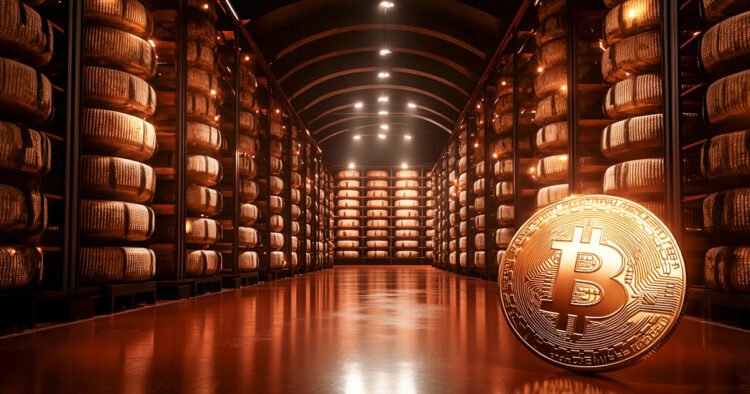

The Bitcoin Coverage Institute (BPI) has proposed an unconventional strategy to bolstering the US authorities’s Bitcoin reserves—promoting off the nation’s Strategic Cheese Reserve.

In a March 7 publish on X, the BPI urged that the US may use proceeds from liquidating its cheese stockpile to fund Bitcoin purchases.

In response to the Institute:

“America ought to instantly liquidate its strategic cheese reserve and convert the proceeds into Bitcoin.”

The BPI added that Bitcoin, quite than cheese, needs to be the asset held in strategic reserves.

Mathew Sigel, head of analysis at VanEck, echoed this sentiment, questioning the need of sustaining a cheese reserve. He urged changing it with a impartial asset like Bitcoin, which may very well be a wiser monetary transfer.

The US reportedly holds between 1.4 billion and 1.5 billion kilos of cheese in chilly storage, an estimated stock value round $3.4 billion. This stockpile exists resulting from authorities insurance policies designed to stabilize dairy costs and assist farmers.

Bitcoin reserve

The proposal follows President Donald Trump‘s current announcement of the Strategic Bitcoin Reserve initiative.

This transfer would permit the US to carry onto its present Bitcoin whereas exploring budget-neutral methods to broaden its present holdings with out imposing further prices on taxpayers.

White Home AI and Crypto Czar David Sacks stated:

“The US is not going to promote any bitcoin deposited into the Reserve. Will probably be saved as a retailer of worth. The Reserve is sort of a digital Fort Knox for the cryptocurrency usually known as ‘digital gold.’”

With this in thoughts, crypto group members are proposing a number of methods for the US to develop its Bitcoin reserves additional.

Matthew Pines, the Govt Director of the BPI, urged that surplus US {dollars}, gold reserves, international trade holdings, and income from privatizing Authorities-Sponsored Enterprises (GSEs) may very well be used to fund further Bitcoin acquisitions.