Key Takeaways

- Bitcoin reached a brand new all-time excessive of $119,300 forward of key crypto laws debates.

- Upcoming payments in Congress might massively influence crypto regulation and stablecoin issuance.

Share this text

Bitcoin superior to a brand new document excessive of $119,300 on Sunday as bullish sentiment mounted forward of a doubtlessly game-changing week for the crypto business.

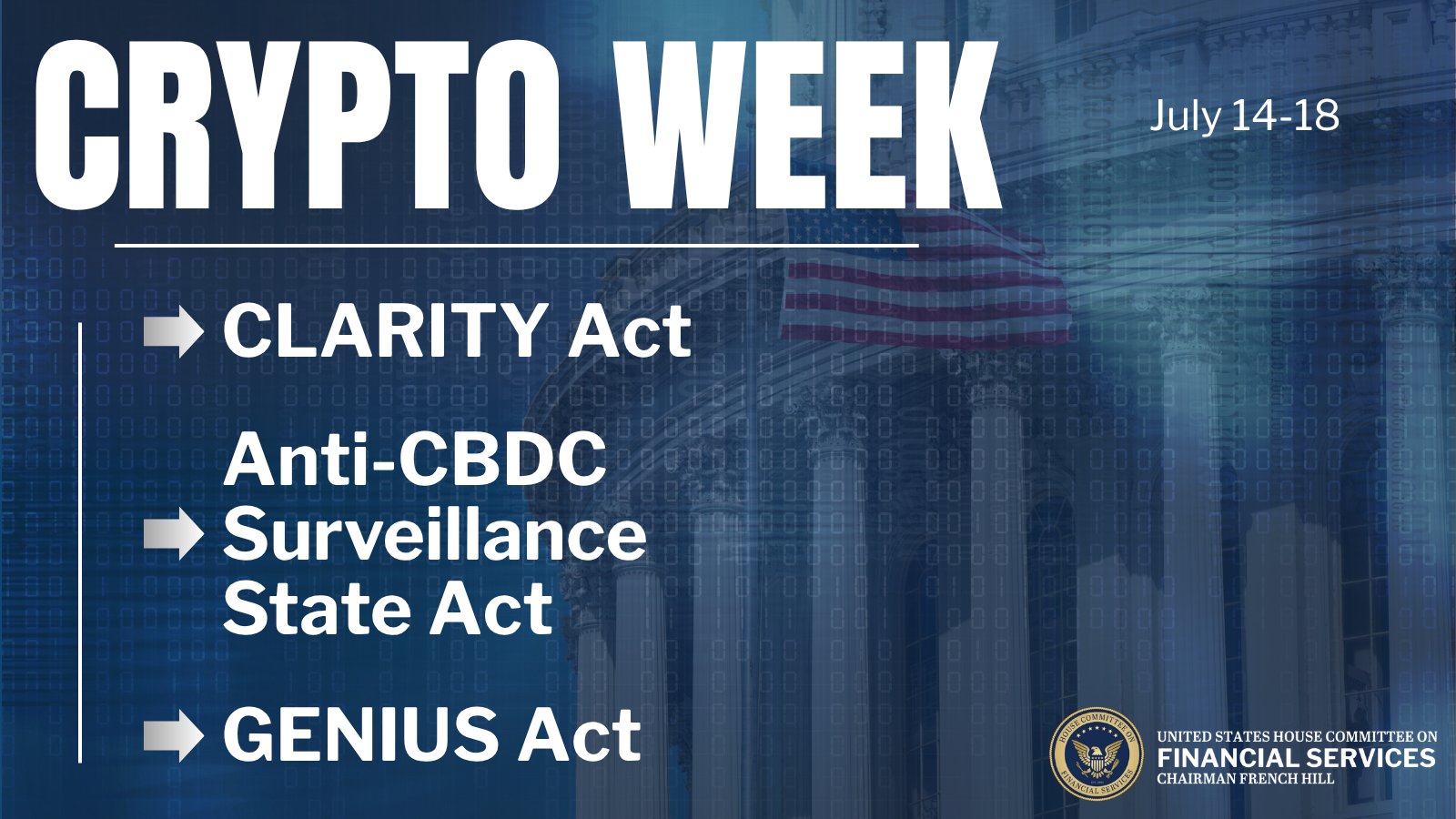

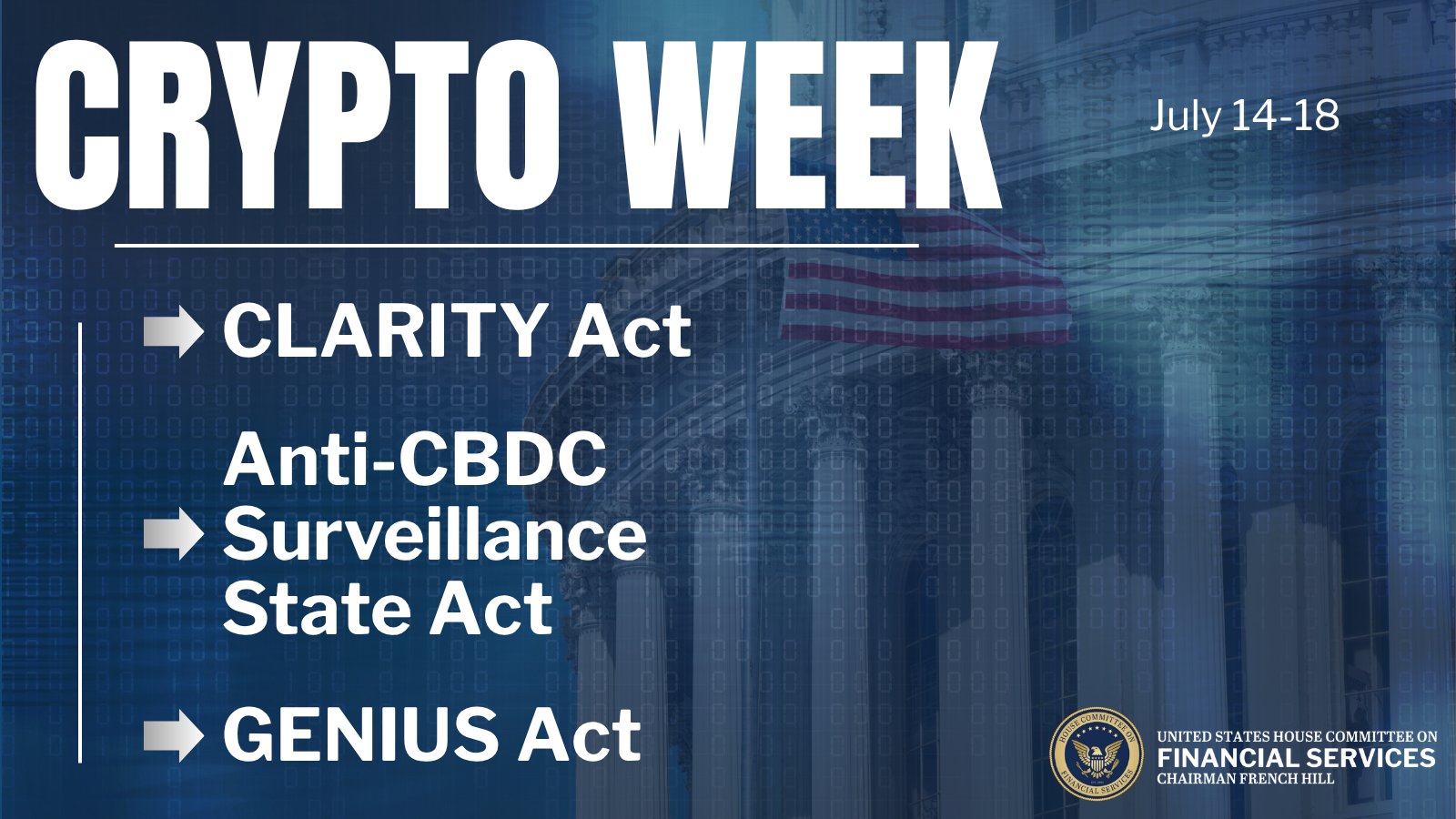

The US Home Monetary Companies Committee has designated the week starting July 14 as “Crypto Week,” throughout which lawmakers will debate three key payments geared toward offering clear regulatory frameworks for digital property, stablecoins, and blockchain applied sciences.

The legislative bundle contains the Digital Asset Market CLARITY Act, which might grant the Commodity Futures Buying and selling Fee unique oversight of crypto transactions and supply exemptions for established blockchain networks.

One other invoice, the GENIUS Act, would enable non-public firms to challenge stablecoins with full money backing, whereas the Anti-CBDC Surveillance State Act seeks to forestall the creation of a US Central Financial institution Digital Foreign money.

Bitcoin’s worth has risen 9.5% previously week, bringing its year-to-date good points to 27%, in response to TradingView information.

The most recent rally, which noticed Bitcoin break by means of $112,000 earlier this week, has been supported by anticipated financial easing, sturdy inflows into spot Bitcoin ETFs, and elevated company adoption.

Analyst sees BTC hitting $130K earlier than year-end correction

Bitcoin’s newest rally has set the stage for a possible last leg in its present multi-year bull cycle, in response to John Glover, Chief Funding Officer at digital asset platform Ledn.

