Key Takeaways:

- USDC’s market cap surge indicators a powerful restoration from the bear market.

- Potential U.S. stablecoin rules may drive additional progress for USDC.

- USDC’s progress is fueled by increasing utility, new integrations, and rising adoption amongst numerous customers.

Circle, the corporate behind USD Coin (USDC), has reached an attention grabbing milestone of $56.3 billion market cap on the tenth of February in line with CoinGecko. This marks USDC’s full restoration from bear market losses. This means that stablecoins have gotten more and more favored within the DeFi sector, as USDC acquired again on monitor taking a high-flight on the stablecoin market.

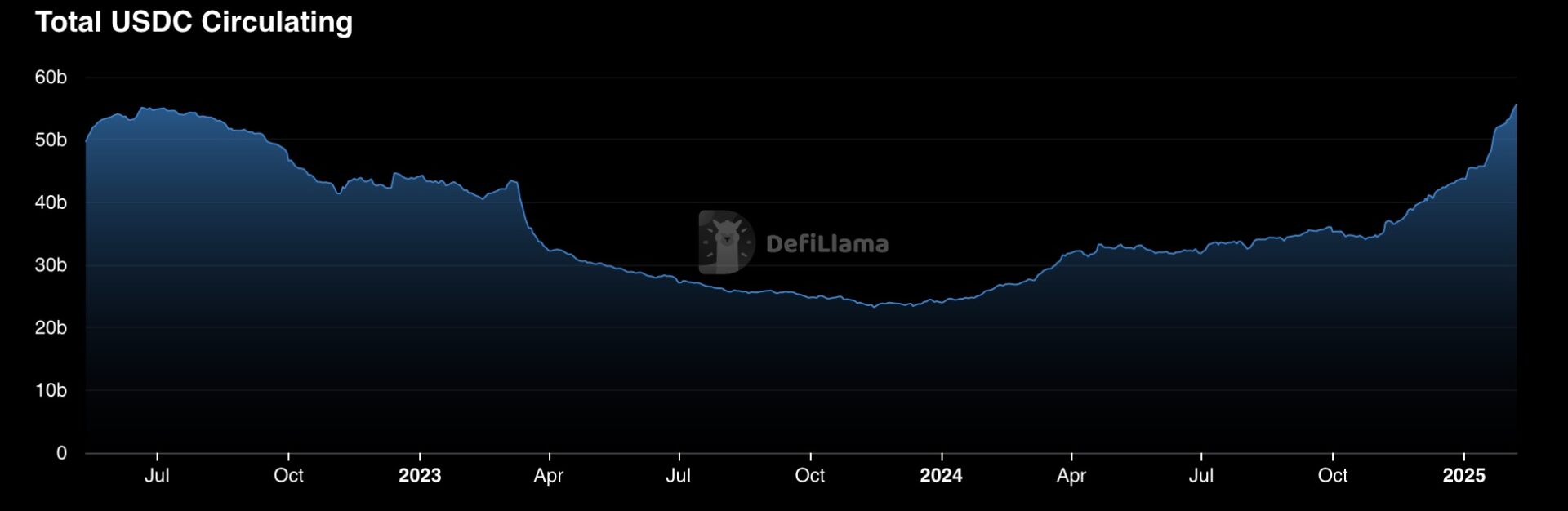

Complete USDC Circulating. Supply: DefiLlama

USDC’s Spectacular Progress Trajectory

The $56.3 billion market cap represents a considerable progress of 23.4% from the $45.6 billion obtained on January 8. The considerably low level for USDC throughout the crypto bear market was $24.1 billion in November 2023. Such a speedy restoration speaks to the disbelief of USDC and the belonging construction. It’s wonderful to see this sped-up change. It reveals that crypto markets usually are not nearly losses to develop into in the end profitable once more.

Circle’s progress is attributed to its strategic introduction of recent blockchains like Sui and Aptos. Along with it, the corporate generated $6 billion of USDC on the Solana blockchain in January 2025, which helped to boost the inventory and keep the coin’s accessible options.

Stablecoin Market Dynamics: USDC vs. USDT

Whereas on one hand there’s a fast progress registered by USDC, however, Tether’s USDT is thought to be the dominant stablecoin available on the market. As of the time of writing, USDT has a market cap of $141.6 billion, boasting a rating within the USD market. Within the final month alone, USDT’s market cap has elevated by over $4 billion.

