GDP is a really sturdy metric of a rustic’s financial well-being; subsequently, making forecasts of the measurement extremely wanted. Policymakers and legislators, for instance, could need to have a tough forecast of the tendencies relating to the nation’s GDP previous to passing a brand new invoice or legislation. Researchers and economists may even think about these forecasts for varied endeavors in each educational and industrial settings.

Forecasting GDP, equally to many different time sequence issues, follows a common workflow.

- Utilizing the built-in FRED (Federal Reserve Financial Information) library and API, we’ll create our options by establishing an information body composed of US GDP together with another metrics which can be carefully associated (GDP = Consumption + Funding + Govt. Spending + Web Export)

- Utilizing a wide range of statistical assessments and analyses, we’ll discover the nuances of our information with a view to higher perceive the underlying relationships between options.

- Lastly, we’ll make the most of a wide range of statistical and machine-learning fashions to conclude which strategy can lead us to probably the most correct and environment friendly forecast.

Alongside all of those steps, we’ll delve into the nuances of the underlying mathematical spine that helps our assessments and fashions.

To assemble our dataset for this mission, we can be using the FRED (Federal Reserve Financial Information) API which is the premier utility to collect financial information. Notice that to make use of this information, one should register an account on the FRED web site and request a customized API key.

Every time sequence on the web site is linked to a selected character string (for instance GDP is linked to ‘GDP’, Web Export to ‘NETEXP’, and many others.). That is essential as a result of after we make a name for every of our options, we have to make it possible for we specify the proper character string to associate with it.

Maintaining this in thoughts, lets now assemble our information body:

#used to label and assemble every characteristic dataframe.

def gen_df(class, sequence):

gen_ser = fred.get_series(sequence, frequency='q')

return pd.DataFrame({'Date': gen_ser.index, class + ' : Billions of {dollars}': gen_ser.values})

#used to merge each constructed dataframe.

def merge_dataframes(dataframes, on_column):

merged_df = dataframes[0]

for df in dataframes[1:]:

merged_df = pd.merge(merged_df, df, on=on_column)

return merged_df

#listing of options for use

dataframes_list = [

gen_df('GDP', 'GDP'),

gen_df('PCE', 'PCE'),

gen_df('GPDI', 'GPDI'),

gen_df('NETEXP', 'NETEXP'),

gen_df('GovTotExp', 'W068RCQ027SBEA')

]

#defining and displaying dataset

information = merge_dataframes(dataframes_list,'Date')

information

Discover that since now we have outlined features versus static chunks of code, we’re free to increase our listing of options for additional testing. Working this code, our ensuing information body is the next:

We discover that our dataset begins from the Sixties, giving us a reasonably broad historic context. As well as, trying on the form of the information body, now we have 1285 situations of precise financial information to work with, a quantity that isn’t essentially small however not huge both. These observations will come into play throughout our modeling section.

Now that our dataset is initialized, we will start visualizing and conducting assessments to collect some insights into the habits of our information and the way our options relate to at least one one other.

Visualization (Line plot):

Our first strategy to analyzing this dataset is to easily graph every characteristic on the identical plot with a view to catch some patterns. We will write the next:

#separating date column from characteristic columns

date_column = 'Date'

feature_columns = information.columns.distinction([date_column])

#set the plot

fig, ax = plt.subplots(figsize=(10, 6))

fig.suptitle('Options vs Time', y=1.02)

#graphing options onto plot

for i, characteristic in enumerate(feature_columns):

ax.plot(information[date_column], information[feature], label=characteristic, colour=plt.cm.viridis(i / len(feature_columns)))

#label axis

ax.set_xlabel('Date')

ax.set_ylabel('Billions of {Dollars}')

ax.legend(loc='higher left', bbox_to_anchor=(1, 1))

#show the plot

plt.present()

Working the code, we get the consequence:

Trying on the graph, we discover under that among the options resemble GDP way over others. As an illustration, GDP and PCE comply with nearly the very same pattern whereas NETEXP shares no seen similarities. Although it might be tempting, we can’t but start choosing and eradicating sure options earlier than conducting extra exploratory assessments.

