Whereas a bull rally correction has been anticipated, Bitcoin’s drop from its all-time excessive of $99,600 to $92,000 managed to wipe out an excellent chunk of optimism from the market. The tempo of Bitcoin’s progress for the reason that US presidential elections in November led many to count on BTC to interrupt by means of the coveted $100,000 mark comparatively rapidly and enter right into a full-blown bull market by 12 months’s finish.

Earlier CryptoSlate analysis analyzed futures funding charges, exploring how the price of sustaining positions displays market sentiment. Persistently excessive volume-weighted and open interest-weighted funding charges mirrored the market’s optimism and confirmed that the rally was largely pushed by derivatives buying and selling.

Nevertheless, it additionally confirmed a big hazard of the market overheating, as elevated funding charges sign extreme leverage that creates a fragile market surroundings. Intervals of excessive funding charges usually precede sharp corrections, as overextended merchants are compelled to exit positions.

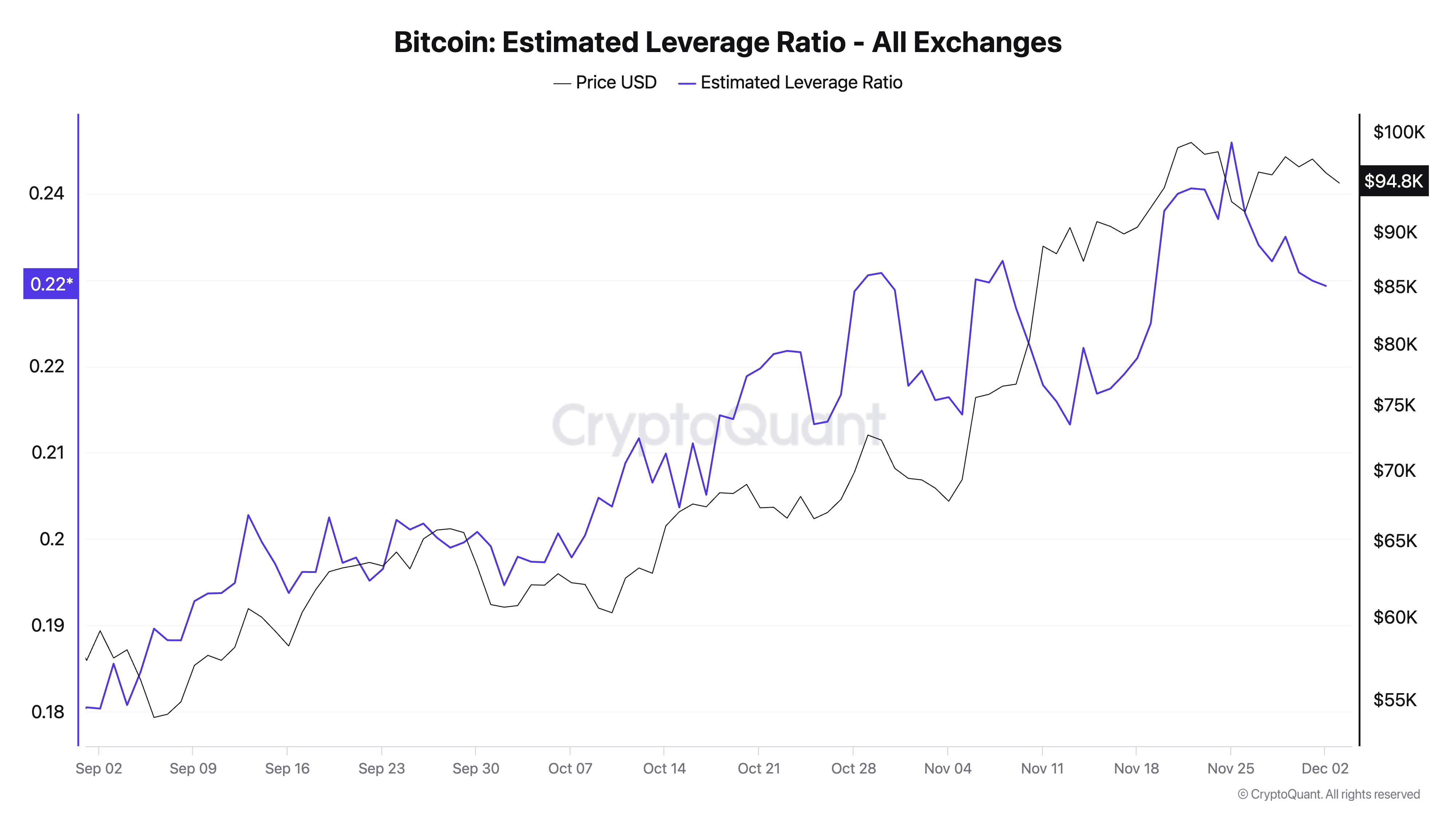

The extent of this leverage might be seen by means of the estimated leverage ratio (ELR). ELR is calculated by dividing the open curiosity in derivatives markets by Bitcoin’s whole trade reserves. A rising ELR signifies that extra leverage is utilized relative to the out there Bitcoin, signaling heightened hypothesis.

The ELR additionally gives a window into how aggressive merchants are in taking leveraged positions and the way a lot of the market is pushed by derivatives moderately than spot exercise. For the reason that starting of September, the ELR has grown considerably, following Bitcoin’s rally from $65,000 to $98,000. This exhibits that merchants had been driving the bullish momentum and deploying leverage alongside the best way, amplifying the upward value motion we’ve seen up to now three months.

Nevertheless, in the previous few days of November, the ELR started to say no whilst Bitcoin’s value remained close to or at its all-time excessive. This divergence is especially vital when analyzing the market, because it signifies a section of deleveraging or danger discount.

Merchants might have began unwinding their leveraged positions to safe earnings or keep away from liquidation danger in an more and more unstable surroundings. The decline in ELR signifies that leveraged exercise was scaling again, lowering the speculative stress that had pushed the rally.

Given the market’s present sensitivity, this deleveraging couldn’t go unnoticed, pushing BTC additional right down to $92,000.