In a word shared with Crypto Briefing, Glover stated that Bitcoin’s latest transfer to a brand new all-time excessive is a transparent sign that the following leg of the bull run is underway. He stated the latest dip to $96,000 appeared to have cleared the best way for continued upside.

“Now we have lastly damaged to new highs, which confirms that the dip to $96k in late June happy the wave (ii) pullback (yellow line) throughout the bigger Wave 5 (orange line),” Glover defined.

“Whereas this doesn’t change the final word goal of circa $136k to finish this bull run, it does doubtless scale back the time it can take to finish. I used to be beforehand in search of this in Q1 of 2026, however now it appears to be like more likely to hit $136k by year-end,” the analyst famous.

Glover projected that Bitcoin’s bull market might peak on the finish of this yr, with a attainable transfer to $130,000 adopted by a short-term correction, after which a last rally to $136,000.

“Search for wave (iii) to complete close to $130k, adopted by a correction to present ranges, after which a rally to the $136k goal into the top of this yr,” he famous. “That can mark the conclusion of the 5-wave transfer that has transpired over the previous 3 years. This completes Wave 3 of the ‘super-cycle,’ which implies within the years to come back, we are going to see larger costs but.”

As for what comes subsequent, Glover believes the bull run could also be adopted by a wholesome correction earlier than Bitcoin resumes its upward trajectory.

He expects Bitcoin to retrace to the $91,000-$109,000 vary, providing a possible re-entry level for traders whereas nonetheless sustaining long-term bullish momentum.

Share this text