ADF (Augmented Dickey-Fuller) Take a look at:

The ADF (Augmented Dickey-Fuller) Take a look at evaluates the stationarity of a selected time sequence by checking for the presence of a unit root, a attribute that defines a time sequence as nonstationarity. Stationarity basically implies that a time sequence has a relentless imply and variance. That is essential to check as a result of many fashionable forecasting strategies (together with ones we’ll use in our modeling section) require stationarity to perform correctly.

Though we will decide the stationarity for many of those time sequence simply by trying on the graph, doing the testing continues to be useful as a result of we’ll probably reuse it in later elements of the forecast. Utilizing the Statsmodel library we write:

from statsmodels.tsa.stattools import adfuller

#iterating by means of every characteristic

for column in information.columns:

if column != 'Date':

consequence = adfuller(information[column])

print(f"ADF Statistic for {column}: {consequence[0]}")

print(f"P-value for {column}: {consequence[1]}")

print("Important Values:")

for key, worth in consequence[4].objects():

print(f" {key}: {worth}")

#creating separation line between every characteristic

print("n" + "=" * 40 + "n")

giving us the consequence:

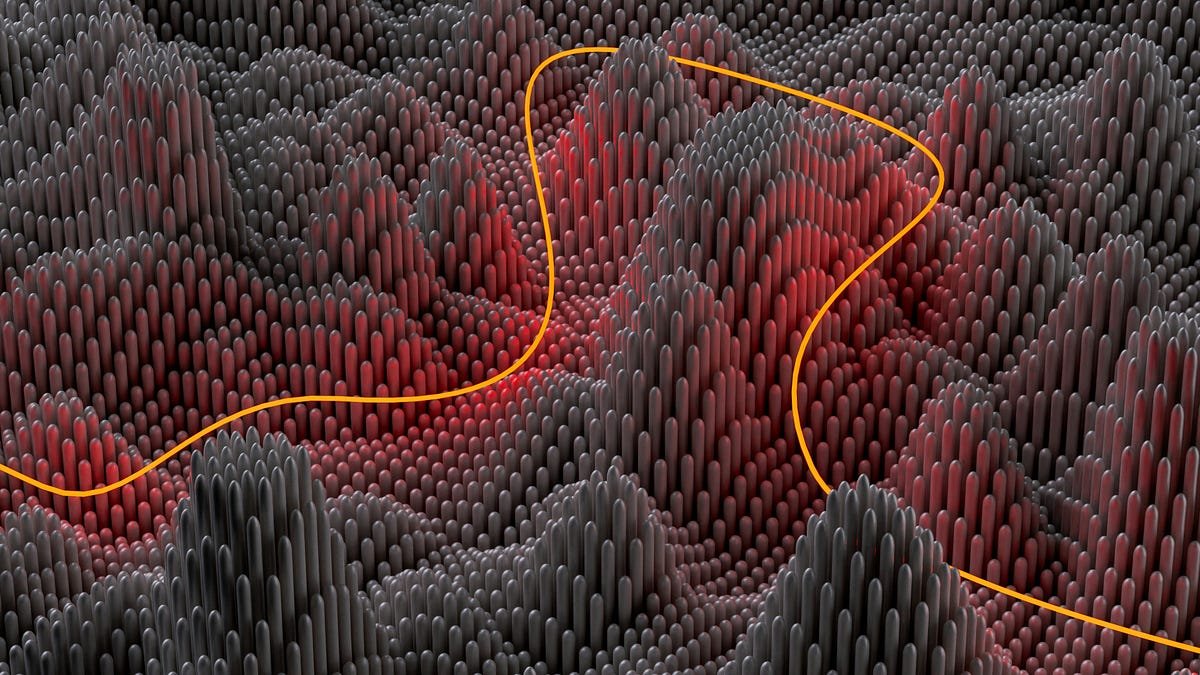

The numbers we have an interest from this check are the P-values. A P-value near zero (equal to or lower than 0.05) implies stationarity whereas a price nearer to 1 implies nonstationarity. We will see that every one of our time sequence options are extremely nonstationary as a result of their statistically insignificant p-values, in different phrases, we’re unable to reject the null speculation for the absence of a unit root. Beneath is an easy visible illustration of the check for one among our options. The purple dotted line represents the P-value the place we’d have the ability to decide stationarity for the time sequence characteristic, and the blue field represents the P-value the place the characteristic is presently.

