Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin has continued to point out energy amid rising macroeconomic uncertainty, with surging U.S. bond yields and escalating world tensions conserving markets on edge. Nonetheless, latest political drama has injected new volatility into the crypto house. The world’s main cryptocurrency skilled a pointy 5% pullback after a extremely publicized conflict between Elon Musk and US President Donald Trump unfolded on the social platform X. The dispute, centered across the “Large Stunning Invoice” criticized by Musk, shortly triggered reactions throughout monetary markets.

Associated Studying

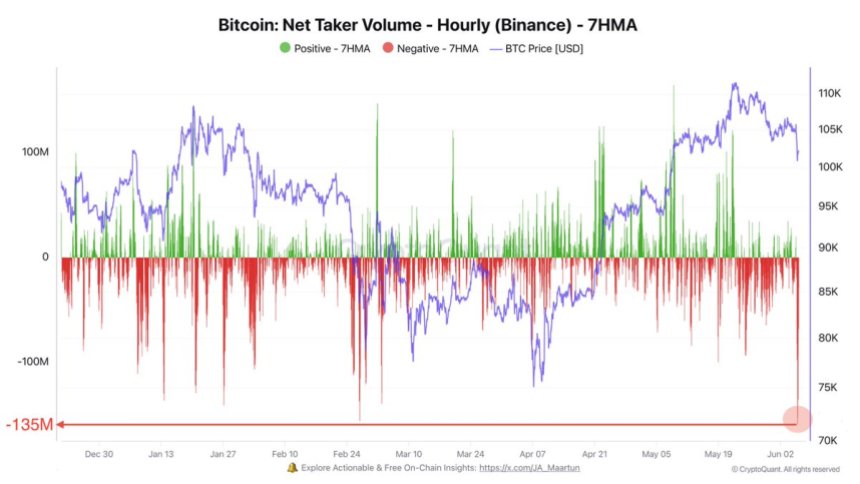

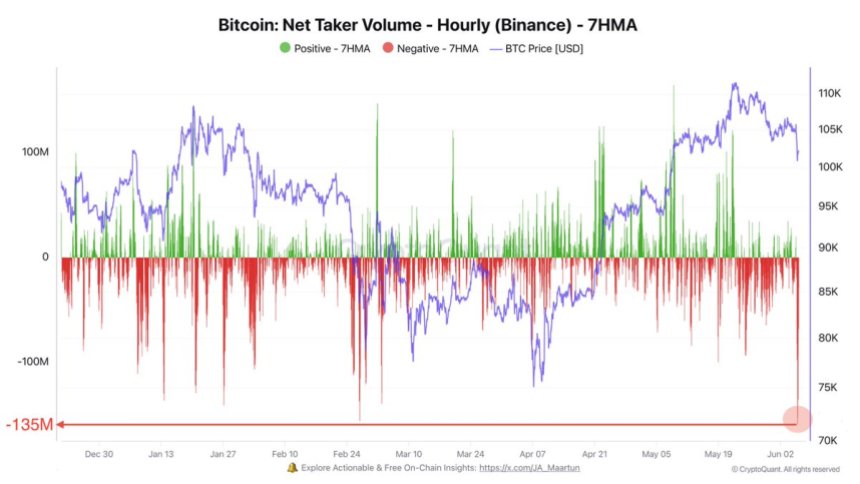

In keeping with high analyst Darkfost, final night time marked essentially the most important shift in dealer conduct on Binance to this point in 2025. Because the political spat gained consideration, merchants responded quickly, viewing the occasion as a risk-off sign. The fallout was rapid within the derivatives market, the place Binance’s web taker quantity plunged from $20 million to -$135 million in underneath eight hours.

This dramatic shift marks the biggest web taker quantity decline of the 12 months, highlighting simply how delicate crypto merchants stay to political developments. Whereas Bitcoin holds key ranges for now, market individuals are watching intently to see if this pullback will deepen or grow to be a launchpad for the following transfer larger.

Bitcoin Rebounds From $100K Assist However Faces Resistance Forward

Bitcoin is as soon as once more at a pivotal level after rebounding from the $100,000 help degree and climbing to the $103,000 vary, displaying resilience regardless of latest volatility. The transfer indicators energy amongst bulls, however the broader market stays cautious as all eyes flip to the $112,000 all-time excessive. A breakout above that degree may ignite a brand new leg up, however failure to take care of momentum might result in a deeper correction beneath present demand ranges.

Macroeconomic situations proceed to weigh on market sentiment, with rising US bond yields and escalating geopolitical tensions—notably the general public conflict between Elon Musk and US President Donald Trump—injecting uncertainty into world threat belongings. The response was clearly seen within the crypto derivatives market.

High analyst Darkfost reported that the web taker quantity on Binance skilled a file shift, plunging from $20 million to -$135 million in underneath eight hours. This marks the biggest decline in directional sentiment seen in 2025. The online taker quantity displays the imbalance between aggressive longs and shorts, and such a steep drop factors to merchants quickly flipping bearish.

