Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

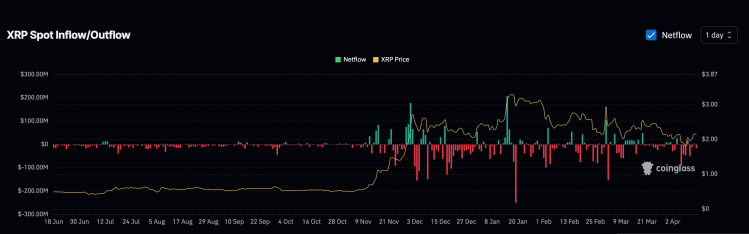

The XRP worth noticed a rise in worth over the weekend as bulls appeared to return to the desk. Because the market has been low over the previous few months, buyers unsurprisingly took this as a chance to get out at a considerably increased worth. This has led to extra destructive networks over the previous few days, including much more purple to the month of April that has been dominated by outflows.

XRP’s April Outflows Cross $300 Million

In accordance with knowledge from Coinglass, XRP has been battling destructive web flows for the higher a part of April, recording extra purple days than inexperienced. Even the inexperienced days have been fairly muted and have fallen wanting the volumes recorded on the purple days. With solely 13 days gone out the month to this point, there has already been greater than $300 million in outflows recorded for the month already.

Associated Studying

To this point, solely 4 out of the 13 days have ended with constructive web flows, popping out to $56.08 million in inflows for the month. In distinction, the opposite 9 days have been dominated by outflows, popping out to $311 million by Sunday.

This constant outflow means that sellers are nonetheless dominating the market, which explains why the XRP worth has continued to stay low all through this time. Moreover, if this destructive web movement development continues, then the XRP worth may endure additional crashes from right here.

Nonetheless, compared to the final three months, the month of April appears to be recording a decelerate in terms of outflows. For instance, months of January and March recorded $150 million outflow days, whereas the best to this point in April has been $90 million, which occurred on April 6.

One Extra Dip Coming?

Whereas there was a return of constructive sentiment amongst XRP buyers, bearish expectations nonetheless abound, though primarily for the short-term. Crypto analyst Egrag Crypto, a identified XRP bull, has identified that the altcoin is more likely to see one other dip in worth earlier than a restoration. However, the expectations for the long-term are nonetheless extraordinarily bullish.

Associated Studying

The crypto analyst highlights the chance for the XRP worth to dip to $1.4, however explains that he continues to carry his place. As for how excessive the worth may go, the analyst preserve three main worth targets: $7.50, $13, and $27.

“For me, I comply with the charts with a transparent understanding that sure occasions will unfold, however I keep up to date on the information to see what narratives are created to affect market actions,” Egrag Crypto defined.

Featured picture from Dall.E, chart from TradingView.com

Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

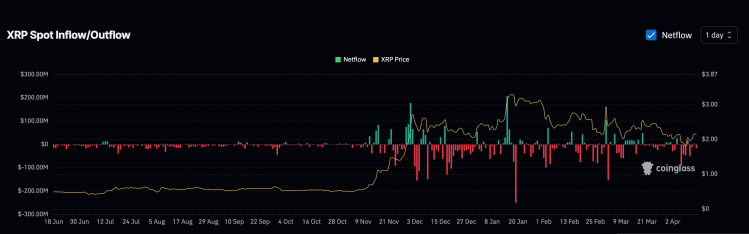

The XRP worth noticed a rise in worth over the weekend as bulls appeared to return to the desk. Because the market has been low over the previous few months, buyers unsurprisingly took this as a chance to get out at a considerably increased worth. This has led to extra destructive networks over the previous few days, including much more purple to the month of April that has been dominated by outflows.

XRP’s April Outflows Cross $300 Million

In accordance with knowledge from Coinglass, XRP has been battling destructive web flows for the higher a part of April, recording extra purple days than inexperienced. Even the inexperienced days have been fairly muted and have fallen wanting the volumes recorded on the purple days. With solely 13 days gone out the month to this point, there has already been greater than $300 million in outflows recorded for the month already.

Associated Studying

To this point, solely 4 out of the 13 days have ended with constructive web flows, popping out to $56.08 million in inflows for the month. In distinction, the opposite 9 days have been dominated by outflows, popping out to $311 million by Sunday.

This constant outflow means that sellers are nonetheless dominating the market, which explains why the XRP worth has continued to stay low all through this time. Moreover, if this destructive web movement development continues, then the XRP worth may endure additional crashes from right here.

Nonetheless, compared to the final three months, the month of April appears to be recording a decelerate in terms of outflows. For instance, months of January and March recorded $150 million outflow days, whereas the best to this point in April has been $90 million, which occurred on April 6.

One Extra Dip Coming?

Whereas there was a return of constructive sentiment amongst XRP buyers, bearish expectations nonetheless abound, though primarily for the short-term. Crypto analyst Egrag Crypto, a identified XRP bull, has identified that the altcoin is more likely to see one other dip in worth earlier than a restoration. However, the expectations for the long-term are nonetheless extraordinarily bullish.

Associated Studying

The crypto analyst highlights the chance for the XRP worth to dip to $1.4, however explains that he continues to carry his place. As for how excessive the worth may go, the analyst preserve three main worth targets: $7.50, $13, and $27.

“For me, I comply with the charts with a transparent understanding that sure occasions will unfold, however I keep up to date on the information to see what narratives are created to affect market actions,” Egrag Crypto defined.

Featured picture from Dall.E, chart from TradingView.com