Key Takeaways

- International crypto buying and selling quantity estimated to exceed $108 trillion in 2024, up 90% from 2022.

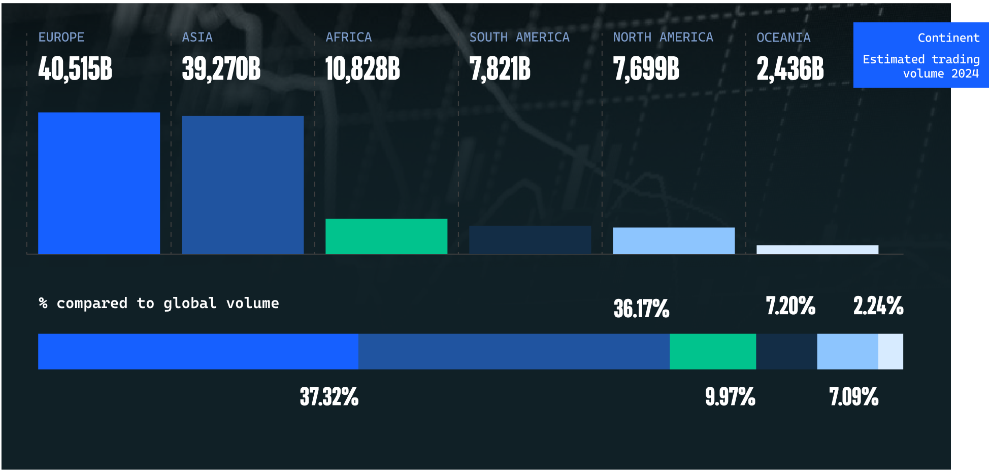

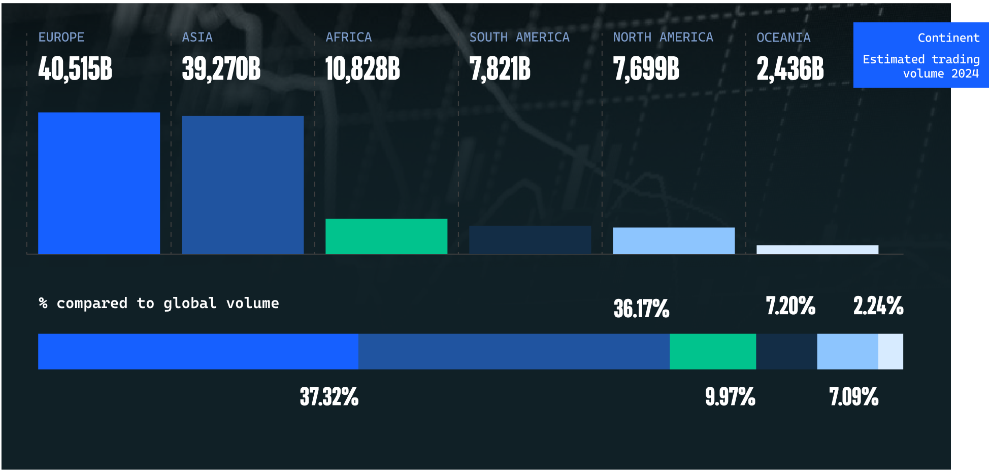

- Europe leads world crypto transaction worth at 37.32%, adopted by Asia at 36.17%.

Share this text

International crypto buying and selling quantity in 2024 is estimated to exceed $108 trillion, practically 90% greater than in 2022, based on a Coinwire report. The US holds the highest spot for the best estimated crypto buying and selling quantity in 2024, surpassing $2 trillion.

Crypto buying and selling quantity has elevated by 42% since 2023, with the market increasing by 89% over the previous three years. This development displays the rising acceptance and adoption of digital belongings worldwide, the report highlighted.

Europe leads in crypto buying and selling, accounting for 37.32% of worldwide transaction worth, with Russia and the UK amounting to the most important volumes within the area. Turkey and India rank 2nd and third globally, respectively, with each international locations boasting buying and selling volumes exceeding $1 trillion.

Asia ranks second in world crypto transaction worth, contributing 36.17%. The area’s fast uptake is attributed to excessive cell penetration, strong tech infrastructure, and rising institutional curiosity.

Binance maintains its place as essentially the most extensively used crypto change, dominating in 100 out of 136 international locations. The change reported a buying and selling quantity of $2.77 trillion, considerably outpacing its opponents.

Different notable exchanges embody OKX and CEX.IO, main in 93 and 92 international locations respectively, with buying and selling volumes of $759 billion and $1.83 billion. Coinbase Trade and Bybit comply with, dominating 90 and 87 international locations, with volumes of $662 billion and $1.14 trillion respectively.

These figures spotlight the aggressive panorama of crypto exchanges and the rising significance of digital belongings within the world monetary system.

Earlier this yr, crypto funds achieved a file $30 billion in buying and selling quantity, predominantly influenced by US spot bitcoin ETFs.

Final month, bitcoin’s worth surpassed $67,000, nearing the $1.38 trillion market cap of silver, with vital contributions from Ether and BlackRock’s bitcoin ETF.

Just lately, an economist mentioned how investments in AI would possibly result in subdued crypto returns, but highlighted a possible $20 trillion financial increase from combining AI and crypto by 2030.

Earlier this month, the transaction quantity of the highest three stablecoins exceeded Visa’s 2023 month-to-month common of $1.2 trillion, underscoring the rising prominence of stablecoins.

Crypto Briefing reported that regardless of the FTX collapse and regulatory hurdles, centralized exchanges dominated 2023’s $36 trillion crypto buying and selling, fueled by optimism for US Bitcoin ETFs.

Share this text