VIF (Variance Inflation Issue) Take a look at:

The aim of discovering the Variance Inflation Issue of every characteristic is to verify for multicollinearity, or the diploma of correlation the predictors share with each other. Excessive multicollinearity just isn’t essentially detrimental to our forecast, nevertheless, it will possibly make it a lot tougher for us to find out the person impact of every characteristic time sequence for the prediction, thus hurting the interpretability of the mannequin.

Mathematically, the calculation is as follows:

with Xj representing our chosen predictor and R²j is the coefficient of willpower for our particular predictor. Making use of this calculation to our information, we arrive on the following consequence:

Evidently, our predictors are very carefully linked to at least one one other. A VIF rating better than 5 implies multicollinearity, and the scores our options achieved far exceed this quantity. Predictably, PCE by far had the best rating which is sensible given how its form on the road plot resembled most of the different options.

Now that now we have regarded completely by means of our information to higher perceive the relationships and traits of every characteristic, we’ll start to make modifications to our dataset with a view to put together it for modeling.

Differencing to realize stationarity

To start modeling we have to first guarantee our information is stationary. we will obtain this utilizing a method known as differencing, which basically transforms the uncooked information utilizing a mathematical components just like the assessments above.

The idea is outlined mathematically as:

This makes it so we’re eradicating the nonlinear tendencies from the options, leading to a relentless sequence. In different phrases, we’re taking values from our time sequence and calculating the change which occurred following the earlier level.

We will implement this idea in our dataset and verify the outcomes from the beforehand used ADF check with the next code:

#differencing and storing authentic dataset

data_diff = information.drop('Date', axis=1).diff().dropna()

#printing ADF check for brand new dataset

for column in data_diff.columns:

consequence = adfuller(data_diff[column])

print(f"ADF Statistic for {column}: {consequence[0]}")

print(f"P-value for {column}: {consequence[1]}")

print("Important Values:")

for key, worth in consequence[4].objects():

print(f" {key}: {worth}")print("n" + "=" * 40 + "n")

working this ends in:

We discover that our new p-values are lower than 0.05, which means that we will now reject the null speculation that our dataset is nonstationary. Having a look on the graph of the brand new dataset proves this assertion:

We see how all of our time sequence at the moment are centered round 0 with the imply and variance remaining fixed. In different phrases, our information now visibly demonstrates traits of a stationary system.

VAR (Vector Auto Regression) Mannequin

Step one of the VAR mannequin is performing the Granger Causality Take a look at which is able to inform us which of our options are statistically important to our prediction. The check signifies to us if a lagged model of a selected time sequence might help us predict our goal time sequence, nevertheless not essentially that one time sequence causes the opposite (word that causation within the context of statistics is a much more troublesome idea to show).

Utilizing the StatsModels library, we will apply the check as follows:

from statsmodels.tsa.stattools import grangercausalitytests

columns = ['PCE : Billions of dollars', 'GPDI : Billions of dollars', 'NETEXP : Billions of dollars', 'GovTotExp : Billions of dollars']

lags = [6, 9, 1, 1] #decided from individually testing every mixturefor column, lag in zip(columns, lags):

df_new = data_diff[['GDP : Billions of dollars', column]]

print(f'For: {column}')

gc_res = grangercausalitytests(df_new, lag)

print("n" + "=" * 40 + "n")

Working the code ends in the next desk:

Right here we’re simply in search of a single lag for every characteristic that has statistically important p-values(>.05). So for instance, since on the primary lag each NETEXP and GovTotExp, we’ll think about each these options for our VAR mannequin. Private consumption expenditures arguably didn’t make this cut-off (see pocket book), nevertheless, the sixth lag is so shut that I made a decision to maintain it in. Our subsequent step is to create our VAR mannequin now that now we have determined that every one of our options are important from the Granger Causality Take a look at.

