Bitcoin has been buying and selling in a decent 4-hour vary between $71,300 and $73,300 since Tuesday, setting the stage for a big transfer within the coming days. Analysts and traders carefully watch this vary as BTC inches nearer to its all-time excessive (ATH).

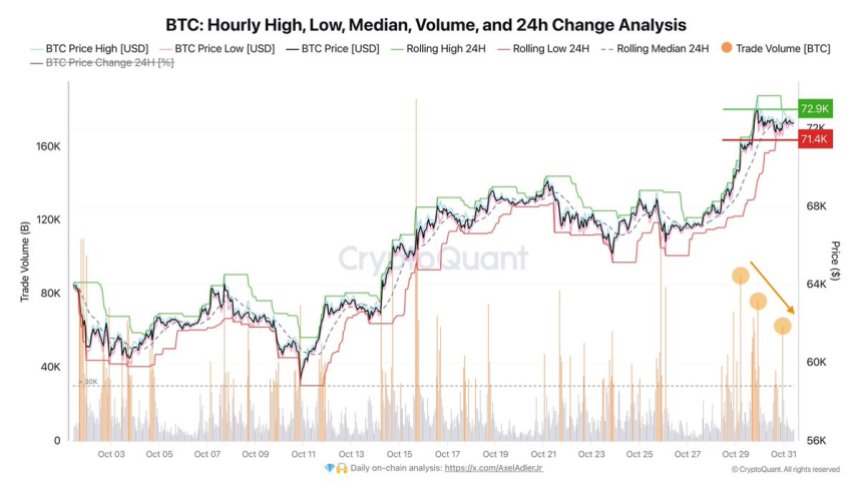

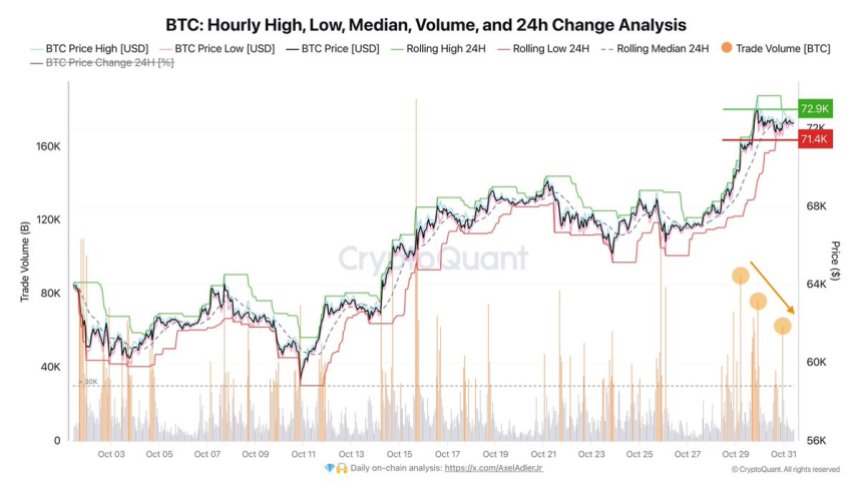

High analyst Axel Adler lately shared key information from CryptoQuant, noting that buying and selling quantity has steadily decreased as Bitcoin stays inside these ranges. Usually, this quantity decline indicators consolidation, a section typically previous a serious worth swing.

Associated Studying

Anticipation is constructing with the U.S. election simply across the nook on November 5. Market sentiment is optimistic, and lots of anticipate Bitcoin to interrupt out of this vary quickly, both pushing into new highs or experiencing a wholesome retrace to gas additional progress.

The approaching days will probably be pivotal for Bitcoin’s trajectory as merchants assess whether or not the consolidation interval will result in a breakthrough into uncharted territory. As BTC flirts with its ATH, the stage is about for a decisive transfer that would form the market’s route by the top of the 12 months.

Bitcoin Value About To Transfer

Bitcoin is at a defining level on this cycle, nearing the top of a 7-month accumulation interval and poised to check new all-time highs. CryptoQuant analyst Axel Adler has famous in a current evaluation on X that BTC is at present range-bound, buying and selling between $72,900 resistance and $71,400 help, with buying and selling volumes displaying a gradual decline.

In response to Adler, this lowered quantity in Bitcoin’s confined vary hints at an impending breakout. Nonetheless, a brand new catalyst seems essential to drive this shift and launch BTC previous its earlier highs.

The upcoming U.S. election could also be that catalyst, with potential market impacts relying on the end result. Market sentiment suggests {that a} Trump victory may stimulate bullish sentiment within the monetary markets, presumably positively influencing Bitcoin’s worth trajectory.

Traders are eyeing this pivotal occasion as a potential set off to push BTC past the $73,794 mark, its all-time excessive, into uncharted worth territory.