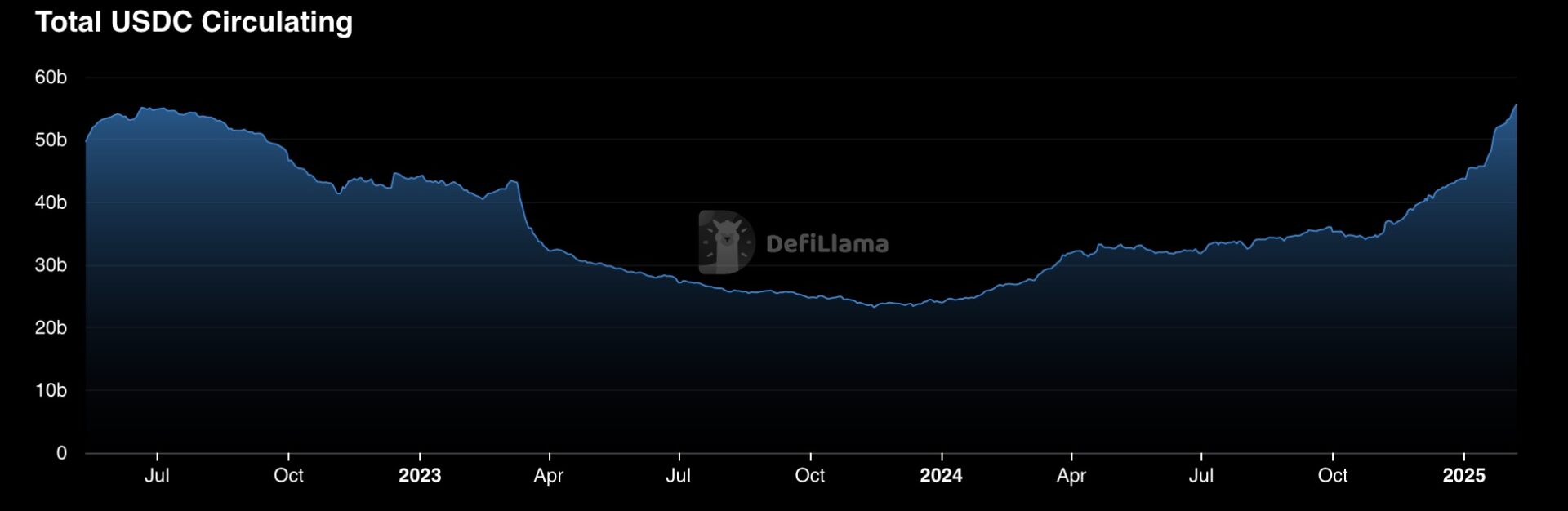

A report from DefiLlama throws gentle on the truth that USDT at current is probably the most dominant stablecoin holding a market share of 63%. However, the USDC share has elevated from 19.4% to 25% inside the final yr, exhibiting that the hole between the 2 is narrowing. Although USDT stays dominant, USDC’s progress suggests a possible shift in investor preferences and larger diversification in stablecoin holdings.

USDT Dominance. Supply: DefiLlama

The Ever-Rising Stablecoin Market

The stablecoin market is experiencing exceptional progress, increasing from $121 billion in August 2023 to $224 billion right this moment. This implies as it’s getting used increasingly stablecoins are discovering their method to varied sectors equivalent to buying and selling, funds, and decentralized finance (DeFi). Throughout a time of maybe excessive volatility, equivalent to cryptocurrency, stablecoins allow the graceful buy and sale of the digital forex concerned and improve the arrogance and credibility of the digital ecosystem.

Extra Information: The Surge of Stablecoins on the Finish of 2024 and What to Anticipate in 2025

Regulatory Scrutiny and the Way forward for Stablecoins within the US

Stablecoins have been a key focus for U.S. policymakers, with regulatory discussions intensifying because the Trump administration. The heightened regulatory stress on stablecoins solely proves the rising acknowledgment of the sector’s potential impact on the banking ecosystem.

A senior White Home official David Sacks, who can also be in control of AI and crypto issues, has insisted that the digital greenback “prolong the greenback’s dominance internationally and prolong it on-line digitally.” He pressured encouraging the steady coin builders to provide you with new initiatives inside the USA. Furthermore, Senator Invoice Hagerty has introduced a stablecoin invoice to the U.S. Congress to organize “a secure and sound regulatory setting that promotes progress.”

Extra Information: Trump Indicators Order to kind Cryptocurrency Working Group and Prohibits CBDC

The concentrate on regulation may very well be an enormous stepping stone in stability for USDC stablecoins, that are thought-about to be extra compliant with regulatory necessities than rival tokens. The continuing regulatory conversations showcased that there ought to be a transparent framework of pointers for stablecoins to work within the American monetary system.

USDC’s Rising Utility and Adoption

Coinbase, a serious cryptocurrency trade, has been a powerful advocate for USDC’s progress, highlighting its varied use circumstances. The platform has solidified the principle utilization of USDC as “one of many primary parts of the onchain monetary ecosystems which can be utilized as a “basic part of the onchain monetary ecosystem,” facilitating funds, remittances, buying and selling, and DeFi actions.”

