Key Takeaways

- Bybit has absolutely restored its withdrawal system after a major hack.

- The trade will launch an in depth incident report and new safety measures quickly.

Share this text

Bybit has absolutely restored its withdrawal system after some delays after a historic hack that focused its Ethereum chilly pockets. The trade is now processing all withdrawal requests with out delays or quantity restrictions, in response to an announcement from Ben Zhou, the corporate’s CEO.

“12 [hours after] the worst hack in historical past. ALL [withdrawals] have been processed. Our [withdrawal] system is now absolutely again to regular tempo, you’ll be able to withdraw any quantity and expertise no delays. Thanks to your endurance and we’re sorry that this has occurred,” Zhou wrote on X on Friday evening.

Bybit will launch a complete incident report and safety measures within the coming days, Zhou said, noting that he ensures the crypto group stays knowledgeable of any new updates.

“Due to all of the purchasers, associates and companions who’ve helped and supported us throughout this excruciation 12 [hours],” Zhou added. “The actual work has simply now began.”

Over $1.4 billion in ETH drained

On Feb. 21, blockchain sleuth ZachXBT flagged suspicious crypto transfers originating from Bybit. Preliminary evaluation indicated the unauthorized withdrawal of roughly 400,000 ETH, 90,000 stETH, 15,000 cmETH, and eight,000 mETH, with estimated losses totaling $1.4 billion.

The funds have been transferred to an tackle starting ‘0x4766.’ The actor then used decentralized exchanges (DEXs) to transform stETH and cmETH to ETH.

On-chain knowledge additionally revealed {that a} switch of 90 USDT was carried out by the actor, now recognized because the Bybit exploiter, earlier than the massive fund drain, suggesting a preliminary take a look at transaction.

Bybit confirmed the breach shortly after its discovery. In an X publish, CEO Zhou said that an ETH multisig chilly pockets was compromised, however reassured customers that different chilly wallets remained safe.

Based on him, Bybit executed a transaction from their ETH chilly pockets to a heat pockets round one hour previous to the incident. The transaction sadly was manipulated, whereby the consumer interface offered to the signers was falsified.

The signers have been offered with a UI that displayed the proper vacation spot tackle and utilized a respectable URL related to Protected. Nonetheless, the signing message related to the transaction was maliciously altered.

This altered message instructed the sensible contract logic of the ETH chilly pockets to be modified, thereby granting the attacker unauthorized management, Bybit CEO defined.

On their official X web page, Bybit additionally issued an announcement clarifying the difficulty. The staff stated they have been collaborating with main blockchain safety specialists and trade specialists to find out the incident’s root trigger and get well the stolen funds.

Bybit detected unauthorized exercise involving certainly one of our ETH chilly wallets. The incident occurred when our ETH multisig chilly pockets executed a switch to our heat pockets. Sadly, this transaction was manipulated by means of a classy assault that masked the signing…

— Bybit (@Bybit_Official) February 21, 2025

Lower than two hours after the hack, Arkham Intelligence reported that the Bybit exploiter transferred round $1.3 billion to 53 addresses.

WE’VE COMPILED A LIST OF BYBIT HACKER WALLETS

The Bybit Hacker at the moment holds $1.37B of ETH and has used 53 wallets thus far.

Pockets checklist beneath: pic.twitter.com/oQK1MhYkqg

— Arkham (@arkham) February 21, 2025

Bybit is solvent: Ben Zhou

Regardless of huge losses, Zhou asserted that “Bybit is solvent.”

Bybit is Solvent even when this hack loss just isn’t recovered, all of purchasers property are 1 to 1 backed, we are able to cowl the loss.

— Ben Zhou (@benbybit) February 21, 2025

BitMEX Analysis did a fast calculation utilizing Bybit’s public reserve knowledge. The staff concluded that the trade has sufficient reserves to cowl its obligations to its customers, regardless of the big quantity of stolen funds.

Primarily based on a really fast again of the envelope calculation, of the numbers within the newest @Bybit_Official printed “Reserve Ratios”, the corporate nonetheless appears to be like solvent, regardless of the large loss over $1bnhttps://t.co/JMWu5Luayl https://t.co/879ZZ18raH pic.twitter.com/8jzAh6xBS8

— BitMEX Analysis (@BitMEXResearch) February 21, 2025

Zhou additionally carried out a reside stream on X to deal with ongoing issues surrounding customers’ funds. Throughout the stream, he stated that Bybit secured a bridge mortgage equal to 80% of the stolen funds from undisclosed companions.

The trade doesn’t plan to repurchase the stolen ETH on the open market to keep away from inflicting a sudden worth surge, Zhou defined, noting that Bybit would use its reserve funds to cowl all losses if vital, guaranteeing the safety of consumer property.

