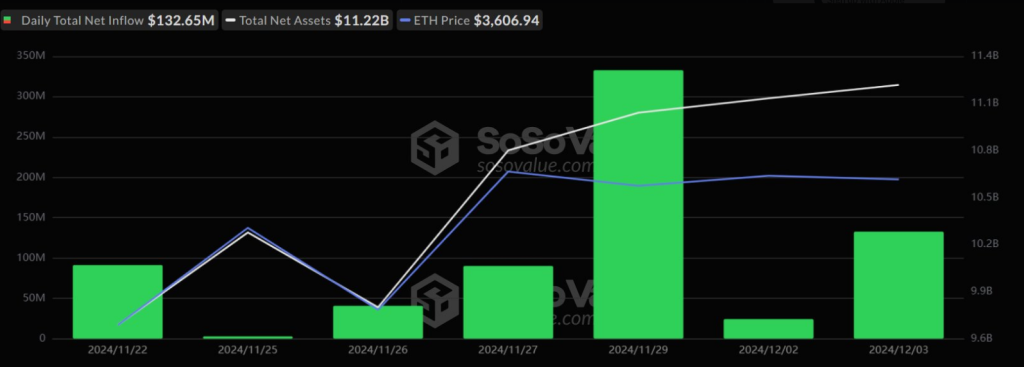

The rising prominence of Ethereum is as soon as once more within the highlight, as latest information signifies a considerable influx of funds into Ether-based ETFs. These merchandise have skilled a outstanding $133 million in internet inflows over the course of seven days, indicating a big enhance in institutional curiosity and investor confidence.

Associated Studying

Ethereum isn’t simply optimistic about exchange-traded funds (ETFs). Analysts are making massive value predictions for the cryptocurrency proper now. It’s because its community is getting used an increasing number of in decentralized finance (DeFi) and technical indicators are displaying that it’ll proceed to rise.

On December 3, the overall internet influx of Ethereum spot ETFs was $133 million, and internet inflows continued for 7 consecutive days. The online influx of Constancy ETF FETH was $73.7239 million, and the online influx of BlackRock ETF ETHA was $65.2929 million. https://t.co/Tvs2oCSxTg pic.twitter.com/HOPyOqmXGU

— Wu Blockchain (@WuBlockchain) December 4, 2024

Institutional Confidence And Robust ETF Inflows

Lots of people have an interest within the Ethereum spot ETFs. Over $714 million has come into the highest altcoin within the final week, displaying that each institutional and particular person patrons have gotten extra all for it. The ETHA ETF from BlackRock and the FETH ETF from Constancy are main the cost. Collectively, they’ve introduced in about $140 million.

The assist of main monetary establishments is boosting exercise and demonstrating that Ethereum is changing into standard within the standard finance sector. This flood of capital demonstrates how Ethereum could unite centralized and decentralized monetary methods.

Analysts Anticipate Mid-Time period Goal Of $6,000 For Ethereum

In keeping with market consultants, the extent of assist for Ethereum stands at $3,300. This can be a protected place for traders to begin as a result of it strikes stability between threat and return. Analysts suggest a mid-term value goal of $6,000 in case Ethereum continues its ascent. Some analysts even anticipate a long-term value of $10,000.

If #Ethereum $ETH experiences a pullback, control the $3,300 assist degree — a possible shopping for alternative.

Our mid-term goal stays $6,000, with a long-term outlook of $10,000! https://t.co/mQQOjrKBFM pic.twitter.com/OEvDIV0ZpD

— Ali (@ali_charts) December 4, 2024

In the meantime, CoinCodex predicts that the value of Ethereum could have gone up by 6.17 % to $4,052.34 by January 4, 2025. With an Excessive Greed variety of 78 on the Worry & Greed Index and different technical indicators, it’s clear that individuals are planning to purchase.

Excessive confidence out there suggests vital development potential, however it’s nonetheless vital to keep in mind the inherent volatility of cryptocurrency investments.

Prior to now 7 days, #Etherum‘s TVL elevated by $4.81B, #Base‘s TVL elevated by $302.02M, and #Hyperliquid‘s TVL elevated by $290.21M.

Funds have flowed into #Ethereum, #Base, and #Hyperliquid. pic.twitter.com/YDZOGU0Esc

— Lookonchain (@lookonchain) December 2, 2024

Associated Studying

Extra Stimulus & Development In TVL

The dominance of Ethereum within the DeFi market was cemented when its complete worth locked surged by $4.81 billion inside a interval of 1 week. Nonetheless, whereas different networks, together with Base and Hyperliquid, had their TVLs rise, Ethereum continues to be seen because the chief.

Ethereum’s trajectory seems optimistic on account of its strong ETF inflows, bullish technical outlook, and rising TVL. Though it could require a while to build up $6,000, the narrative is compelling on account of institutional assist and regular momentum.

Ethereum stays a basic element of the cryptocurrency market, combining investor confidence with innovation.

Featured picture from Pexels, chart from TradingView