VAR (Vector Auto Regression) is a mannequin which might leverage totally different time sequence to gauge patterns and decide a versatile forecast. Mathematically, the mannequin is outlined by:

The place Yt is a while sequence at a selected time t and Ap is a decided coefficient matrix. We’re basically utilizing the lagged values of a time sequence (and in our case different time sequence) to make a prediction for Yt. Figuring out this, we will now apply this algorithm to the data_diff dataset and consider the outcomes:

Taking a look at this forecast, we will clearly see that regardless of lacking the mark fairly closely on each analysis metrics used (MAE and MAPE), our mannequin visually was not too inaccurate barring the outliers attributable to the pandemic. We managed to remain on the testing line for probably the most half from 2018–2019 and from 2022–2024, nevertheless, the worldwide occasions following clearly threw in some unpredictability which affected the mannequin’s capability to exactly decide the tendencies.

VECM (Vector Error Correction Mannequin)

VECM (Vector Error Correction Mannequin) is just like VAR, albeit with a couple of key variations. In contrast to VAR, VECM doesn’t depend on stationarity so differencing and normalizing the time sequence won’t be obligatory. VECM additionally assumes cointegration, or long-term equilibrium between the time sequence. Mathematically, we outline the mannequin as:

This equation is just like the VAR equation, with Π being a coefficient matrix which is the product of two different matrices, together with taking the sum of lagged variations of our time sequence Yt. Remembering to suit the mannequin on our authentic (not distinction) dataset, we obtain the next consequence:

Although it’s arduous to check to our VAR mannequin to this one on condition that we at the moment are utilizing nonstationary information, we will nonetheless deduce each by the error metric and the visualization that this mannequin was not capable of precisely seize the tendencies on this forecast. With this, it’s truthful to say that we will rule out conventional statistical strategies for approaching this drawback.

Machine Studying forecasting

When deciding on a machine studying strategy to mannequin this drawback, we wish to bear in mind the quantity of information that we’re working with. Previous to creating lagged columns, our dataset has a complete of 1275 observations throughout all time-series. Which means that utilizing extra advanced approaches, comparable to LSTMs or gradient boosting, are maybe pointless as we will use a extra easy mannequin to obtain the identical quantity of accuracy and way more interpretability.

Prepare-Take a look at Cut up

Prepare-test splits for time sequence issues differ barely from splits in conventional regression or classification duties (Notice we additionally used the train-test cut up in our VAR and VECM fashions, nevertheless, it feels extra acceptable to handle within the Machine Studying part). We will carry out our Prepare-Take a look at cut up on our differenced information with the next code:

#90-10 information cut up

split_index = int(len(data_diff) * 0.90)

train_data = data_diff.iloc[:split_index]

test_data = data_diff.iloc[split_index:]

#Assigning GDP column to focus on variable

X_train = train_data.drop('GDP : Billions of {dollars}', axis=1)

y_train = train_data['GDP : Billions of dollars']

X_test = test_data.drop('GDP : Billions of {dollars}', axis=1)

y_test = test_data['GDP : Billions of dollars']

Right here it’s crucial that we don’t shuffle round our information, since that will imply we’re coaching our mannequin on information from the longer term which in flip will trigger information leakages.

Additionally as compared, discover that we’re coaching over a really giant portion (90 p.c) of the information whereas usually we’d practice over 75 p.c in a standard regression activity. It’s because virtually, we aren’t truly involved with forecasting over a big time-frame. Realistically even forecasting over a number of years just isn’t possible for this activity given the overall unpredictability that comes with real-world time sequence information.

Random Forests

Remembering our VIF check from earlier, we all know our options are extremely correlated with each other. This partially performs into the choice to decide on random forests as one among our machine-learning fashions. determination bushes make binary decisions between options, which means that theoretically our options being extremely correlated shouldn’t be detrimental to our mannequin.

So as to add on, random forest is mostly a really sturdy mannequin being strong to overfitting from the stochastic nature of how the bushes are computed. Every tree makes use of a random subset of the entire characteristic area, which means that sure options are unlikely to dominate the mannequin. Following the development of the person bushes, the outcomes are averaged with a view to make a closing prediction utilizing each particular person learner.

We will implement the mannequin to our dataset with the next code:

from sklearn.ensemble import RandomForestRegressor

#becoming mannequin

rf_model = RandomForestRegressor(n_estimators=100, random_state=42)

rf_model.match(X_train, y_train)y_pred = rf_model.predict(X_test)

#plotting outcomes

printevals(y_test,y_pred)

plotresults('Precise vs Forecasted GDP utilizing Random Forest')

working this provides us the outcomes:

We will see that Random Forests was capable of produce our greatest forecast but, attaining higher error metrics than our makes an attempt at VAR and VECM. Maybe most impressively, visually we will see that our mannequin was nearly completely encapsulating the information from 2017–2019, simply previous to encountering the outliers.