Coinbase has actively promoted USDC’s utility by offering customers with alternatives to earn curiosity (as much as 4.5% APY), borrow USDC in opposition to contract and take part in it in over 200 buying and selling pairs. The trade has additionally enabled USDC funds in over 70 international locations by means of partnerships with firms like Stripe, Yellow Card, and Distant.com.

USDC’s progress by means of integrations and partnerships highlights its rising utility within the real-world economic system and its potential as a extensively accepted digital forex.

Stablecoins: A Hedge In opposition to Inflation and a Gateway to DeFi

Stablecoins are cryptographic belongings backed by a steady asset, normally a fiat forex just like the US greenback. They’re essential to the digital cost system and are steadily utilized in creating international locations as safety in opposition to hyper-inflation. In addition to, stablecoin holders can make use of decentralized protocols to stake and earn yields, identical to when one deposits money in a typical checking account and receives a specific amount of curiosity.

Making an allowance for their stability and the truth that they can be utilized for incomes, stablecoins are useful to all those that are keen to put money into the digital setting for the aim of preserving and increasing their wealth. The incomes alternative of stablecoins has develop into a breakthrough in bringing individuals of lesser earnings bands nearer to the monetary sector and DeFi alternatives.

Current Developments Additional Boosting USDC

Just a few latest occasions have pushed USDC even greater recently:

- Europe’s Market in Crypto Belongings (MiCA) regulation: MiCA is the regulation that governs stablecoins and digital cash tokens (EMTs) within the EU and is a clarification and a step ahead for the crypto asset class.

- Excessive potential progress of the US crypto trade: the emotions of the market and the penetration of Donald Trump’s pro-crypto imaginations have been affected, and this has helped throughout the curiosity within the cryptocurrency trade.

- CFTC Pilot Program: The Commodity Futures Buying and selling Fee (CFTC) has arrange a pilot scheme that USDC is in as a candidate, and it may possibly perhaps be used as collateral out there sooner or later.

Extra Information: MiCA Regulation: A New Daybreak or a Darkish Cloud for Europe’s Crypto Market?

Contemplating these elements, USDC is well-positioned for continued progress and adoption within the coming years.

The latest success of USDC reveals the function of innovation, regulatory transparency, and the advantages of utility in pushing the expansion of a cryptocurrency. As stablecoins are nonetheless within the strategy of evolving, the USDC has already develop into a major participant in the way forward for finance. The CFTC venture, involving Circle in affiliation with Coinbase, MoonPay, Ripple, and Crypto.com, is an “revolutionary concept” as CFTC appearing chair Caroline Pham places it, that may open the door to a clearer roadmap for digital belongings inside the present monetary system. This sort of cooperation between officers and market contractors is essential for innovation whereas making the event of the crypto ecosystem humane.

Key Takeaways:

- USDC’s market cap surge indicators a powerful restoration from the bear market.

- Potential U.S. stablecoin rules may drive additional progress for USDC.

- USDC’s progress is fueled by increasing utility, new integrations, and rising adoption amongst numerous customers.

Circle, the corporate behind USD Coin (USDC), has reached an attention grabbing milestone of $56.3 billion market cap on the tenth of February in line with CoinGecko. This marks USDC’s full restoration from bear market losses. This means that stablecoins have gotten more and more favored within the DeFi sector, as USDC acquired again on monitor taking a high-flight on the stablecoin market.

Complete USDC Circulating. Supply: DefiLlama

USDC’s Spectacular Progress Trajectory

The $56.3 billion market cap represents a considerable progress of 23.4% from the $45.6 billion obtained on January 8. The considerably low level for USDC throughout the crypto bear market was $24.1 billion in November 2023. Such a speedy restoration speaks to the disbelief of USDC and the belonging construction. It’s wonderful to see this sped-up change. It reveals that crypto markets usually are not nearly losses to develop into in the end profitable once more.

Circle’s progress is attributed to its strategic introduction of recent blockchains like Sui and Aptos. Along with it, the corporate generated $6 billion of USDC on the Solana blockchain in January 2025, which helped to boost the inventory and keep the coin’s accessible options.

Stablecoin Market Dynamics: USDC vs. USDT

Whereas on one hand there’s a fast progress registered by USDC, however, Tether’s USDT is thought to be the dominant stablecoin available on the market. As of the time of writing, USDT has a market cap of $141.6 billion, boasting a rating within the USD market. Within the final month alone, USDT’s market cap has elevated by over $4 billion.

A report from DefiLlama throws gentle on the truth that USDT at current is probably the most dominant stablecoin holding a market share of 63%. However, the USDC share has elevated from 19.4% to 25% inside the final yr, exhibiting that the hole between the 2 is narrowing. Although USDT stays dominant, USDC’s progress suggests a possible shift in investor preferences and larger diversification in stablecoin holdings.

