Though a primary CBM system will supply some stable advantages and insights, to get the utmost worth out of a CBM system, extra superior parts are wanted. Beneath we focus on a number of of an important parts, resembling having churn fashions with a number of time horizons, including value optimization, utilizing simulation-based forecasting and including competitor pricing knowledge.

A number of Horizon Churn Fashions

Generally it is sensible to have a look at churn from completely different views, and a kind of angles is the time horizon — or end result interval — you permit the mannequin to have. For some enterprise eventualities, it is sensible to have a mannequin with a brief end result interval, whereas for others it might probably make sense to have a mannequin with a 1-year end result interval.

To higher clarify this idea, assume you construct a churn mannequin with 10-week end result interval. This mannequin can then be used to present a prediction whether or not a given buyer will churn inside a 10-week interval. Nonetheless, assume now that you’ve got remoted a particular occasion that you recognize causes churn and that you’ve got a brief window of maybe 3 weeks to implement any preventative measure. On this case it is sensible to coach a churn mannequin with a 3-week horizon, conditional on the precise occasion you recognize causes churn. This manner you possibly can focus any retention actions on the purchasers most susceptible to churning.

This type of differentiated method permits for a extra strategic allocation of assets, specializing in high-impact interventions the place they’re wanted most. By adapting the mannequin’s time horizon to particular conditions, firms can optimize their retention efforts, finally enhancing buyer lifetime worth and lowering pointless churn.

Pricing Optimization & Buyer Worth Elasticity

Worth is in lots of instances the ultimate a part of technique execution, and the winners are those who can successfully translate a technique into an efficient value regime. That is precisely what a CBM system with prize optimization permit firms to do. Whereas the subject of value optimization simply warrants its personal article, we attempt to briefly summarize the important thing concepts under.

The very first thing wanted to get began is to get knowledge on historic costs. Ideally completely different ranges of value throughout time and different explanatory variables. This lets you develop an estimate for value elasticity. As soon as that’s in place, you possibly can develop anticipated values for churn at varied value factors and use that to forecast anticipated values for income. Aggregating up from a buyer degree offers the anticipated worth and anticipated churn on a product foundation and you will discover optimum costs per product. In additional complicated instances you may as well have a number of cohorts per product that every have their optimum value factors.

For instance, assume an organization has two completely different merchandise, product A and product B. For product A, the corporate needs to develop its consumer base and are solely prepared to simply accept a set quantity of churn, whereas additionally being aggressive out there. Nonetheless, for product B they’re prepared to simply accept a specific amount of churn in return for having an optimum value with respect to anticipated revenues. A CBM system permits for the roll out of such a technique and provides the management a forecast for the long run anticipated revenues of the technique.

Simulation-Primarily based Forecasting

Simulation primarily based forecasting gives a extra sturdy means producing forecast estimates moderately than simply doing level estimation primarily based on anticipated values. Through the use of strategies like Monte Carlo simulation, we’re ready generate chance densities for outcomes, and thus present choice makers with ranges for our predictions. That is extra highly effective than simply level estimates as a result of we’re in a position to quantify the uncertainty.

To grasp how simulation primarily based forecasting can be utilized, we will illustrate with an instance. Suppose we now have 10 clients with given churn possibilities, and that every of those clients have a yearly anticipated income. (In actuality we sometimes have a multivariate churn operate that predicts churn for every of the purchasers.) For simplicity, assume that if the shopper churns we find yourself with 0 income and in the event that they don’t churn we maintain all of the income. We will use python to make this instance concrete:

import random

# Set the seed for reproducibility

random.seed(42)# Generate the lists once more with the required adjustments

churn_rates = [round(random.uniform(0.4, 0.8), 2) for _ in range(10)]

yearly_revenue = [random.randint(1000, 4000) for _ in range(10)]

churn_rates, yearly_revenue

This provides us the next values for churn_rates and yearly_revenue:

churn_rates: [0.66, 0.41, 0.51, 0.49, 0.69, 0.67, 0.76, 0.43, 0.57, 0.41]

yearly_revenue: [1895, 1952, 3069, 3465, 1108, 3298, 1814, 3932, 3661, 3872]

Utilizing the numbers above, and assuming the churn occasions are impartial, we will simply calculate the common churn price and in addition the entire anticipated income.