Ok Nearest Neighbors

KNN (Ok-Nearest-Neighbors) was one closing strategy we’ll try. A part of the reasoning for why we select this particular mannequin is because of the feature-to-observation ratio. KNN is a distanced based mostly algorithm that we’re coping with information which has a low quantity of characteristic area comparative to the variety of observations.

To make use of the mannequin, we should first choose a hyperparameter ok which defines the variety of neighbors our information will get mapped to. A better ok worth insinuates a extra biased mannequin whereas a decrease ok worth insinuates a extra overfit mannequin. We will select the optimum one with the next code:

from sklearn.neighbors import KNeighborsRegressor

#iterate over all ok=1 to ok=10

for i in vary (1,10):

knn_model = KNeighborsRegressor(n_neighbors=i)

knn_model.match(X_train, y_train)y_pred = knn_model.predict(X_test)

#print analysis for every ok

print(f'for ok = {i} ')

printevals(y_test,y_pred)

print("n" + "=" * 40 + "n")

Working this code offers us:

We will see that our greatest accuracy measurements are achieved when ok=2, following that worth the mannequin turns into too biased with rising values of ok. figuring out this, we will now apply the mannequin to our dataset:

#making use of mannequin with optimum ok worth

knn_model = KNeighborsRegressor(n_neighbors=2)

knn_model.match(X_train, y_train)y_pred = knn_model.predict(X_test)

printevals(y_test,y_pred)

plotresults('Precise vs Forecasted GDP utilizing KNN')

leading to:

We will see KNN in its personal proper carried out very effectively. Regardless of being outperformed barely by way of error metrics in comparison with Random Forests, visually the mannequin carried out about the identical and arguably captured the interval earlier than the pandemic from 2018–2019 even higher than Random Forests.

Taking a look at all of our fashions, we will see the one which carried out the perfect was Random Forests. That is more than likely as a result of Random Forests for probably the most half being a really sturdy predictive mannequin that may be match to a wide range of datasets. Normally, the machine studying algorithms far outperformed the standard statistical strategies. Maybe this may be defined by the truth that VAR and VECM each require a large amount of historic background information to work optimally, one thing which we didn’t have a lot of on condition that our information got here out in quarterly intervals. There additionally could also be one thing to be stated about how each the machine studying fashions used have been nonparametric. These fashions typically are ruled by fewer assumptions than their counterparts and subsequently could also be extra versatile to distinctive drawback units just like the one right here. Beneath is our closing greatest prediction, eradicating the differencing transformation we beforehand used to suit the fashions.

By far the best problem relating to this forecasting drawback was dealing with the huge outlier attributable to the pandemic together with the next instability attributable to it. Our strategies for forecasting clearly can’t predict that this is able to happen, finally reducing our accuracy for every strategy. Had our purpose been to forecast the earlier decade, our fashions would more than likely have a a lot simpler time discovering and predicting tendencies. By way of enchancment and additional analysis, I feel a attainable resolution can be to carry out some type of normalization and outlier smoothing method on the time interval from 2020–2024, after which consider our absolutely skilled mannequin on new quarterly information that is available in. As well as, it might be useful to include new options which have a heavy affect on GDP comparable to quarterly inflation and private asset evaluations.

For conventional statistical methods- https://hyperlink.springer.com/e book/10.1007/978-1-4842-7150-6 , https://www.statsmodels.org/steady/generated/statsmodels.tsa.vector_ar.vecm.VECM.html

For machine studying strategies — https://www.statlearning.com/

For dataset — https://fred.stlouisfed.org/docs/api/fred/

FRED offers licensed, free-to-access datasets for any person who owns an API key, learn extra right here — https://fredhelp.stlouisfed.org/fred/about/about-fred/what-is-fred/

All footage not particularly given credit score within the caption belong to me.

please word that with a view to run this pocket book you will need to create an account on the FRED web site, request an API key, and paste stated key into the second cell of the pocket book.