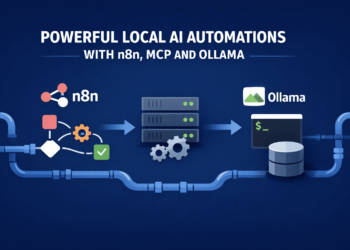

Large information analytics is revolutionizing actual property investing by offering extra knowledgeable choices and decreasing uncertainty. Previously, traders relied on instinct and restricted earlier information, however with huge information analytics, market tendencies can now be predicted as a lot as 85% of the time. With such accuracy, traders could make sensible decisions on property worth, rental wants, and future potential appreciation. Consequently, rising numbers of traders are resorting to technology-based approaches to identify profitable alternatives. The sector is rising quick, with the true property analytics market worldwide anticipated to broaden from $5.5 billion in 2019 to $13.4 billion by 2024, as per a MarketsandMarkets report.

Aside from particular person traders, actual property funding trusts (REITs) additionally acquire from data-driven evaluation, enabling them to maximise asset allocation and portfolio administration. Now, 145 million Individuals are REIT homeowners, and actual property is a big a part of most funding portfolios. With AI-driven analytics and real-time information from websites like Zillow and CoStar, traders can distinction properties, monitor market tendencies, and streamline important processes like rental pricing and threat evaluation. With know-how constantly advancing, information analytics is quick turning into a vital instrument for anybody trying to maximize returns in an more and more aggressive actual property atmosphere.

Investing in Actual Property Funding Trusts (REITs) has turn into a preferred method for people to faucet into the world of actual property with out the hassles of proudly owning bodily property. In the event you’re keen to learn from property investments and even discover alternatives like an upcoming IPO, step one is to open a demat account.

Right here, on this weblog, we will provide you with a step-by-step, complete information on how you can start, so that you’re nicely conscious of the method and stay up to date.

Understanding the Fundamentals

There are a couple of key ideas that you must know earlier than you open up a demat account:

What’s a Demat Account?

A demat account, or a dematerialised account, is an on-line account the place you can retailer your securities—such as shares, bonds, mutual funds, and exchange-traded funds (ETFs)—electronically. It eliminates the conventional technique of holding share certificates, which makes investing easier and safer. In the event you intend to commerce or spend money on the inventory market, a demat account is required.

In India, to start one, you’ll have to choose a dealer that gives protected Demat Account companies. After opening your account, your investments are easy to deal with. You gained’t want to fret about shedding or misplacing bodily certificates; you’ll have simple, fast entry to your funding portfolio. And all transactions are fast and safe, which will make you really feel at ease as you construct wealth.

What are REITs (Actual Property Funding Trusts)?

Actual Property Funding Trusts, or REITs, personal, function, or finance income-producing actual property. They permit traders to take part in the true property market with out having to purchase, handle, or finance any property immediately. This offers diversification in your portfolio and a gentle revenue stream, making them a pretty possibility for a lot of traders.

Why you Ought to Contemplate Investing in REITs?

REITs (Actual Property Funding Trusts) are a easy technique to spend money on actual property with out shopping for property. They work like shares, which means you possibly can simply purchase and promote them everytime you need. REITs assist diversify your funding portfolio and infrequently pay good dividends to traders. In the event you’re watching an upcoming IPO, REITs is usually a sensible technique to get in early on thrilling new alternatives.

Step-by-Step Information to Opening a Demat Account for REITs

You could comply with a couple of steps if you wish to open a demat account:

1. Analysis and Select a Brokerage

Step one is to decide on a brokerage agency or monetary establishment that fits your funding fashion and objectives. Search for a supplier with a user-friendly on-line platform, dependable customer support, and aggressive charges. Many brokerages at this time supply packages particularly tailor-made for learners and seasoned traders alike.

Make sure the brokerage helps REIT buying and selling and offers insights on market tendencies and upcoming IPO occasions.