This sharp reversal signifies fear-driven positioning. Nonetheless, ought to Bitcoin rebound convincingly, it may set off a cascade of quick liquidations, doubtlessly fueling a robust rally towards new highs.

Associated Studying

Worth Motion Particulars: Testing Key Degree

The 4-hour Bitcoin chart reveals a robust rebound after briefly breaking beneath the $103,600 help degree. BTC dipped as little as $101,159 earlier than consumers stepped in aggressively, driving the worth again to $103,826 on the time of writing. This bounce got here exactly on the 200-period transferring common (purple line), signaling that bulls are nonetheless defending key demand zones regardless of latest volatility.

The restoration candle printed with rising quantity, suggesting renewed curiosity and a possible short-term development reversal. Nonetheless, Bitcoin nonetheless faces important resistance forward, with the 50, 100, and 200 EMAs (inexperienced, blue, purple strains) now appearing as dynamic resistance between $104,600 and $107,000. A detailed above these ranges would affirm energy and will open the door for a retest of the $109,300 resistance.

Associated Studying

For now, the worth motion signifies a high-stakes battle between bulls and bears. If BTC holds above $103,600 and builds momentum, the market may regain confidence and push larger. Nonetheless, failure to reclaim the transferring averages might sign exhaustion and expose the worth to a different retest of the $100K psychological degree.

Featured picture from Dall-E, chart from TradingView

Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin has continued to point out energy amid rising macroeconomic uncertainty, with surging U.S. bond yields and escalating world tensions conserving markets on edge. Nonetheless, latest political drama has injected new volatility into the crypto house. The world’s main cryptocurrency skilled a pointy 5% pullback after a extremely publicized conflict between Elon Musk and US President Donald Trump unfolded on the social platform X. The dispute, centered across the “Large Stunning Invoice” criticized by Musk, shortly triggered reactions throughout monetary markets.

Associated Studying

In keeping with high analyst Darkfost, final night time marked essentially the most important shift in dealer conduct on Binance to this point in 2025. Because the political spat gained consideration, merchants responded quickly, viewing the occasion as a risk-off sign. The fallout was rapid within the derivatives market, the place Binance’s web taker quantity plunged from $20 million to -$135 million in underneath eight hours.

This dramatic shift marks the biggest web taker quantity decline of the 12 months, highlighting simply how delicate crypto merchants stay to political developments. Whereas Bitcoin holds key ranges for now, market individuals are watching intently to see if this pullback will deepen or grow to be a launchpad for the following transfer larger.

Bitcoin Rebounds From $100K Assist However Faces Resistance Forward

Bitcoin is as soon as once more at a pivotal level after rebounding from the $100,000 help degree and climbing to the $103,000 vary, displaying resilience regardless of latest volatility. The transfer indicators energy amongst bulls, however the broader market stays cautious as all eyes flip to the $112,000 all-time excessive. A breakout above that degree may ignite a brand new leg up, however failure to take care of momentum might result in a deeper correction beneath present demand ranges.

Macroeconomic situations proceed to weigh on market sentiment, with rising US bond yields and escalating geopolitical tensions—notably the general public conflict between Elon Musk and US President Donald Trump—injecting uncertainty into world threat belongings. The response was clearly seen within the crypto derivatives market.

High analyst Darkfost reported that the web taker quantity on Binance skilled a file shift, plunging from $20 million to -$135 million in underneath eight hours. This marks the biggest decline in directional sentiment seen in 2025. The online taker quantity displays the imbalance between aggressive longs and shorts, and such a steep drop factors to merchants quickly flipping bearish.

This sharp reversal signifies fear-driven positioning. Nonetheless, ought to Bitcoin rebound convincingly, it may set off a cascade of quick liquidations, doubtlessly fueling a robust rally towards new highs.

Associated Studying

Worth Motion Particulars: Testing Key Degree

The 4-hour Bitcoin chart reveals a robust rebound after briefly breaking beneath the $103,600 help degree. BTC dipped as little as $101,159 earlier than consumers stepped in aggressively, driving the worth again to $103,826 on the time of writing. This bounce got here exactly on the 200-period transferring common (purple line), signaling that bulls are nonetheless defending key demand zones regardless of latest volatility.

The restoration candle printed with rising quantity, suggesting renewed curiosity and a possible short-term development reversal. Nonetheless, Bitcoin nonetheless faces important resistance forward, with the 50, 100, and 200 EMAs (inexperienced, blue, purple strains) now appearing as dynamic resistance between $104,600 and $107,000. A detailed above these ranges would affirm energy and will open the door for a retest of the $109,300 resistance.

Associated Studying

For now, the worth motion signifies a high-stakes battle between bulls and bears. If BTC holds above $103,600 and builds momentum, the market may regain confidence and push larger. Nonetheless, failure to reclaim the transferring averages might sign exhaustion and expose the worth to a different retest of the $100K psychological degree.

Featured picture from Dall-E, chart from TradingView