Income Cycle Feels Completely different Now

There was a time when income cycle efficiency was judged largely by operational benchmarks. Claims processed. Days in accounts receivable. Staffing ratios. These measures nonetheless matter, however they now not inform the total story.

Over the previous a number of years, one thing has shifted. Denials really feel much less predictable. Payer interpretations range extra broadly. Documentation necessities appear to tighten with out a lot discover. Income cycle leaders spend extra time managing uncertainty than enhancing velocity.

When variability will increase, finance feels it first. Money projections tighten. Capital planning turns into extra cautious. Conversations that after centered on development start to incorporate contingency language. Income stability, not simply effectivity, turns into the precedence. That change in emphasis explains why synthetic intelligence has entered income discussions with extra seriousness than earlier than.

Automation Helped, However It Wasn’t Sufficient

Most well being programs have already invested closely in automation. Eligibility checks are largely standardized. Coding instruments help with documentation. Fee posting processes are much more environment friendly than they have been a decade in the past.

But the core downside remained. Claims have been nonetheless denied for refined causes. Appeals consumed time. Forecasting relied closely on historic developments that now not felt dependable. Automation improved movement. It didn’t remove publicity.

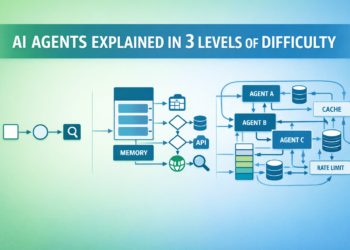

The distinction now could be the introduction of programs that acknowledge patterns, not simply guidelines.

AI on the Entrance Finish of Income Danger

Predictive fashions educated on years of claims knowledge can now detect combos of variables that are inclined to set off payer rejection. These insights will be utilized earlier than a declare leaves the group.

When documentation gaps or authorization inconsistencies are flagged early, groups have a chance to appropriate them with out getting into the enchantment cycle. The development in first-pass acceptance could seem incremental at first, however its monetary impact compounds.

Much less rework shortens the income timeline. Shorter timelines cut back volatility. Diminished volatility strengthens confidence in projections.

That is the place AI begins to affect monetary outcomes in ways in which earlier automation couldn’t.

Documentation and the Quiet Sources of Leakage

Income loss doesn’t all the time arrive in an apparent type. It typically seems as small inconsistencies that accumulate over time. A lacking modifier. An understated degree of service. A contract clause was utilized inconsistently throughout departments.

AI-supported assessment programs can scan documentation and billing knowledge concurrently, figuring out patterns which are troublesome for guide assessment to catch persistently. These instruments don’t change experience. They slender the main target in order that experience is utilized the place it issues most.

Enhancing documentation alignment does greater than get better income. It strengthens the reliability of economic reporting and reduces the anxiousness that comes with audit publicity.

From Reporting to Anticipating

For years, income cycle dashboards have described the previous. They present what was billed, what was denied, and what was collected. That info stays obligatory, nevertheless it doesn’t forestall disruption.

Predictive analytics begins to vary the orientation. By combining inside efficiency knowledge with payer conduct historical past, finance groups can estimate reimbursement timing with extra readability than earlier than.

The forecasts won’t ever be excellent. Healthcare reimbursement is simply too advanced for that. However narrowing the vary of uncertainty permits management to make choices with larger steadiness.

The income cycle, in that sense, turns into a contributor to ahead planning fairly than a recorder of previous occasions.

Working Smarter Inside Staffing Limits

Income cycle staffing stays a persistent concern. Skilled professionals are troublesome to recruit. Coaching takes time. Turnover interrupts continuity.

AI-supported prioritization instruments ease a few of the strain on lean groups. As denial patterns or larger-dollar claims begin to stand out, workers naturally shift their consideration. Complicated appeals are picked up earlier, and repetitive follow-up now not absorbs as a lot time.

This isn’t about changing workers. It’s about directing restricted experience towards work that protects margin. In an atmosphere the place sources are constrained, that focus is sensible fairly than aspirational.

Measuring What Truly Improves

AI in income cycle administration shouldn’t be judged by what number of workflows are automated. Its worth reveals up in monetary outcomes, decrease preventable denials, stronger collections, a manageable price to gather, and steadier forecasts

When AI initiatives are assessed in opposition to these indicators, they transfer from experimental initiatives to operational instruments with clear monetary worth.

That transition is refined however essential. It displays a shift from expertise curiosity to disciplined utility.

A Gradual Repositioning of Income Operations

The growth of AI inside income cycle administration just isn’t dramatic in look. There wasn’t a single turning level, only a regular shift in strategy.

Interventions happen earlier. Knowledge is interpreted extra intelligently. Forecasts really feel much less fragile. Over time, these incremental changes reshape how income threat is managed.

Healthcare reimbursement will stay advanced. No system eliminates that actuality. What improves is the group’s means to identify patterns earlier and reply with extra intention.

With margins tight and payer behaviour continuously shifting, steadiness issues. When AI is utilized fastidiously and monitored correctly, it may possibly assist create that steadiness.

Income cycle administration, as soon as considered primarily as an operational necessity, is more and more embedded inside the monetary construction of the group. The expertise itself is barely a part of the story. The bigger shift lies in how income threat is anticipated and managed.