.8 goal, bringing $457.97 into play and room for a further +93% climb…” he acknowledged.

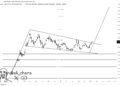

Different analysts have additionally expressed optimistic views about SOL. Analyst “Cryptocurb” famous SOL’s consolidation inside an uneven triangle sample, tweeting that SOL has been buying and selling between $120 and $210 for over 180 days, fluctuating between month-to-month help and resistance ranges.

He additional projected that when this consolidation part breaks, “the transfer goes to be MASSIVE.” In accordance with the pundit, we are able to “anticipate a swift transfer as much as $400-$500, earlier than development to $800-$1,000” or extra, as soon as the breakout happens.

Including to the optimistic outlook, Ali Martinez highlighted a possible technical sign for a Solana rebound within the brief time period. On Thursday, he tweeted that the TD Sequential indicator has issued a purchase sign on SOL’s day by day chart, suggesting a potential rebound over the subsequent one to 4 day by day candlesticks.

Elsewhere, analyst Sai Prathap highlighted historic worth developments main as much as Solana’s annual Breakpoint convention. He identified that in earlier years, SOL skilled vital pre-event worth surges: 68% in 2021, 42% in 2022, and 58% in 2023.

With this 12 months’s Breakpoint convention scheduled to begin on September twentieth in Singapore, Prathap prompt an identical rally might happen. He additional added that anticipated fee cuts in mid-September might additional increase the probability of a worth surge, emphasizing that it’s a matter of chances.

At press time, SOL was buying and selling at $125.44, reflecting a 3.74% drop over the previous 24 hours.