Key Takeaways:

- Ethena has now earned $3.28 million in every day income, surpassing main DeFi protocols.

- Ethena’s native token ENA noticed a 4% worth leap after the income milestone.

- Strategic strikes, reminiscent of treasury fund allocation, contribute to Ethena’s development.

In a bid to remodel the decentralized finance (DeFi) panorama, Ethena, an Ethereum-based stablecoin protocol, is taking the world by storm because it rapidly climbs the ranks. Latest information exhibits Ethena’s every day take has reached $3.28 million, even eclipsing PancakeSwap and Jupiter. This outstanding achievement underscores the growing prominence of Ethena and its stablecoin, USDe, within the crypto panorama.

USDe Fuels Ethena’s Income Surge

Ethena has carved out a distinct segment for itself within the decentralized stablecoin sector since its launch. USDe is a decentralized stablecoin designed to supply enhanced stability by modern monetary mechanisms.

Information from DefiLlama additionally confirms Ethena has risen to the third spot amongst protocols by every day charges. That is largely attributable to income generated by its stablecoin USDe. These numbers aren’t any joke: USDe has a $5.4 billion market cap and a $63 million 24-hour buying and selling quantity, up 23.6% from the day past.

However for all of the hype round Ethena, it’s actually necessary to level out the incumbents within the stablecoin income race. All the identical, Tether (USDT) nonetheless dominates, producing $18.31 million in every day income, and Circle (USDC) is behind at $6.12 million. Nevertheless, Ethena has entered the scene as a critical contender and potential disruptor out there.

Ethena’s income mannequin depends on charges from minting, redemption, and yield-generating mechanisms. With the rising adoption of DeFi, the flexibility to maintain these excessive income ranges might be essential to the protocol, for its long-term success.

Ethena Outpaces DeFi Giants

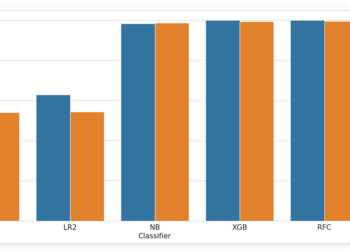

Ethena’s every day income far exceeds that of a number of different DeFi protocols. Within the final 24 hours, PancakeSwap generated $2.54 million, whereas Jupiter accrued $1.99 million. Meteora and Uniswap had been subsequent with $1.89 million and $1.73 million, respectively. That makes this comparability much more spectacular for the expansion trajectory of Ethena.

Ethena has risen to the third spot amongst protocols by every day charges. Supply: DefiLlama

Ethena’s mannequin is completely different from conventional DeFi protocols that present income from liquidity swimming pools and swaps — it’s way more targeted on issuing stablecoins and treasury administration. In moments of market turbulence, this imaginative and prescient distinction would possibly place Ethena as a greater competitor. Not like conventional DeFi platforms that closely depend on buying and selling charges and liquidity incentives, Ethena’s structured strategy to stablecoin administration affords a extra predictable and doubtlessly sustainable income mannequin.

ENA Token Reacts Positively

Ethena’s rising reputation had a constructive influence on market sentiment. Based on the protocol, ENA, Ethena’s native token, noticed a acquire of greater than 4% instantly after the income announcement. Its market cap practically topped $2 billion, and the 24-hour buying and selling quantity was $282 million. Notably, this surge in buying and selling exercise additionally led to a rise in liquidity throughout main exchanges, making ENA extra accessible to each institutional and retail traders. That is indicative of investor perception in Ethena’s long-term prospects.

Social sentiment round Ethena has been notably sturdy, with extra chatter on crypto boards and social media. Ethena’s speedy development has satisfied many traders that the protocol has the potential to turn into a long-term participant within the stablecoin area, exhibiting sturdy resilience.

Ethena’s fortunes don’t simply depend upon market circumstances. The protocol has been making rising investments in the precise locations. Ethena, for example, invested $200 million in BlackRock’s tokenized U.S. Treasury fund, BUIDL. This transfer indicators an effort to align with mainstream monetary devices.

As well as, final December Ethena launched its second stablecoin, USDtb. Powered by BUIDL, USDtb represents a lovely alternative for traders to earn passive earnings by yield era in distinction to conventional stablecoins. This novel method might be liable for the speedy growth in USDtb provide.

Ethena Stablecoin USDtb

Business Analyst Weighs In: Ethena’s Technique and the Way forward for Stablecoins

Think about a situation the place somebody seeks a secure yield-backed asset. They might choose USDtb because it offers a yield underlying tokenized U.S. treasury belongings. This permits a yield-generating native foreign money asset to offer higher returns than merely holding an area foreign money with USDtb.

Though Ethena has made spectacular strides, it nonetheless faces headwinds. Stablecoins proceed to face growing stress from regulators, whereas competitors from incumbents like Tether and Circle stays sturdy. Lastly, Ethena might want to hold excessive yields for USDtb holders whereas limiting systemic threat if the mission is to endure.

Extra Information: Ethena Labs Raises $100M For TradFi Enlargement With New Token