Associated Studying

A profitable breakout from the present vary may usher Bitcoin into worth discovery mode, the place FOMO (concern of lacking out) may drive shopping for stress, amplifying the surge. However, if BTC fails to safe a brand new excessive, it might dip again towards decrease help ranges, probably consolidating additional till the mandatory momentum builds.

BTC Flirting With ATH

Bitcoin is holding robust above $72,000, inching nearer to breaking its all-time excessive (ATH) and coming into a worth discovery section. Value discovery sometimes ushers in vital beneficial properties, as recent highs gas market optimism and shopping for stress.

Nonetheless, BTC has but to decisively break previous its earlier ATH of $73,794, and a short lived decline under $70,000 stays a risk if demand doesn’t strengthen quickly.

The $71,000 help stage now serves as a vital base for BTC. If the value holds above this mark within the coming days, momentum will doubtless construct for a strong try to interrupt the ATH, probably triggering a brand new wave of bullish sentiment.

Merchants and traders carefully watch BTC’s efficiency at these ranges, figuring out that any sustained motion above $73,794 may sign the beginning of a strong uptrend as Bitcoin pushes into uncharted territory.

Associated Studying

In the meantime, a brief retrace to decrease help ranges may present the liquidity wanted to propel BTC past its present resistance. Whether or not by a direct push or a minor pullback, Bitcoin’s resilience above $72,000 units the stage for an imminent check of ATH, with worth discovery and new highs on the horizon.

Featured picture from Dall-E, chart from TradingView

Bitcoin has been buying and selling in a decent 4-hour vary between $71,300 and $73,300 since Tuesday, setting the stage for a big transfer within the coming days. Analysts and traders carefully watch this vary as BTC inches nearer to its all-time excessive (ATH).

High analyst Axel Adler lately shared key information from CryptoQuant, noting that buying and selling quantity has steadily decreased as Bitcoin stays inside these ranges. Usually, this quantity decline indicators consolidation, a section typically previous a serious worth swing.

Associated Studying

Anticipation is constructing with the U.S. election simply across the nook on November 5. Market sentiment is optimistic, and lots of anticipate Bitcoin to interrupt out of this vary quickly, both pushing into new highs or experiencing a wholesome retrace to gas additional progress.

The approaching days will probably be pivotal for Bitcoin’s trajectory as merchants assess whether or not the consolidation interval will result in a breakthrough into uncharted territory. As BTC flirts with its ATH, the stage is about for a decisive transfer that would form the market’s route by the top of the 12 months.

Bitcoin Value About To Transfer

Bitcoin is at a defining level on this cycle, nearing the top of a 7-month accumulation interval and poised to check new all-time highs. CryptoQuant analyst Axel Adler has famous in a current evaluation on X that BTC is at present range-bound, buying and selling between $72,900 resistance and $71,400 help, with buying and selling volumes displaying a gradual decline.

In response to Adler, this lowered quantity in Bitcoin’s confined vary hints at an impending breakout. Nonetheless, a brand new catalyst seems essential to drive this shift and launch BTC previous its earlier highs.

The upcoming U.S. election could also be that catalyst, with potential market impacts relying on the end result. Market sentiment suggests {that a} Trump victory may stimulate bullish sentiment within the monetary markets, presumably positively influencing Bitcoin’s worth trajectory.

Traders are eyeing this pivotal occasion as a potential set off to push BTC past the $73,794 mark, its all-time excessive, into uncharted worth territory.

Associated Studying

A profitable breakout from the present vary may usher Bitcoin into worth discovery mode, the place FOMO (concern of lacking out) may drive shopping for stress, amplifying the surge. However, if BTC fails to safe a brand new excessive, it might dip again towards decrease help ranges, probably consolidating additional till the mandatory momentum builds.

BTC Flirting With ATH

Bitcoin is holding robust above $72,000, inching nearer to breaking its all-time excessive (ATH) and coming into a worth discovery section. Value discovery sometimes ushers in vital beneficial properties, as recent highs gas market optimism and shopping for stress.

Nonetheless, BTC has but to decisively break previous its earlier ATH of $73,794, and a short lived decline under $70,000 stays a risk if demand doesn’t strengthen quickly.

The $71,000 help stage now serves as a vital base for BTC. If the value holds above this mark within the coming days, momentum will doubtless construct for a strong try to interrupt the ATH, probably triggering a brand new wave of bullish sentiment.

Merchants and traders carefully watch BTC’s efficiency at these ranges, figuring out that any sustained motion above $73,794 may sign the beginning of a strong uptrend as Bitcoin pushes into uncharted territory.

Associated Studying

In the meantime, a brief retrace to decrease help ranges may present the liquidity wanted to propel BTC past its present resistance. Whether or not by a direct push or a minor pullback, Bitcoin’s resilience above $72,000 units the stage for an imminent check of ATH, with worth discovery and new highs on the horizon.

Featured picture from Dall-E, chart from TradingView