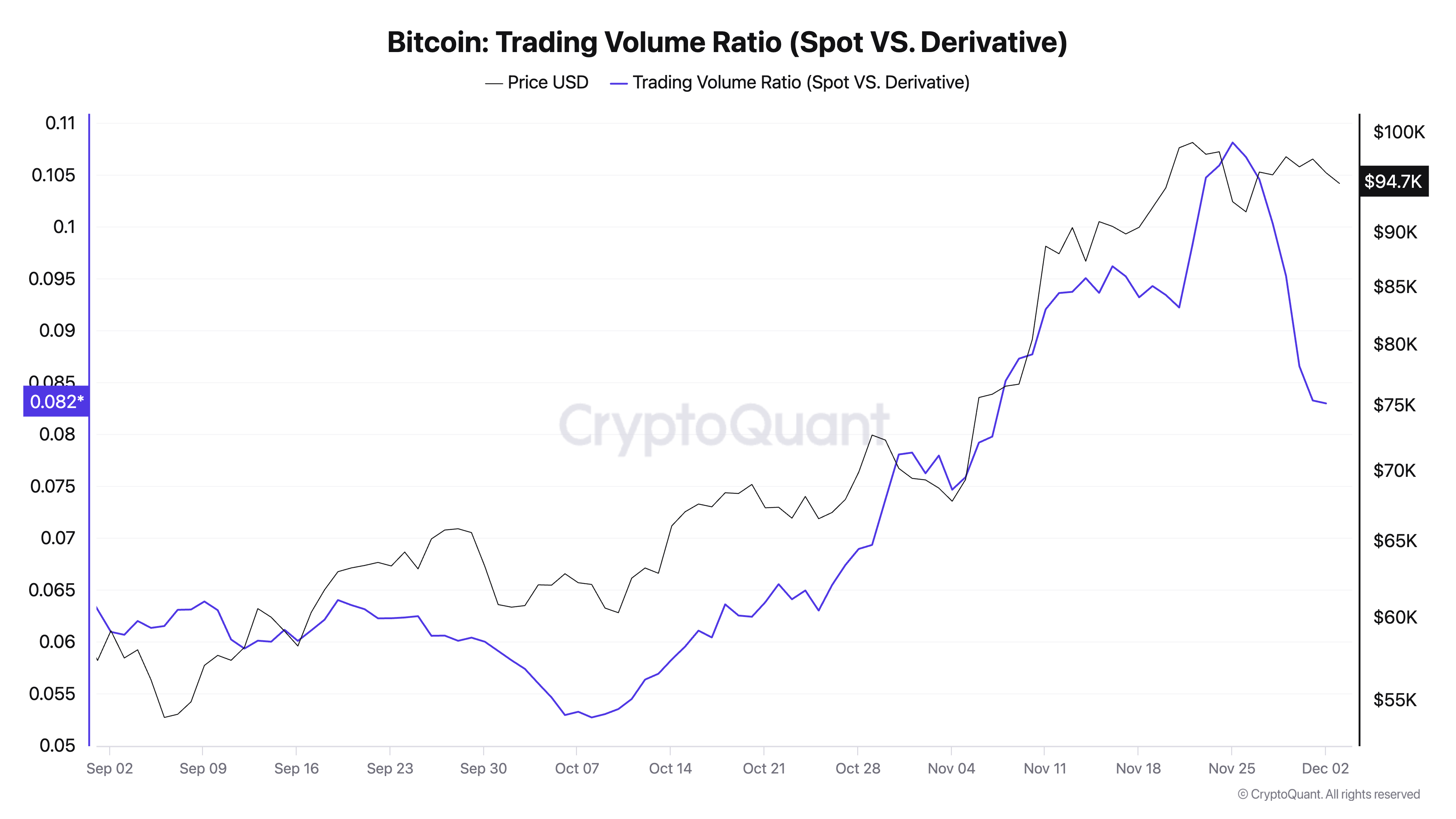

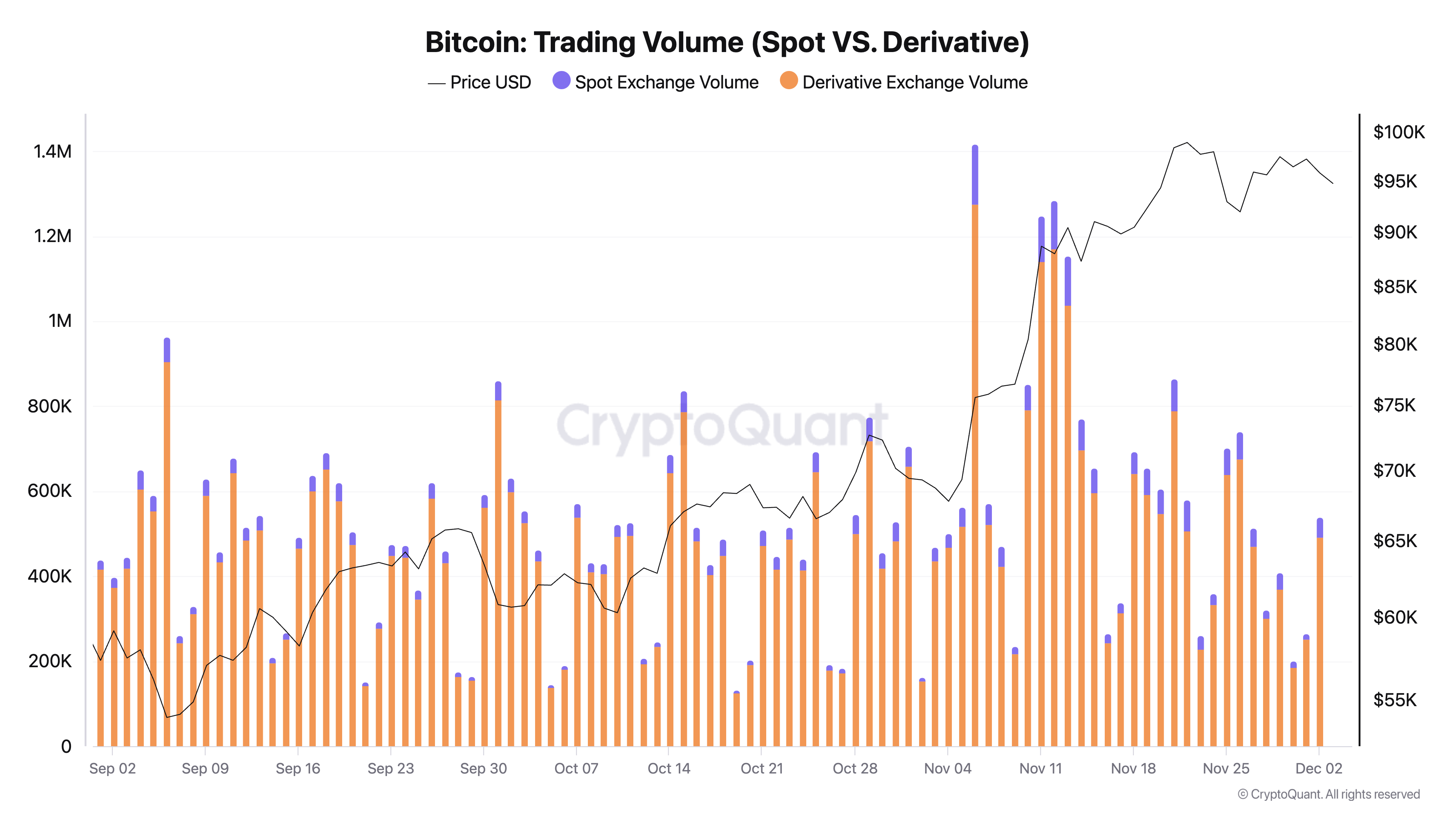

We all know that deleveraging within the derivatives market prompted this drop by wanting on the ratio between spot and derivatives buying and selling quantity. Derivatives have constantly dwarfed spot buying and selling quantity, displaying simply how a lot speculative exercise influences value.

In November, the buying and selling quantity ratio between spot and derivatives markets remained low, signaling that almost all exercise was concentrated in derivatives moderately than spot markets. As the worth peaked, the spinoff buying and selling quantity spiked even additional, whereas spot quantity confirmed much less dramatic progress. This means that the worth rally was closely influenced by leveraged merchants moderately than natural demand from spot consumers.

Within the closing days of November and the primary two days of December, the spinoff quantity started to say no sharply, mirrored in each absolutely the buying and selling volumes and the buying and selling quantity ratio. This drop in spinoff exercise coincided with the decline in ELR, suggesting that merchants had been scaling again their speculative positions.

The falling spot-to-derivative quantity ratio throughout the rally and its slight restoration as costs stabilized close to $95,000 suggests a brief pullback in speculative fervor. Nevertheless, the decrease ratio general indicators that derivatives markets stay the first driver of Bitcoin’s value actions, even throughout deleveraging phases.

The mixture of ELR and buying and selling quantity metrics reveals the extent to which speculative exercise drives Bitcoin’s value actions and the way leverage can amplify each rallies and corrections. The latest decline in ELR and derivatives quantity, coupled with a slight restoration within the spot-to-derivative ratio, means that the market is getting into a interval of consolidation.

If natural spot exercise will increase, this may increasingly present a more healthy basis for future value strikes.

The put up Huge deleveraging stopped Bitcoin from breaking by means of $100k appeared first on CryptoSlate.