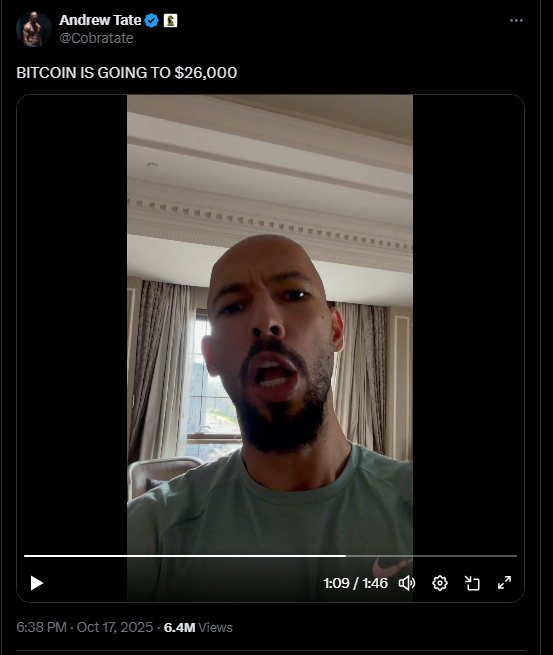

In accordance with posts and quick clips revealed on October 17, 2025, social media persona Andrew Tate warned that Bitcoin might fall to $26,000 earlier than a backside kinds.

Associated Studying

His clip argues that so long as many merchants count on fast rebounds and maintain lengthy bets, the market can hold sliding till optimism is gone.

However, it was the “automobile crash” and “shedding your total household” and having an arm amputated in an accident half that sounded disturbing. It was all a metaphor in regards to the actuality of investing in Bitcoin and that all the things might worsen. No less than, in the best way he sees it.

On Psychology & Danger

Tate’s message was largely darkish and foreboding. He spoke about ache, struggling and the way an excessive amount of expectation can wreck folks’s desires. His message enters on market psychology: too many individuals nonetheless pondering value received’t go decrease, which is the worst half — and that retains danger alive.

He framed the transfer as a capitulation or “amputation” — a second when merchants lastly surrender and positions are cleared. A number of crypto shops picked up the clip and reposted quick movies of his feedback throughout X and Instagram.

Market information provides context to why his warning grabbed consideration. Bitcoin not too long ago pulled again from highs earlier in October and traded close to the $106,000–$107,000 space on October 17, with massive liquidations hitting futures and choices desks.

BITCOIN IS GOING TO $26,000 pic.twitter.com/Ng8ntmjWow

— Andrew Tate (@Cobratate) October 17, 2025

Experiences present tons of of thousands and thousands cleared from leveraged positions within the latest sell-off. That sort of compelled promoting can amplify strikes in both route.

Market Strikes And Knowledge Factors

Different shops identified outflows from spot Bitcoin ETFs on days when costs slid, proof that institutional flows can swing rapidly and have an effect on liquidity.

Some protection named single-day ETF outflows within the tons of of thousands and thousands, underscoring how fragile demand can look in a down leg. On the identical time, just a few market vets argued that these drops create shopping for probabilities for longer-term gamers.

Observers cut up on likelihood. Some analysts warn {that a} deep correction is feasible if broad liquidity dries up or if macro shocks hit danger belongings.

Others be aware that structural change — like bigger custody flows and ETF frameworks — creates extra consumers than in previous cycles, which might make a plunge to $26,000 unlikely and not using a main exterior shock.

Associated Studying

What Merchants Ought to Watch

In the meantime, key numbers to observe are assist close to four-figure and five-figure ranges that merchants have flagged this week, liquidations throughout futures, and ETF flows out and in of spot merchandise.

Momentum indicators versus gold and on-chain metrics have additionally been highlighted by some shops as indicators of whether or not sellers are exhausted or simply getting began.

Briefly, Tate’s $26,000 name is a daring, easy forecast constructed on a sentiment argument. It’s newsworthy as a result of it got here from a extensively adopted determine and since crypto is risky proper now. However it’s one state of affairs amongst many.

Featured picture from Gemini, chart from TradingView