# Calculate the entire anticipated income utilizing (1 - churn_rate) * yearly_revenue for every buyer

adjusted_revenue = [(1 - churn_rate) * revenue for churn_rate, revenue in zip(churn_rates, yearly_revenue)]

total_adjusted_revenue = sum(adjusted_revenue)# Recalculate the anticipated common churn price primarily based on the unique knowledge

average_churn_rate = sum(churn_rates) / len(churn_rates)

average_churn_rate, total_adjusted_revenue

With the next numbers for average_churn_rate and total_adjusted_revenue:

average_churn_rate:0.56,

total_adjusted_revenue: 13034.07

So, we will count on to have about 56% churn and a complete income of 13034, however this doesn’t inform us something concerning the variation we will count on to see. To get a deeper understanding of the vary of potential outcomes we will count on, we flip to Monte Carlo simulation. As an alternative of taking the anticipated worth of the churn price and complete income, we as a substitute let the state of affairs play out 10000 instances (10000 is right here chosen arbitrarily; the quantity needs to be chosen in order to attain the specified granularity of the ensuing distribution), and for every occasion of the simulation clients both churn with chance churn_rate or they stick with chance 1- churn_rate.

import pandas as pdsimulations = pd.DataFrame({

'churn_rate': churn_rates * 10000,

'yearly_revenue': yearly_revenue * 10000

})

# Add a column with random numbers between 0 and 1

simulations['random_number'] = (

[random.uniform(0, 1) for _ in range(len(simulations))])

# Add a column 'not_churned' and set it to 1, then replace it to 0 primarily based on the random quantity

simulations['not_churned'] = (

simulations['random_number'] >= simulations['churn_rate']).astype(int)

# Add an 'iteration' column ranging from 1 to 10000

simulations['iteration'] = (simulations.index // 10) + 1

This provides a desk just like the one under:

We will summarize our outcomes utilizing the next code:

# Group by 'iteration' and calculate the required values

abstract = simulations.groupby('iteration').agg(

total_revenue=('yearly_revenue',

lambda x: sum(x * simulations.loc[x.index, 'not_churned'])),

total_churners=('not_churned', lambda x: 10 - sum(x))

).reset_index()

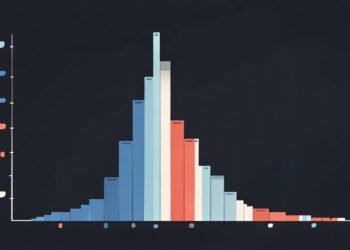

And eventually, plotting this with plotly yields:

The graphs above inform a a lot richer story than the 2 level estimates of 0.56 and 13034 we began with. We now perceive way more concerning the potential outcomes we will count on to see, and we will have an knowledgeable dialogue about what ranges of churn and income we we discover acceptable.

Persevering with with the instance above we might for instance say that we’d solely be ready to simply accept a 0.1 % likelihood of 8 or extra churn occasions. Utilizing particular person buyer value elasticities and simulation primarily based forecasting, we might tweak the anticipated churn_rates for purchasers in order that we might precisely obtain this end result. This type of buyer base management is just achievable with a complicated CBM system.

The Significance of Competitor Pricing

Some of the vital components in pricing is the competitor value. How aggressive opponents are will to a big diploma decide how versatile an organization could be in its personal pricing. That is very true for commoditized companies resembling utilities or telcos the place it’s laborious for suppliers to distinguish. Nonetheless, regardless of the significance of competitor pricing, many enterprise select to not combine this knowledge into their very own value optimization algorithms.

The explanations for not together with competitor pricing in value algorithms are diversified. Some firms declare that it’s too troublesome and time consuming to gather the info, and even when they began now, they nonetheless wouldn’t have all of the historical past they should prepare all the value elasticity fashions. Others say the costs of competitor merchandise are usually not instantly corresponding to their very own and that gathering them can be troublesome. Lastly, most firms additionally declare that they’ve value managers who manually monitor the market and when opponents make strikes, they’ll regulate their very own costs in response, in order that they don’t have to have this knowledge of their algorithms.

The primary argument can more and more be mitigated by good net scraping and different intelligence gathering strategies. If that’s not sufficient, there are additionally typically businesses that may present historic market knowledge on costs for varied industries and sectors. Relating to the second argument about not having comparable merchandise, one can even use machine studying methods to tease out the precise price of particular person product parts. One other methodology can also be to make use of completely different consumer personas that can be utilized to estimate the entire month-to-month prices of a particular set of merchandise or product.

Finally, not together with competitor costs leaves the pricing algorithms and optimization engines at a drawback. In industries the place value calculators and comparability web sites make it more and more straightforward for purchasers to get a grasp of the market, firms run a danger of being out-competed on value by extra superior opponents.