2. Collect the Required Paperwork

Opening a demat account is just like opening any checking account; you need to submit some important paperwork for id and tackle verification. You must have:

- Proof of Identification: A government-issued photograph ID (like your passport, PAN card, or driver’s license).

- Proof of Tackle: Utility payments, rental agreements, or any official doc that confirms your present tackle.

- Pictures: Current passport-sized images.

- Financial institution Account Particulars: Your checking account data is used to hyperlink your demat account for clean fund transfers.

3. Fill Out the Software Kind

When you’ve chosen your brokerage and gathered the required paperwork, the following step is to fill out the applying kind. Most brokers supply a web-based kind that’s easy to finish. As you fill within the particulars, double-check for errors and guarantee all data matches your supporting paperwork. Accuracy is essential on this step, as any mismatches may delay the verification course of.

4. Full the In-Individual Verification (IPV) Course of

Many brokerages now supply a web-based Built-in Verification Course of (IPV) that may be accomplished by way of video calls or a cellular app. Nonetheless, if an in-person go to is required, schedule an appointment on the nearest department. Throughout this step, a consultant will confirm your paperwork and id, which is essential to organising your account.

5. Signal the Settlement and Submit Your Software

After the verification, you’ll be requested to signal an settlement. This doc outlines the phrases and circumstances of the demat account, the charges, and the companies the brokerage offers. It’s important to learn this doc totally and perceive your duties as an investor.

As soon as signed, submit your software. The brokerage will then course of your software, and as soon as permitted, you’ll obtain your demat account particulars.

6. Hyperlink Your Financial institution Account

Linking your checking account to your demat account is important for straightforward transactions. This connection helps you to switch funds immediately, making investing in REITs and even collaborating in an upcoming IPO easy. Most brokers supply a safe on-line course of to finish this step, guaranteeing that your investments are only a few clicks away.

7. Begin Investing in REITs

Now that your demat account is energetic, you’re prepared to take a position. Along with your account arrange, you should buy REITs immediately via your brokerage platform. Browse the accessible REITs and examine their efficiency, dividend historical past, and property portfolio. Many platforms additionally supply analysis studies and knowledgeable evaluation, which might help you make knowledgeable choices.

Suggestions for New Buyers

Investing in REITs is usually a rewarding expertise, however it’s important to strategy it with the appropriate mindset and a well-informed technique:

- Educate Your self: Earlier than investing, be taught as a lot as you possibly can about REITs, market tendencies, and financial components that have an effect on actual property. Loads of on-line sources, webinars, and even workshops can be found for learners.

- Diversify Your Investments: Whereas REITs are a good way to diversify, keep in mind that no funding is with out threat. Contemplate balancing your portfolio with a mixture of shares, bonds, and different belongings.

- Keep Up to date: Monetary markets might be dynamic. Test for information associated to actual property and the broader financial system recurrently. This may embrace updates on an upcoming IPO, market shifts, or adjustments in rates of interest that may have an effect on property investments.

- Seek the advice of a Monetary Advisor: In the event you’re new to investing or not sure about your decisions, talking with a monetary advisor might be extremely useful. They’ll supply personalised recommendation based mostly in your monetary objectives and threat tolerance.

- Monitor Your Investments: Monitor your portfolio’s efficiency when you’ve invested. Most on-line platforms supply real-time updates, and lots of present analytical instruments that will help you perceive market tendencies.

Conclusion

Opening a demat account for REITs is a comparatively easy but pivotal step in the direction of constructing a diversified and resilient funding portfolio. By understanding the fundamental ideas, following the step-by-step course of, and maintaining abreast of market tendencies, you’re nicely in your technique to harnessing the advantages of actual property investments with out the standard complexities of property administration.

Knowledge analytics is reworking actual property investing by providing exact market predictions, threat evaluation instruments, and portfolio optimization methods. Knowledge-driven insights are shaping the way forward for actual property investing. As analytics instruments proceed to evolve, traders who embrace these improvements could have a big benefit in maximizing returns and minimizing dangers in an more and more aggressive market.