Zhou added that the hacker would face difficulties promoting the stolen ETH, as most main buying and selling platforms have restricted liquidity and may implement transaction-blocking measures.

Crypto trade unites to help Bybit

Business figures and members of the crypto group have rallied behind Bybit, pledging their assist within the aftermath of the safety breach.

Changpeng ‘CZ’ Zhao, the previous Chief Government Officer of Binance, and Justin Solar, the founding father of the Tron blockchain, have indicated their intent to supply assist.

OKX and KuCoin additionally issued statements displaying their help to Bybit.

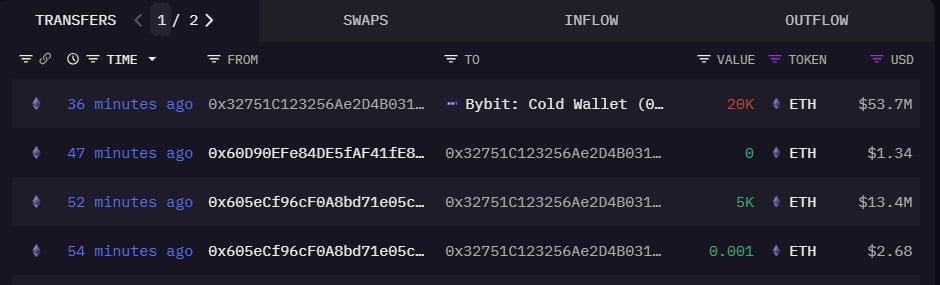

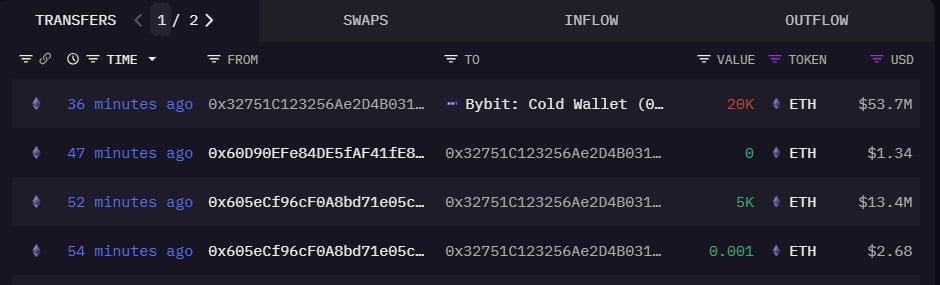

Based on on-chain knowledge, Binance and Bitget deposited over 50,000 ETH into Bybit’s chilly wallets on Friday afternoon in assist of Bybit. Arkham additionally introduced a bounty of fifty,000 ARKM for anybody who may determine the Bybit hacker.

“Our techniques have blacklisted hackers’ wallets. We are going to block any transactions flowing in from illicit addresses to the trade as soon as it has been monitored. Our staff of safety, and researchers, are at the moment monitoring these actions. If we make any important findings, we’ll share an evaluation of this incident and what the trade can do to keep away from comparable points,” Bitget CEO Gracy Chen shared in an announcement. Bitget transferred roughly 40,000 ETH to Bybit.

“These are Bitget’s personal funds, which now we have despatched for the goodwill of the crypto area. All Bitget’s customers’ funds are securely saved on our platform and customers can verify the Proof of Reserve accordingly,” Chen said.

On Feb. 22, a whale transferred 20,000 ETH value round $53 million to Bybit’s chilly pockets, Lookonchain reported.

Lazarus Group allegedly concerned

Arkham recognized North Korea’s Lazarus Group because the hackers behind the assault, citing proof offered by ZachXBT.

The blockchain investigator reportedly submitted “definitive proof” to Arkham. Arkham additionally shared ZachXBT’s findings with the Bybit staff to assist their ongoing investigation.

ZachXBT stated he discovered proof linking the Bybit hack to the $70 million Phemex hack in January, which was allegedly carried out by the Lazarus Group.

Newest updates

Based on the newest updates from ZachXBT and Bybit CEO, the Bybit attackers (the Lazarus Group) began transferring 5,000 ETH stolen from Bybit to a brand new tackle within the early hours of Saturday.

The group is reportedly trying to launder the funds utilizing the eXch mixer and bridge the funds to Bitcoin by means of Chainflip. Bybit CEO Ben has appealed to Chainflip to assist forestall additional asset motion.

In response, Chainflip stated they took rapid steps to deal with the state of affairs. Nonetheless, Chainflip emphasised that as a decentralized protocol, they lack the flexibility to utterly block, freeze, or redirect funds.

Share this text