USDT Dominance. Supply: DefiLlama

The Ever-Rising Stablecoin Market

The stablecoin market is experiencing exceptional progress, increasing from $121 billion in August 2023 to $224 billion right this moment. This implies as it’s getting used increasingly stablecoins are discovering their method to varied sectors equivalent to buying and selling, funds, and decentralized finance (DeFi). Throughout a time of maybe excessive volatility, equivalent to cryptocurrency, stablecoins allow the graceful buy and sale of the digital forex concerned and improve the arrogance and credibility of the digital ecosystem.

Extra Information: The Surge of Stablecoins on the Finish of 2024 and What to Anticipate in 2025

Regulatory Scrutiny and the Way forward for Stablecoins within the US

Stablecoins have been a key focus for U.S. policymakers, with regulatory discussions intensifying because the Trump administration. The heightened regulatory stress on stablecoins solely proves the rising acknowledgment of the sector’s potential impact on the banking ecosystem.

A senior White Home official David Sacks, who can also be in control of AI and crypto issues, has insisted that the digital greenback “prolong the greenback’s dominance internationally and prolong it on-line digitally.” He pressured encouraging the steady coin builders to provide you with new initiatives inside the USA. Furthermore, Senator Invoice Hagerty has introduced a stablecoin invoice to the U.S. Congress to organize “a secure and sound regulatory setting that promotes progress.”

Extra Information: Trump Indicators Order to kind Cryptocurrency Working Group and Prohibits CBDC

The concentrate on regulation may very well be an enormous stepping stone in stability for USDC stablecoins, that are thought-about to be extra compliant with regulatory necessities than rival tokens. The continuing regulatory conversations showcased that there ought to be a transparent framework of pointers for stablecoins to work within the American monetary system.

USDC’s Rising Utility and Adoption

Coinbase, a serious cryptocurrency trade, has been a powerful advocate for USDC’s progress, highlighting its varied use circumstances. The platform has solidified the principle utilization of USDC as “one of many primary parts of the onchain monetary ecosystems which can be utilized as a “basic part of the onchain monetary ecosystem,” facilitating funds, remittances, buying and selling, and DeFi actions.”

Coinbase has actively promoted USDC’s utility by offering customers with alternatives to earn curiosity (as much as 4.5% APY), borrow USDC in opposition to contract and take part in it in over 200 buying and selling pairs. The trade has additionally enabled USDC funds in over 70 international locations by means of partnerships with firms like Stripe, Yellow Card, and Distant.com.

USDC’s progress by means of integrations and partnerships highlights its rising utility within the real-world economic system and its potential as a extensively accepted digital forex.

Stablecoins: A Hedge In opposition to Inflation and a Gateway to DeFi

Stablecoins are cryptographic belongings backed by a steady asset, normally a fiat forex just like the US greenback. They’re essential to the digital cost system and are steadily utilized in creating international locations as safety in opposition to hyper-inflation. In addition to, stablecoin holders can make use of decentralized protocols to stake and earn yields, identical to when one deposits money in a typical checking account and receives a specific amount of curiosity.

Making an allowance for their stability and the truth that they can be utilized for incomes, stablecoins are useful to all those that are keen to put money into the digital setting for the aim of preserving and increasing their wealth. The incomes alternative of stablecoins has develop into a breakthrough in bringing individuals of lesser earnings bands nearer to the monetary sector and DeFi alternatives.

Current Developments Additional Boosting USDC

Just a few latest occasions have pushed USDC even greater recently:

- Europe’s Market in Crypto Belongings (MiCA) regulation: MiCA is the regulation that governs stablecoins and digital cash tokens (EMTs) within the EU and is a clarification and a step ahead for the crypto asset class.

- Excessive potential progress of the US crypto trade: the emotions of the market and the penetration of Donald Trump’s pro-crypto imaginations have been affected, and this has helped throughout the curiosity within the cryptocurrency trade.

- CFTC Pilot Program: The Commodity Futures Buying and selling Fee (CFTC) has arrange a pilot scheme that USDC is in as a candidate, and it may possibly perhaps be used as collateral out there sooner or later.

Extra Information: MiCA Regulation: A New Daybreak or a Darkish Cloud for Europe’s Crypto Market?

Contemplating these elements, USDC is well-positioned for continued progress and adoption within the coming years.

The latest success of USDC reveals the function of innovation, regulatory transparency, and the advantages of utility in pushing the expansion of a cryptocurrency. As stablecoins are nonetheless within the strategy of evolving, the USDC has already develop into a major participant in the way forward for finance. The CFTC venture, involving Circle in affiliation with Coinbase, MoonPay, Ripple, and Crypto.com, is an “revolutionary concept” as CFTC appearing chair Caroline Pham places it, that may open the door to a clearer roadmap for digital belongings inside the present monetary system. This sort of cooperation between officers and market contractors is essential for innovation whereas making the event of the crypto ecosystem humane.